The Federal Open Market Committee (FOMC) remains committed to future rate cuts, but not in the immediate future. In a widely anticipated move, the Fed kept the federal funds rate steady at 5.25% to 5.50% with a unanimous 12-0 vote. Fed Chair Jerome Powell’s cautious press conference reaffirmed the “high-for-longer” stance, emphasizing that while rate hikes are off the table for now, a rapid response to any unexpected job market weakening will be forthcoming. The recent cooling in May’s Consumer Price Index (CPI) was a positive sign, but the FOMC will need more such reports before considering rate cuts.

Market Expectations and the Dot Plot

With the FOMC firmly on hold, attention shifted to the dot plot projections. Markets had priced in a reduction from the three quarter-point rate cuts projected in March to one or two cuts for the remainder of the year, with a slight risk of no cuts. Following the dovish May CPI report, markets anticipated two cuts in 2024, likely starting in September. However, the FOMC surprised by projecting just one quarter-point cut in 2024, raising the median rate to 5.1% from 4.6% in March. The projections for 2025 included four cuts, bringing the median to 4.1%, up from 3.9%, and four cuts in 2026, maintaining a 3.1% median.

Revised Long-Run Rate Forecast

The long-term median rate forecast was revised upwards to 2.8% from March’s 2.6%. Powell attributed this adjustment to conservative forecasting, reflecting changes in the inflation outlook after higher-than-expected price pressures earlier in the year. He noted a lack of high confidence behind these forecasts.

The forecast distribution showed a slight downward skew for 2024, with some forecasters predicting no rate cuts, while others anticipated one or two quarter-point cuts. The long-run estimates revealed an increase in the high-end forecasts, raising the central tendency from 2.5%-3.1% to 2.5%-3.5%, and the median long-run estimate to 2.8% from 2.6%.

Economic Projections

The FOMC’s Summary of Economic Projections (SEP) indicated slight downward revisions for Q4/Q4 GDP forecasts for 2024 and more significant reductions for 2025. The central tendencies now stand at 1.9%-2.3% for 2024 and 1.8%-2.2% for 2025, aligning with a GDP estimate of 2.0% for both years. The jobless rate projections for 2024 and 2025 were nearly unchanged, with a forecasted median of 4.0% for 2024 and 4.2% for 2025.

Inflation forecasts for 2024 and 2025 were raised, reflecting caution after higher-than-expected inflation in Q1. The central tendencies for 2024 are now 2.5%-2.9% for the PCE chain price headline and 2.8%-3.0% for the core, exceeding estimates of 2.4% and 2.8%. For 2025, the projections are 2.2%-2.4% for the headline and 2.3%-2.4% for the core, compared to expectations of 2.1% and 2.3%. Powell noted that heightened inflation forecasts influenced the more hawkish rate path in the dot plot.

Assessing Rate Restrictiveness

The adjustments in the dot plot and inflation estimates raise questions about whether rates are “sufficiently restrictive.” Powell acknowledged this uncertainty, stating that the Fed will assess over time. He believes current policy is “restrictive,” but the increased longer-run funds rate estimates suggest current rates may not be restrictive enough. The upward revision indicates the FOMC believes rates will not return to pre-pandemic levels.

