- The Japanese Yen attempts to regain lost ground after declining more than 0.60% on Monday.

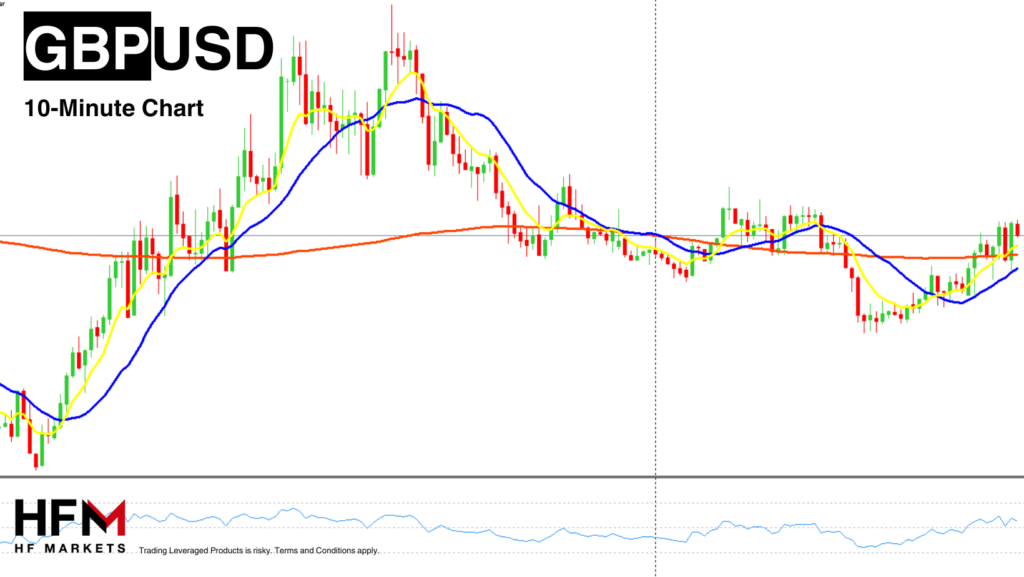

- The Great British Pound is moving sideways as investors wait for the UK’s Autumn budget. Experts expect major changes to the fiscal policy and high volatility.

- Alphabet is to release their latest quarterly earnings report within the upcoming hours. The stock has increased 1.35% in the 24 hours leading up to the release.

- The NASDAQ and SNP500 are again on the rise after retracing.

NASDAQ – Investors Turn Their Attention To Vital Earnings Data!

The NASDAQ’s price movement for the next 24 hours will almost entirely be dependent on the quarterly earnings reports from Alphabet and Advanced Micro Devices (AMD). However, investors will also need to monitor the JOLTS Job Openings and CB Consumer Confidence. If these two economic releases significantly differ from current expectations, the earnings data will not be the only price driver.

Alphabet stocks make up 4.77% of the NASDAQ’s total value, and Advanced Micro Devices 1.64%. Therefore today’s earnings data will be relevant to 6.41% of the NASDAQ’s weight but will influence the US technology sector in general. Alphabet will release their earnings report before the market opens whereas AMD will release theirs after the market closes.

Alphabet stock has increased 1.35% in the 24 hours leading up to the release and AMD stocks 3.19%. This indicates that investors expect the quarterly earnings reports for the two companies to remain positive. In addition to earnings, traders and shareholders will closely monitor any comments on ad spending and monetizing AI. These two elements can also trigger volatility. Major earnings reports will continue tomorrow with the release of Microsoft and Meta earnings which hold a weight of 12.99%.

While most investors are focusing on Alphabet, AMD, Microsoft, and Meta’s earnings, they should also watch the day’s two economic releases closely. If these two releases differ significantly from the current expectations, it will have a significant impact on the NASDAQ, particularly the JOLTS Job Openings. Ideally, for the NASDAQ, investors would like to see a slightly weaker figure. This would benefit the NASDAQ as it would prompt a more dovish Federal Reserve, but not indicate a recession.

The VIX is trading 0.20% higher during this morning’s Asian session which is not positive but will not indicate any significant risk. However, ideally investors will like to see the VIX index drop below 0.00%. The 10-Year Bond Yields are 14 points lower, known to be positive for the stock market in general.

In terms of technical analysis, the price continues to remain above the 75-Bar Exponential Moving Average and above the neutral level on the RSI. In addition to this, the price is above the VWAP and Cumulative Delta data indicates buy orders outnumber the sell orders as it stands. For this reason, technical indicators currently mainly point towards an upward price movement.

GBPUSD – Investors Await Significant US Economic Data & Upcoming UK Budget!

The US Dollar Index and the GBP Index are currently similar and keeping within a recurring range of between -0.02% and +0.02%. The GBPUSD is also more or less at the day’s opening price. However, this is likely to change after the US releases their JOLTS Job Openings and CB Consumer Confidence. The GBPUSD can also witness higher volatility as the European and UK trading session opens.

The British Retail Consortium’s (BRC) Retail Price Index data is putting some pressure on the Pound, as annual figures slowed from –0.6% to –0.8% in October, below analysts’ expectations of –0.5%. This also suggests a further easing of inflation risks, potentially allowing the BoE to pursue more aggressive rate cuts.

The UK consumer lending data will be released today at 11:30 AM (GMT+2), with Net Consumer Lending projected to decrease to £4.1 billion in September from £4.2 billion, and Mortgage Approvals expected to decline to 64,200 from 64,858. However, the deciding factor for the GBPUSD will be the JOLTS Job Opening and CB Consumer Confidence. Higher than expected is deemed to be positive for the US Dollar across the board.

Click here to access our Webinar Schedule

Michalis Efthymiou

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.