Long term bullish momentum on the Dollar remains as the DXY adds to its gains from last week, en route to retest August highs.

Dollar

The greenback came out of the gate this week adding to the gains accumulated on Friday. This exuberance is mainly driven by fresh recession concerns brought about by weaker than expected Chinese data, which caused an increase in the flow of investors towards the safe-haven currency. Further momentum was added by hawkish comments made from FED policymakers around early signals that inflation could have potentially peaked.

Technical Analysis (H4)

In terms of market structure, price has been moving correctively since 14 July 2022 in relation to the overall price action in the uptrend. This entire corrective structure is forming a bullish continuation pattern (falling wedge.) The probability is that this pattern will yield an impulsive wave upon completion. .

What could happen henceforth in the short term is a smaller correction before bulls take control of price and challenge the monthly high around the 106.51 area, and if broken impulsively, could open the gate for price to challenge the peak formation around the 109.00 area.

Euro

A significant recovery of the European currency still seems further down the road according to market analysts, amid a week devoid of any considerable economic data that could support a sustained bullish scenario. Some of this pressure can be attributed to renewed recession fears emanating from the Chinese economy which put a damper on the optimism gained last week in regard to the “inflation-recovery”.

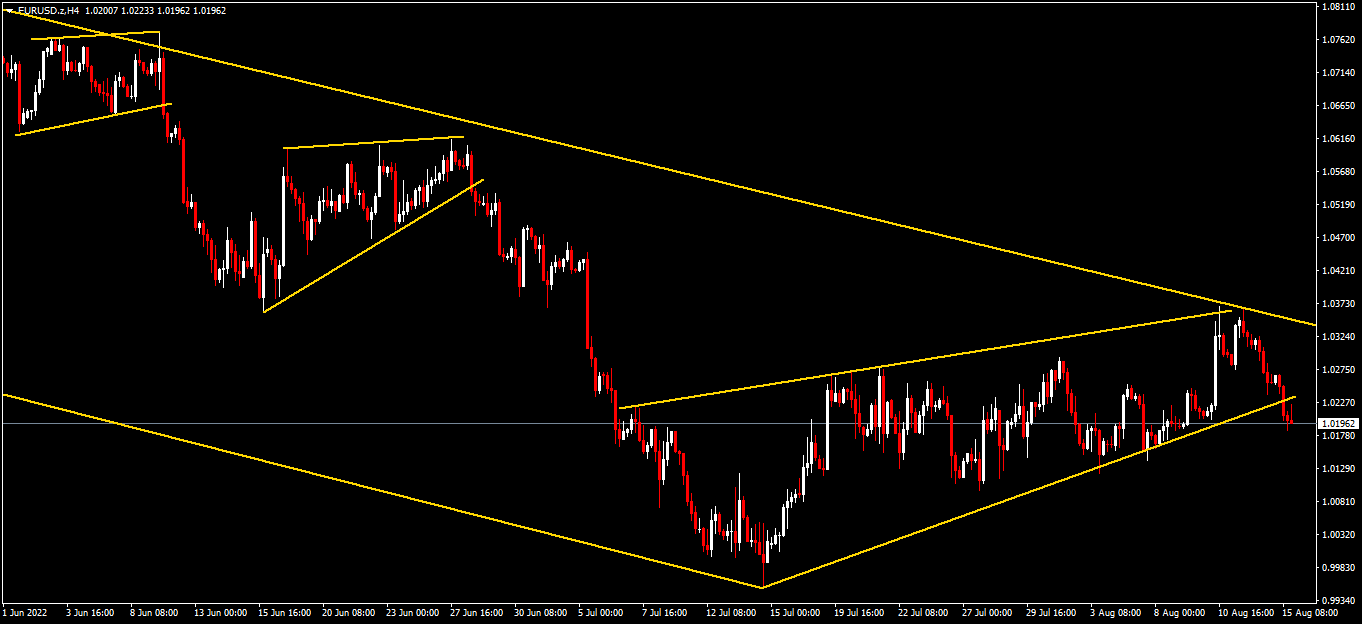

In terms of market structure, price has been moving correctively since 14 July 2022 in relation to the overall price action in the downtrend. This entire corrective structure is forming a bearish continuation pattern (rising wedge) The probability is that this pattern will yield an impulsive wave upon completion.