Market Reactions

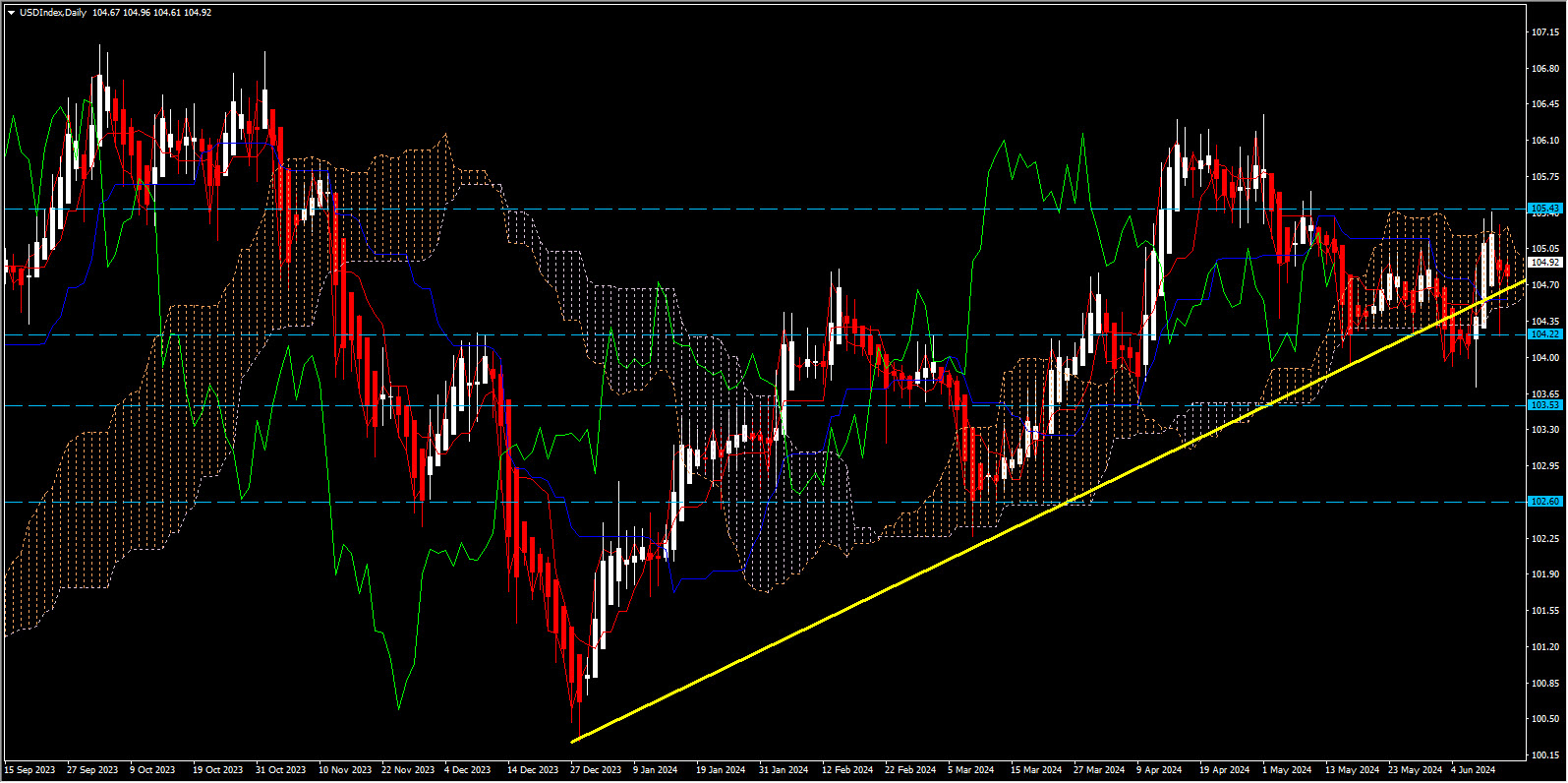

The USDIndex has been on a wild ride on the data and FOMC stance. The buck slumped to a session low of 104.25 on yesterday’s CPI report, then firmed to a session high of 105.33 after the FOMC’s hawkish stance before closing at 104.65. It traded around 104.98 overnight before dropping to 104.65 on today’s claims and PPI numbers that fed market expectations for rate cuts. It has rebounded back to 104.83 given the likelihood that the FOMC is looking to maintain a high-for-longer stance. After some chop on the data, the buck is now firmer against all its G10 peers.

Treasuries extended small overnight gains after another soft inflation report and a pop in jobless claims, both supporting market hopes for easing as soon as September, and the potential for more than 1 rate cut this year. While contrary to the FOMC’s dot plot, it was only a matter of 1 dot that skewed the median away from reflecting 2 easings this year. Wall Street was little moved with the futures mixed. The Dow continues to underperform and is -0.2% in the red. The NASDAQ is up 0.69% and the S&P 500 is 0.23% higher.

By maintaining a cautious but hawkish stance, the FOMC continues to navigate the complex landscape of economic indicators, aiming to balance growth and inflation in a post-pandemic economy.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.