Nvidia Corp., an American multinational technology behemoth with market cap over $3.1T (the second most valuable company in the world) which specializes in the design and manufacture of computer graphics processors, chipsets and related multimedia software, shall release its earnings report for the fiscal quarter ending July 2024, on 28th August (Wednesday) after market close.

What is to be expected in the upcoming earnings release?

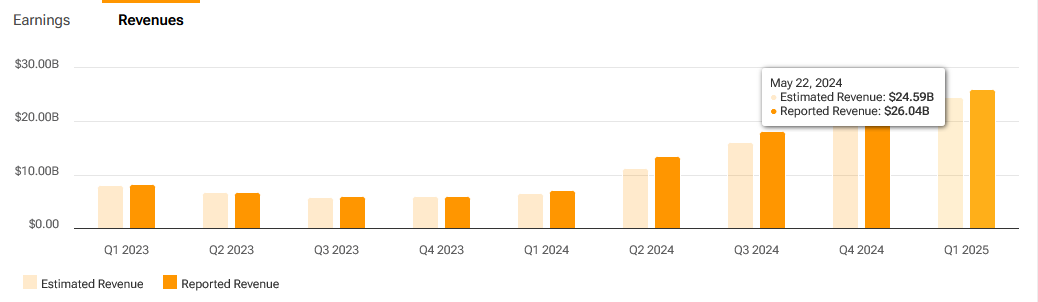

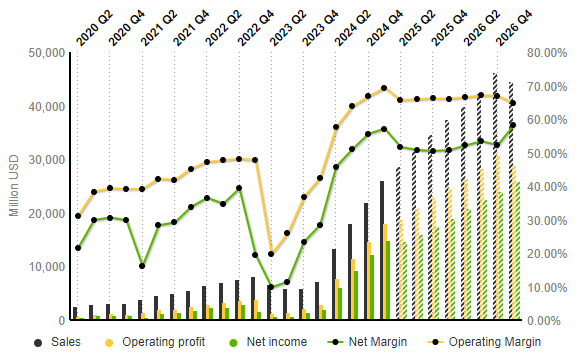

Nvidia: Revenues & Earnings (After Deduction of Tax and Expenses). Source: Tipranks

The latest revenue reported by Nvidia hit $26.0B, up 17.6% and 262%, from Q4 2024 and a year ago, respectively. This was driven by continued growth of the company’s Data Center segment, including a strong demand for Hopper GPUs. Net income was up 21% (q/q) and up 628% (y/y), to $14.9B. Gross margin was also up 2.4 points quarterly and up 13.8 points from the same period last year, to 78.4%.

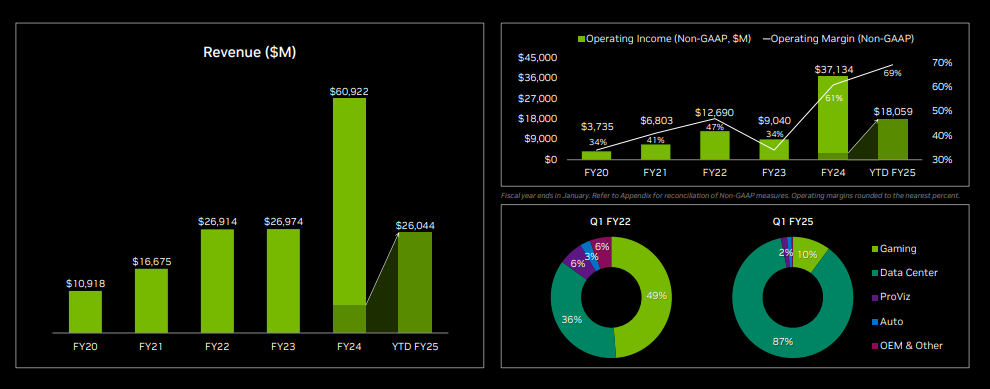

Nvidia Financial Analysis. Source: Nvidia Presentation

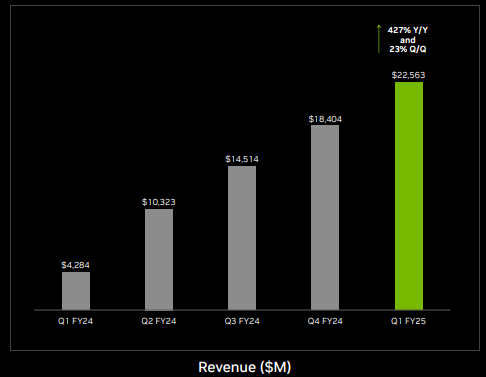

In general, the Data Center segment continued to drive most of the gains. In the previous quarter, it recorded sales revenue worth $22.6B, up 23% from the previous quarter, and up 427% from the same period last year.

As the company recently unveiled the Blackwell platform to fuel a new era of generative AI supercomputing, market participants are optimistic that demand may well exceed supply at least into the next year.

Sales revenue in the Gaming segment was reported at $2.5B, down -8% from the previous quarter due to seasonally lower GPU sales for laptops, but up 18% (y/y) from the same period last year, buoyed by higher demand in general. The company has a massive installed base of over 100 million AI-ready RTX PCs and workstations shipped, highly demanded by creators, gamers and AI enthusiasts.

On the other hand, Professional Visualization recorded revenue down -8% (q/q), but up 45% (y/y) to $427 million. The management holds a strong belief that its Generative AI and Omniverse industrial digitalization shall drive the next wave of professional visualization growth in the coming quarters.

Automotive reported revenue at $329 million, up 17% (q/q) and 11% (y/y), respectively. To date, some of the EV makers which have been using Nvidia’s AI car computer include Li Auto, Great Wall Motor, ZEEKR, and Xiaomi. Its DRIVE Thor – the centralized car computer which combines advanced driver assistance and an AI cockpit on a single safe and secure system – is also slated for production next year and will be another catalyst for boosting the segment’s revenue.

Nvidia: Income Statement Evolution (Quarterly Data). Source: Market Screener

Nvidia: Income Statement Evolution (Quarterly Data). Source: Market Screener

According to projection by S&P Global Market Intelligence, sales revenue is expected to reach $28.6B in the coming quarter, up nearly 10% from the previous quarter, and up 112% from the same period last year. Operating profit is projected to edge slightly higher from the previous quarter, to $18.8B, whereas net income is expected to remain flat at $14.8B. Operating margin is expected to decline towards 65.61%, previously 69.34%; Net margin is expected to be down by -5.51% from the previous quarter, to 51.63%.

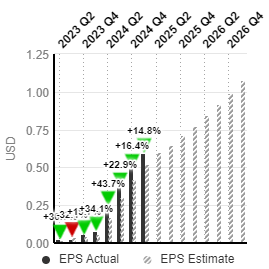

Nvidia: EPS. Source: Market Screener

EPS is estimated to hit $0.60, unchanged from the previous quarter. It was $0.25 in Q2 2024.

The #NVIDIA share price remains supported above psychological level $100 and the recent low $90.70. Overall price remains pressured below the 100-week SMA. A better-than-expected earnings result or positive guidance may keep the asset price buoyed, towards the next resistance $200.50 and $354. The company share price hit an ATH at $1255.60, before the announcement of a stock split.

Click here to access our Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.