USDJPY on Friday fell -0.65% to post a 3-week low. The yen found support on Friday amid signs the BOJ intervened in the forex market on Thursday to support the yen. In addition, an upward revision to Japan’s May industrial production was positive for the yen. Japan’s May industrial production was revised up to +3.6% m/m from the previously reported +2.8% m/m.

On Thursday, the yen jumped as much as 2.6% to 157.41 per dollar, with signs of exceptional trading volumes fuelling intervention bets from the Ministry of Finance, after the yen hit 38-year lows earlier in the week. The increase in trading volume was followed by daily data showing a ¥31.7 trillion drain on Japan’s current account, equivalent to more than $20 billion worth of foreign exchange purchases. Meanwhile, according to a Bloomberg analysis of central bank accounts, the BOJ spent about 3.5 trillion yen ($22 billion) when it intervened in the forex market on Thursday to support the yen.

Leading currency diplomat Masato Kanda refused to confirm whether the government had a hand in the yen’s rise. Investors are also looking forward to the BoJ’s policy meeting at the end of July in which officials are expected to announce plans to reduce bond purchases and possibly raise interest rates again.

Meanwhile, some measures of wage growth may have begun to reflect the high wage increases agreed in this year’s spring wage negotiations, consistent with the BOJ’s stance of continued monetary policy normalisation this year. Japan’s largest trade union federation had earlier announced an average wage increase of 5.1% for its members for the current fiscal year, the largest increase seen in more than 30 years.

Before the May earnings data was released this week, the pay rise may not have been significantly reflected in the monthly earnings figures. In May’s data, although the headline earnings figure only rose modestly, another data set closely monitored by BoJ officials, regular payrolls for full-time workers, measured by the same sample increased to 2.7% y/y, far exceeding consensus expectations of 2.2%. Rising wage growth and the potential for a virtuous wage-price cycle to develop, is likely to be the key factor behind future BoJ monetary policy normalisation.

It should be noted, however, that BoJ officials are likely to take a rather cautious approach to monetary policy adjustment, to ensure that this development actually takes place. Therefore, the BoJ is expected to wait until its October meeting to raise its policy rate, before undertaking further monetary policy normalisation as early as 2025.

The Japanese yen stabilised around $158.00 in quiet trade on Monday [Japanese holiday]. On the monetary policy front, investors are looking forward to the BOJ policy meeting at the end of July in which officials are expected to announce plans to reduce bond purchases and possibly raise interest rates again. Externally, the yen faced pressure from a rising dollar that benefited from safe-haven bids following the assassination attempt on former US President Trump.

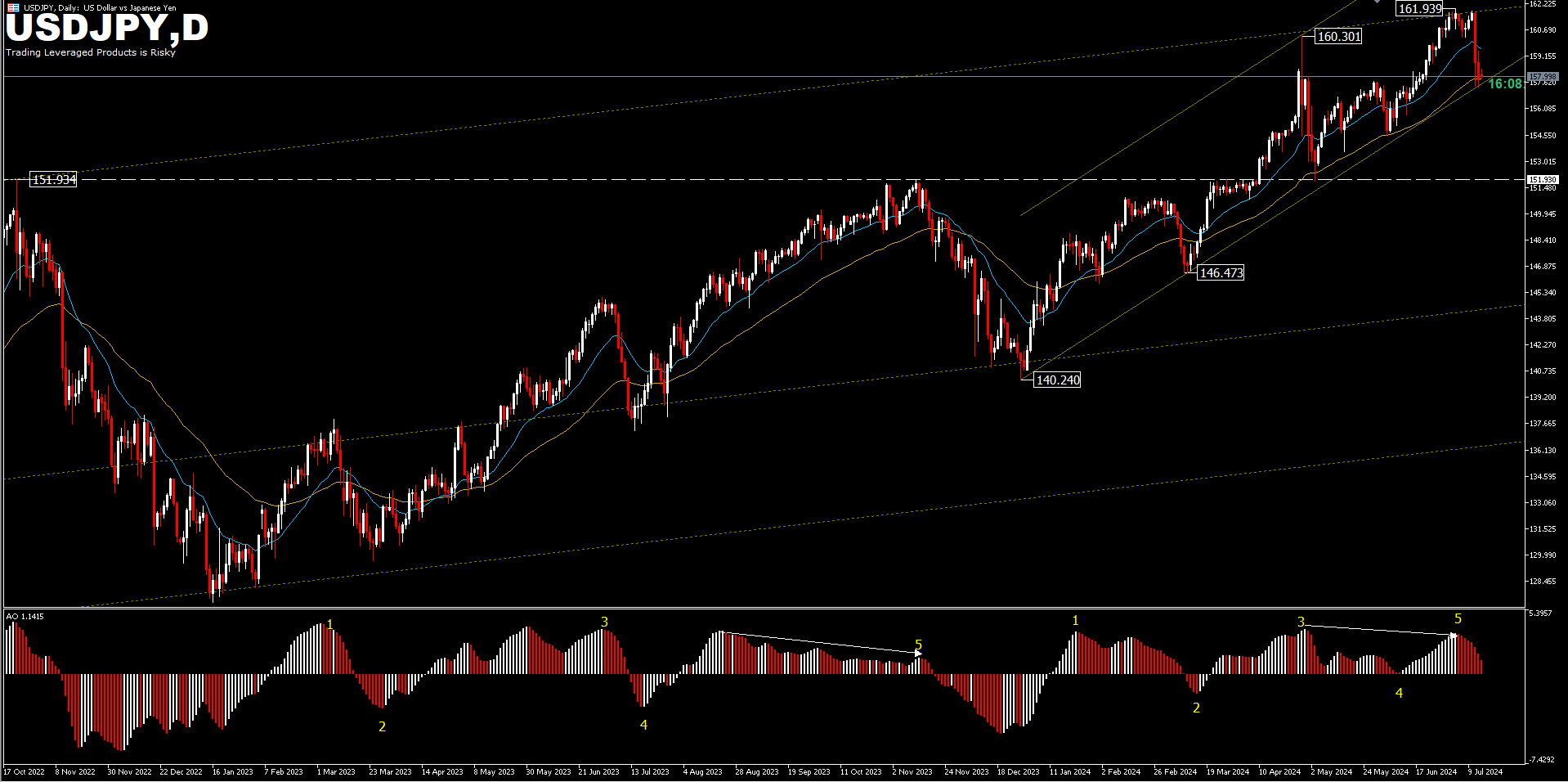

From a technical perspective, USDJPY registered resistance at 161.93 at the beginning of the month. Further downside is still capped by the bullish trendline [from 140.24 – 146.47 drawdown]. A break of this trendline, could open the door for a further decline up to the resistance price level which has become support at 151.93 [Oct’2022 peak], to bring a rebound at this level. The long-term uptrend could still continue up to 161.93 at a later stage. The next movement will depend on the depth of the current correction from 161.93. However, a sustained break of 151.93 would indicate, that a larger scale correction or trend reversal is underway.

In addition to the price being stuck at the trendline, the price is also stuck at the EMA50 bar. The correction wave could possibly continue, after the trendline break and the move below the 50-bar EMA.

Last week’s sharp decline confirmed a short-term topping at 161.93. Given the bearish daily divergence conditions, the decline from 161.93 is likely a correction of the overall five-wave rally from 140.24. Risk will remain on the downside as long as 159.43 resistance holds. A sustained break of the bullish trendline will confirm the bearish case. The next projections are 38.2% and 50.0% retracement [of the 140.25 – 161.94 pullback] at 153.64 and 151.08 respectively.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.