- Safe haven assets, including Gold, the US Dollar and Bonds decline as the stock market attempts to regain some lost ground.

- The Fed Chairman advises that they will not take rash decisions and will take the time over the next two months to determine if they need to act in June. Economists continue to indicate a cut in June and 3 cuts in 2024.

- Investors turn their attention to this evening’s speeches from FOMC members, Barkin and Mester.

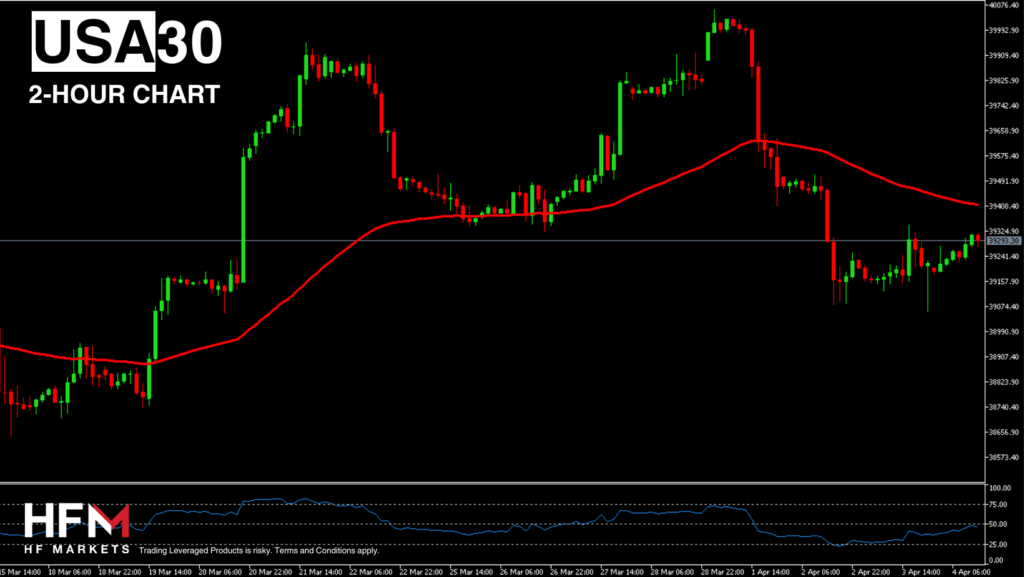

- The Dow Jones trades 0.24% higher but remains lower than previous price ranges.

USA30

Indications within the market point towards the Dow Jones potentially attempting to retrace to a higher price. This includes the pre-market open trading performance, the value of the Dollar and US Bond Yields. The US Dollar Index trades 0.17% lower and Bond Yields are 0.008% higher. These factors are known to support the stock market, and the investors are also paying close attention to the upcoming earnings season, which is only 6 days away.

However, technical analysis is currently indicating that sellers are controlling the market. This can be seen both on momentum indicators and oscillators (2-Hour chart). However, even if sellers are currently “controlling” the market, the instrument can still retrace upwards within today’s session. The 75-BAR EMA indicates the price can retrace upwards by a further 0.35-0.40%.

When evaluating the price movement of the day for each component, before the market opens, only 3 of the 30 stocks are declining. Therefore, 90% of the components are trading higher which backs a possible retracement. However, it is important that investors also monitor the reaction within the first 30 minutes after the New York market opens. Currently, the best performing stocks are Travelers Cos and Amazon.

The retracement so far has been fueled by two factors. The first is the lower price which triggered a more stable demand level in comparison to sell orders. The second is the latest US data from Wednesday. The ADP Non-Farm Payroll Change was higher than expectations and higher than the previous month. This improved investor sentiment while the ISM Services PMI data made the possibility of a rate cut more likely. However, economists advise the PMI data is relatively weak in terms of its influence. Instead, the future guidance and rate adjustments will be determined primarily by the CPI data on the 10th of April.

In the short term, investors will focus on this evening’s speeches and the tone of the Federal Open Market Committee. The main price driver will be tomorrow’s employment data. Ideally investors wish to see the Average Earnings for March read as low as possible, or at least below 0.3%. Simultaneously for the Unemployment Rate to remain unchanged and for the Employment Change to read higher than expectations but not higher than the previous month. This would support a resilient economy, less inflation pressure, and the possibility of interest rate adjustments.

Michalis Efthymiou

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.