Fastenal Co.

Fastenal Co is an OEM fasteners company, offering, security products and more. It currently has approximately 1,760 branches with 14 distribution centers and a company market capitalization of $29 billion. It is expected to report second-quarter earnings on Wednesday, July 13, 2022, before the market opens.

According to Zacks, earnings per share forecasts remain unchanged at $0.5 over the past 60 days, representing a 19.1% year-over-year growth. Revenue was forecast at $1.79 billion , indicating an 18.6% increase from last year’s reported figure of $1.51 billion. In the last four quarters, Fastenal has beaten forecasts in both sales and earnings per share. The company has performed well through issues such as price inflation, supply chain challenges and labor shortages until benefiting from all types of products, markets and end-users customers.

In terms of markets, products, and end customers, it looks promising for this quarter’s earnings report. In May and April , industrial sales increased 22.4% and 25.7% compared to the same month last year. Non-residential construction grew 10.7% and 13.4% in May and April 2022, respectively. Fastener equipment sales rose 20% in May. (vs. 25.5% increase in April) Security sales increase 15.6% in May. That compares to 16.7% growth in April.

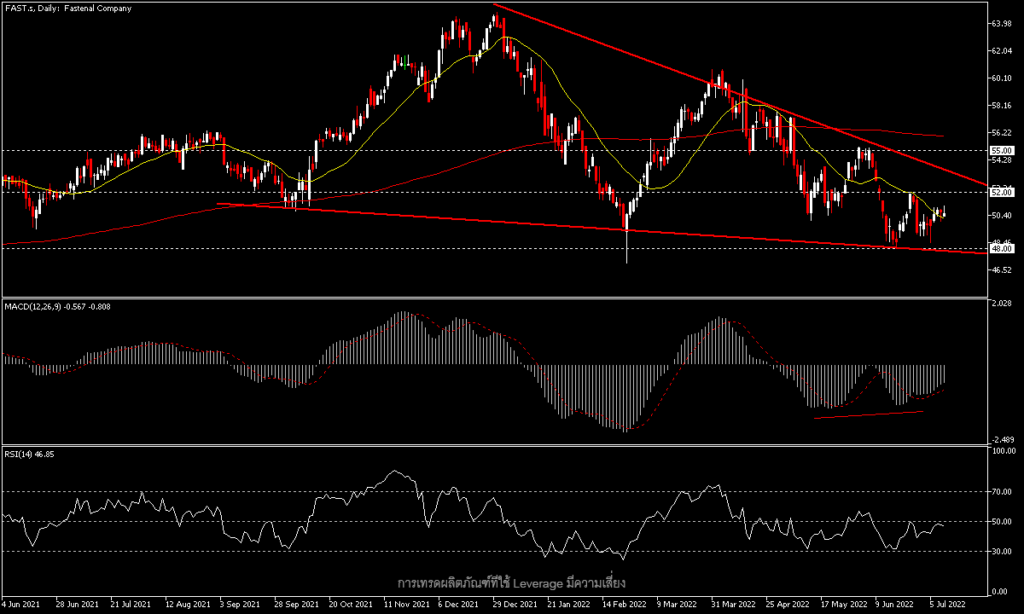

Fastenal‘s (FAST.s) share price since year-to-date has dropped more than -21%, and so far, the company’s share price has been holding on to the lows of the year with a falling wedge price pattern. The forecast turned out to be better than expected. The 52.00 and 55.00 price levels could be tested as resistance. to return to a new round of uptrend On the other hand, if the turnover causes the price to decline further There will be important support levels at 48.00 and 43.00.

Delta Air Lines Inc.

Delta is one of the largest airlines in the world having more than 300 routes in more than 50 countries around the world and a market value of 18.90 billion US Dollars. It is also expected to report second-quarter 2022 results on Wednesday, July 13, before the market opens. Zacks expects Q2 earnings to jump significantly compared to the prior-year quarter. (After beating forecasts for several quarters in a row) with forecast earnings per share up 257% at $1.68 per share vs -$1.07 per share and sales up 90.97% at $13.61 billion vs $7.13 billion.

It is undeniable that the COVID-19 pandemic has seriously affected the airline business. This includes Delta Airlines, and now it seems that the time has come for reaping the benefits of a journey that is about to return to prosperity. However, rising energy costs could undoubtedly hurt the company’s bottom line, although Delta is known for having a long history of managing costs in the airline industry.

A significant statement made by Delta’s management has been: They will rebuild their global network to increase the seasonal potential of the aviation industry. Before the outbreak of COVID-19 the company used older aircraft, the 767-300ERs, to meet summer demand in the Atlantic. While undesirable aircraft can be cost-effectively used during times of high demand, Delta does not employ the highest demand-chasing strategy it once did. Because the cost of doing so cannot be justified in other parts of the market.

Delta’s share price (DAL.s ) since year-to-date has dropped -25.05% and is now under s pressure in the yearly low zone below the 30.00 level at the bottom of the broadening triangle pattern. Next support is at 28.00 and 25.00, while resistance is now in the 32.00 and 36.00 zones. Overall, short-term prices are still biased towards the downtrend. This is because the price is still below the MA20 line and the MACD is below the 0 line and the RSI is still down around 35.

Click here to access our Economic Calendar

Chayut Vachirathanakit

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.