USOIL [WTI] crude oil futures rose above $70 per barrel on Monday, extending the 1.4% gain from the previous week, fuelled by ongoing disruptions to US Gulf oil infrastructure and expectations of a US rate cut. Nearly 20% of Gulf of Mexico oil production is still offline due to Hurricane Francine. In addition, investors are increasingly betting on a 50 bps interest rate cut by the Federal Reserve, which could boost economic activity and increase oil demand.

However, concerns remain over slowing demand, after Chinese data showed the longest industrial slowdown since 2021, with weaker-than-expected investment, casting doubt on China’s growth target of 5%. China’s August industrial production rose +4.5%y/y, weaker than expectations of +4.7% y/y. In addition, August retail sales rose +2.1% y/y, weaker than expectations of +2.5% y/y. Also, August new home prices fell -0.73% m/m, the largest decline in 9-3/4 years.

Meanwhile, Libya’s oil exports fell significantly amid stalled UN-led talks on central bank control. Libya’s crude oil exports fell to 314,000 barrels per day last week from 468,000 barrels per day earlier this month. Earlier this month, Libya’s eastern government declared force majeure on all oil fields, terminals and crude export facilities, as it called for a halt to all crude production and exports due to political conflict over who controls the country’s central bank and oil revenues.

Crude oil prices found support, after OPEC+ on 5 September agreed to temporarily halt a scheduled crude oil production increase of 180,000 bpd in October and November due to recent crude oil price weakness and signs of fragile global energy demand.

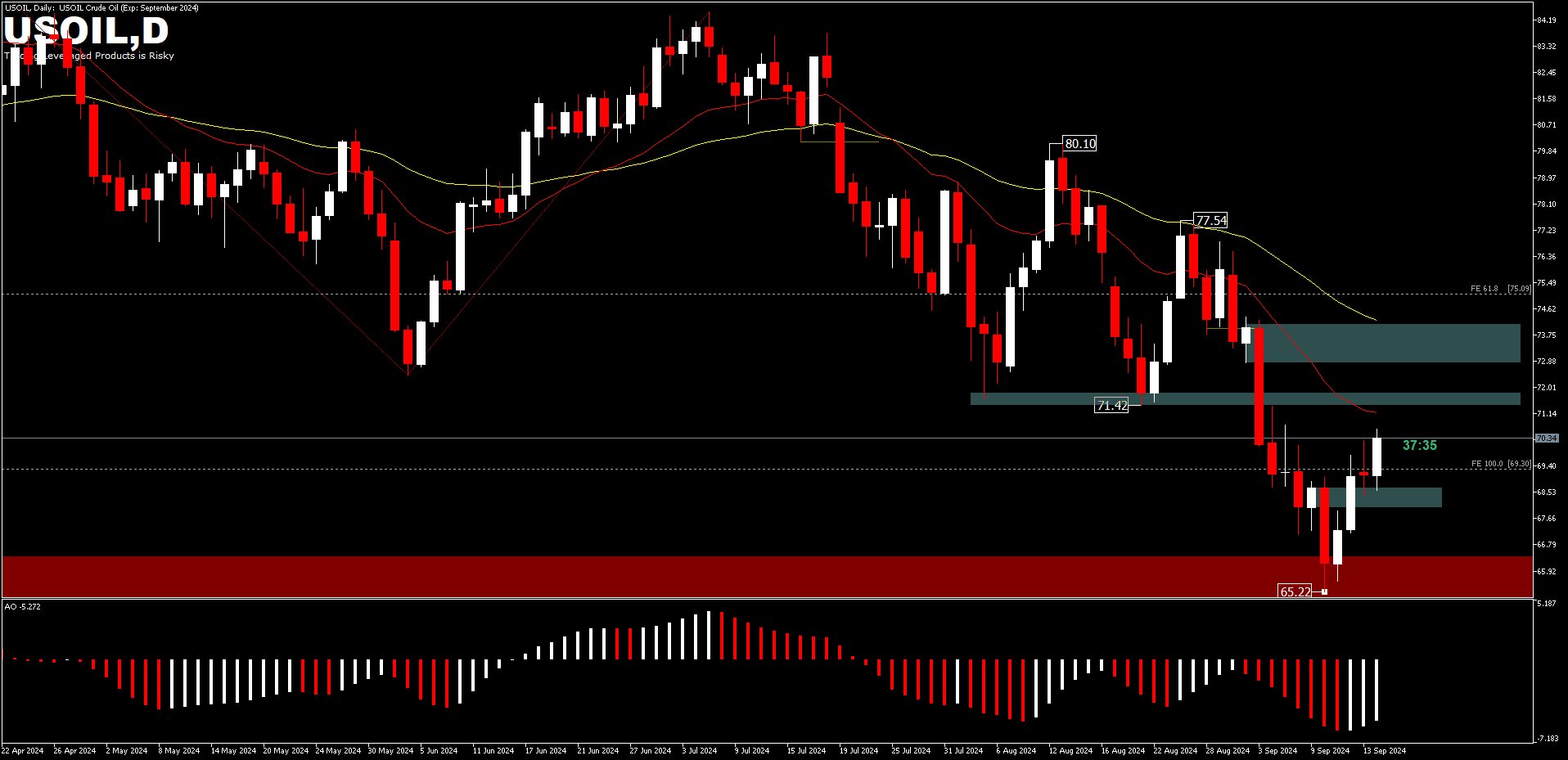

In the oil market, USOIL futures are trading at around $70.36 at the time of writing. Strengthening from the low of $65.22 recorded last week. In general, oil prices have not fully recovered, and the bearish threat is still seen controlling the market, with prices still moving below the 20-bar and 50-bar EMAs. Although the daily candle pattern signalled a reversal in an inside-up pattern, it’s likely that the rally movement will face resistance from the 20-bar EMA near the $71.42 support. A move above this level, could bias the price towards testing the 50-bar EMA. As long as the price trades below $71.42, the bulls will have to regain strength to dominate the market.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.