What could happen henceforth in the short term is a smaller correction before bears take control of price and challenge the monthly low around the 1.0129 area, and if broken impulsively, could open the gate for price to challenge the peak formation around the parity area.

Pound

Sterling began the week pressured by lower-than-expected employment data, erasing all the gains made last week on the back of optimism around inflation beginning to ease. Adding to that are political concerns around the next British Prime Minister, with the current candidates failing to inspire amid energy concerns in the country, as well as Brexit woes in the form of disappointing progress with the Northern Ireland deal.

Technical Analysis (H4)

In terms of market structure, current price action moved correctively towards the 1.2280 area in the form of an ascending channel, acting as a potential bearish continuation of the overall larger trend. Henceforth, the probabilities of this pattern since the break of the lower trendline in the channel, point towards the bears taking control of price to break below last week’s low around the 1.2020 area. An impulsive break below the above-mentioned area could open the gate for the bears to challenge the peak formation around the 1.1791 area.

Gold

Gold heads into the new week on the back foot ahead of Wednesday’s FOMC minutes. Any significant upside move is unlikely until Wednesday because of the sheer significance of the clues hidden within the minutes which will give investors a clearer picture of how the FED will act in September regarding a 50bp rate hike vs the prospect of a 75bp hike.

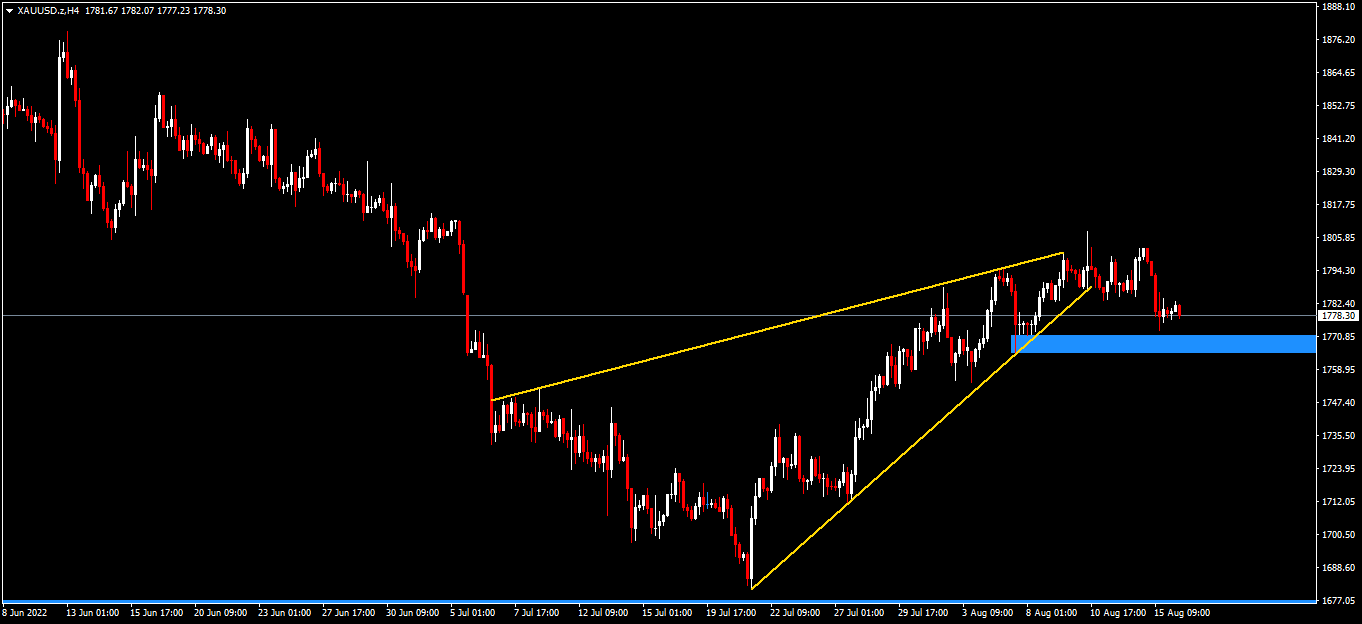

In terms of market structure, price has moved correctively since around the 20th of July 2022 from $1,680 towards the $1,805 area in the form of a bearish continuation pattern (rising wedge). If price breaks impulsively below the significant $1,770 area, then we could see bears take control of price to challenge the low at the $1,680 area.

Click here to access our Economic Calendar

Ofentse Waisi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.