It was all about June CPI and the report did not disappoint. Risk was for a hot report and the Administration warned of rising pressures. The most dramatic movers were the hot CPI report and the BoC’s 100 bp hike. Those opened the door for an outsized Fed move and in turn heightened risk for a recession. A bearish curve inversion play as the data nail the coffin for a 75 bp hike on July 27, with nontrivial risk of more aggressive action, either with a 100 bp increase which the BoC just effected, or with consecutive 75 bp moves in July and September. USD sustained gains, Oil settled at 200 DMA and Stocks traded mixed. Stocks were up 0.6% and 0.4% in Japan and Australia respectively, the latter helped by a record low unemployment report (50-year low) while Chinese imports continue to linger as the country’s Covid policy keeps a lid on activity. The AUD rallied on the numbers, as traders boosted speculations for a 75 bp rate hike from the RBA in August.

- USDIndex held above 108.00 level, but failed to break 3-day resistance.

- Yields: the 10-year ended over 7 bps lower at 2.89%, reflecting credibility in the FOMC’s policy stance. Fed funds futures priced in a 54% chance for a 100 bp rate hike on July 27 with rising odds for 170 bps in hikes from here.

- Stocks: USA100 tumbled -0.15%. The USA500 is off -0.45%, and the USA30 has slid -0.67%.

- USOIL traded at $95 holding above 200-day SMA.

- Gold found a bid but gains were trimmed. Currently down to $1,706.

- FX Markets: EURUSD holds fractionally above parity at 1.0002, USDJPY skyrocketed to 139.28, Cable fell to 1.1856. AUD and to a lesser extent the NZD gained.

- Today – US calendar has jobless claims and PPI, but the earning releases are in the spotlight with JPMorgan Chase & Co., Morgan Stanley, First Republic Bank, Cintas etc.

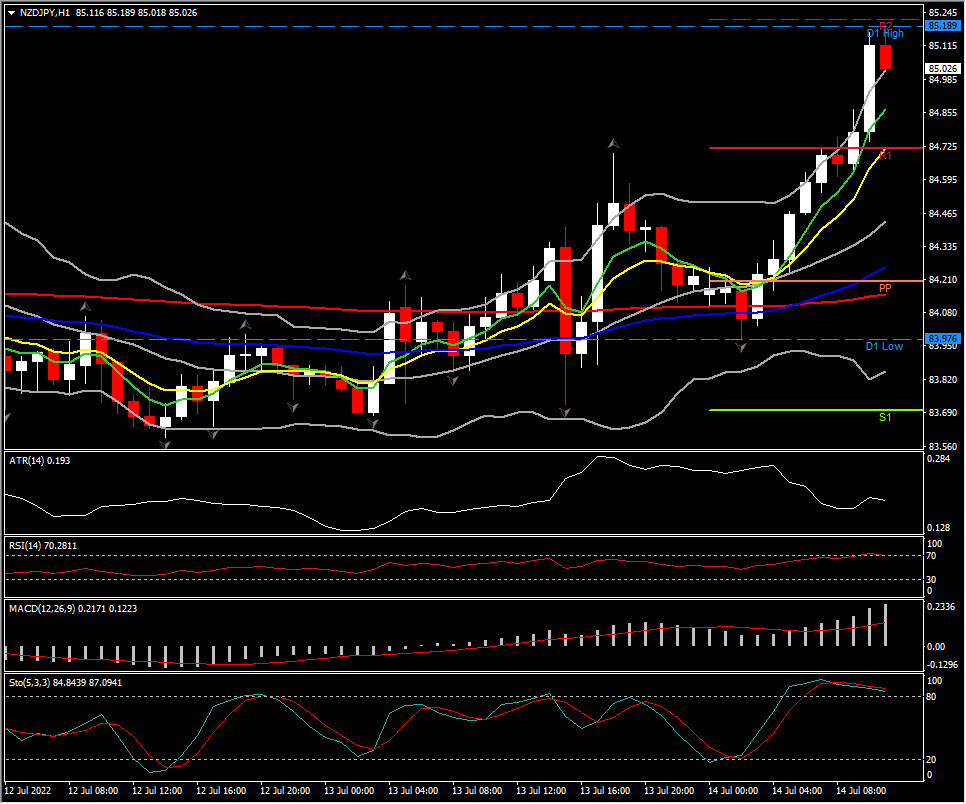

Biggest FX Mover @ (06:30 GMT) NZDJPY (+1.62%) breached 85.20. MAs aligned higher, MACD histogram & signal line extend further northwards, RSI above 70 but falling. H1 ATR 0.193, Daily ATR 0.975.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.