- The US Dollar increases in value for a fourth consecutive day as the NFP release edges closer.

- US economic data continues to support a soft landing and gradual interest rate cuts.

- US ISM Services PMI beat expectations and rose to an 18-month high.

- Oil prices rise to a 30-day high as Israel confirms the IDF will retaliate against Iran’s latest strikes.

NZDUSD – Markets Expect The RBNZ To Cut, USD Depends On Jobs Data!

The NZDUSD continues to trade downwards for a third day and has done so while only forming one minor retracement. Traders now question how far the exchange rate can fall?

Price action is currently indicating that the market is attempting to drive the exchange rate lower as the Federal Reserve dials down its dovish tone. So far, the price potential looks on track to decline closer to the previous support levels. The closest support level can be seen at 0.61514 and then 0.61234. However, if it is able to do so will depend on the upcoming economic data, particularly this afternoon’s US employment data.

The market has raised their NFP Employment Change expectations to 150,000 for September. However, participants continue to predict no change for the Unemployment Rate. If the NFP rises above the expected figure while the Unemployment Rate remains the same or falls, the data would potentially support the USD further. In addition to this, the next Federal Reserve rate decision in November will most definitely be a 25-basis point cut. This would be key for the NZDUSD to continue its bearish trend back to the 0.61234 level.

On the other hand, investors also should note that the RBNZ will also confirm their rate decision on Wednesday 9th. Therefore, can the price action change as we approach the weekend and next week’s rate decision? This is something investors will need to monitor. Though, so far the worst performing currency of the week continues to be the New Zealand Dollar along with the Japanese Yen.

House prices in New Zealand fell for the seventh consecutive month, though at a slower rate, dropping by just 0.5% following a decrease in borrowing costs, according to economists at CoreLogic NZ. This trend highlights a reduction in purchasing power amid a slowing economy, as rising unemployment starts to impact household incomes. The outlook could shift if monetary authorities maintain their dovish approach at their upcoming meeting on October 9th. Notably, this stance has already helped bring the average two-year mortgage rate below 6.0%.

If the above data does prompt the Reserve Bank of New Zealand to cut interest rates, the NZD could witness stronger pressure. The Official Cash Rate is currently at 5.25% and analysts expect the Central Bank to cut a further 0.50% to 4.75%.

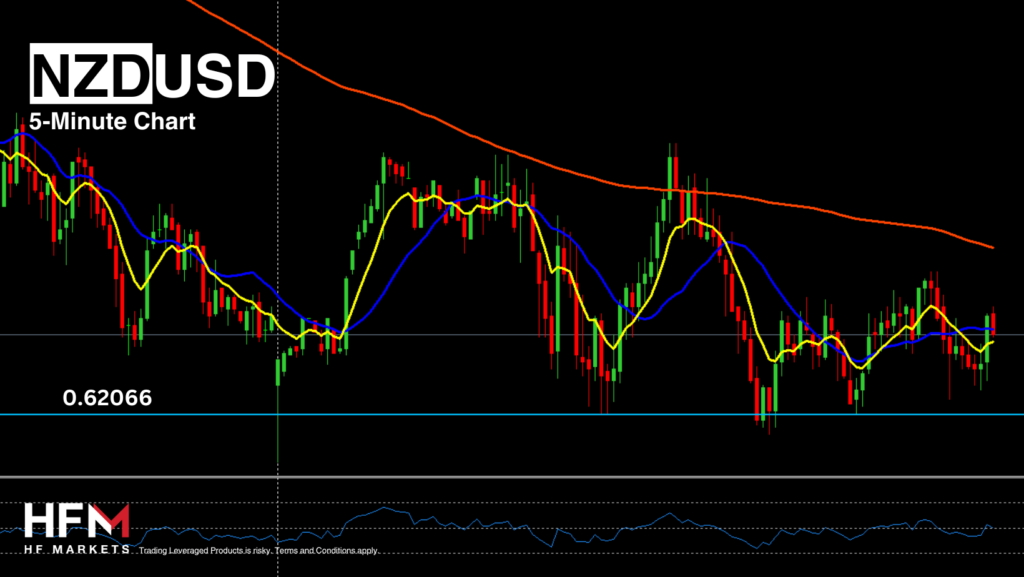

When evaluating the price movement on the two hour timeframe, the NZDUSD is finding support at the same price but the resistance is not yet clear. This also indicates that sellers remain considerably active. The support level can be seen at 0.62066 and the price has crossed downwards which indicates a sell signal. Though some traders may wish for the support level to be broken before speculating downward price movement.

Furthermore, on the 5-Minute Chart the NZDUSD trades below the 200-bar SMA and on the 2-Hour Chart below the 75-bar EMA. This indicates the trend could potentially continue but traders will need to be cautious about volatility and timing.

Click here to access our Webinar Schedule

Michalis Efthymiou

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.