“Trump trade” has boosted the US Dollar and US stocks, but Trump’s policies may have less favorable effects on global assets. Trump’s plan to raise tariffs is expected to negatively impact economies worldwide, especially exporters like China.

Asia & European Sessions:

Financial Markets Performance:

- The USDIndex continues to rise and is currently at 105.75. It hit a 1-year high.

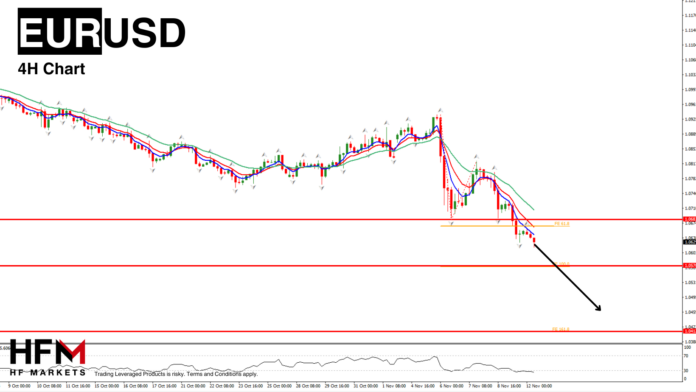

- EURUSD drifts to 1.0620 and GBPUSD is in a sell off, currently at 1.2800.

- Oil prices fell after their biggest 2-week decline, amid a weak demand outlook from China, a stronger US Dollar, and concerns over a potential oversupply.

- Crude oil has traded within a narrow range since mid-last month, influenced by Middle East tensions, the US election, and OPEC+ output decisions.

- Gold remains under pressure and is currently at just $2604.36 per ounce. It hit a one-month low, down 5% since Trump’s election victory, as a strong dollar and US equity rotation pressured the metal. Gold’s decline was also technical, breaking below the 50-day moving average, causing funds to cover long positions. Despite recent drops, gold remains up 25% for the year, supported by central bank purchases and geopolitical risks.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.