Deere & Company, also known as John Deere, is an American manufacturing company engaged in the production of heavy equipment, especially equipment for plowing, livestock, plantation and agricultural purposes, is scheduled to report its third quarter fiscal results on Friday, August 19. The company is expected to post revenue growth, due to high demand for agricultural equipment and a strong price environment.

Trefis estimates Deere’s total revenue for fiscal 2022 at around $13.0 billion, slightly higher than the consensus forecast of $12.9 billion. The strong rebound in demand for farm equipment over the past few quarters, a trend that is likely to continue over the last quarter, is expected to continue to support the company’s performance. In addition, rising agricultural commodity prices, and the above-average age of agricultural equipment are likely to contribute to the company’s top-line growth.

Deere’s revenue rose 11% y/y to $13.4 billion in the latest report, driven by a 10% increase in farm and lawn equipment sales, while construction and forestry equipment sales rose 9%. Deere’s fiscal third quarter 2022 earnings per share (EPS) is forecast at $6.70, above the consensus estimate of $6.65. Deere’s net profit of $2.1 billion in Q2 reflected a 17% increase from its $1.8 billion profit in the previous year’s quarter. The company’s operating margins remained around 20% for the quarter. Looking at the full 2022 fiscal year, EPS is forecast to be $23.45, compared to the $18.99 seen in the 2021 fiscal year.

Trefis estimates Deere’s valuation to be $410 per share, reflecting a 19% increase from the current market price of $344 representing a forward P/EBITDA multiple of 10x based on Deere’s EBITDA forecast and compared to the last two-year average of 9x. This means, if the company reports upbeat Q3 results and its full fiscal guidance is better than forecast, it is more likely that P/EBITDA will be revised upwards, resulting in higher levels for Deere shares.

In other news, Deere & Company is rumored to have made a minority investment in Hello Tractor, an ag-tech company based in Nairobi, Kenya. Hello Tractor connects tractor owners with smallholders in Africa and Asia through a farm equipment sharing app, which allows farmers to track and manage their fleet, customer orders and access financing options.

Technical Overview

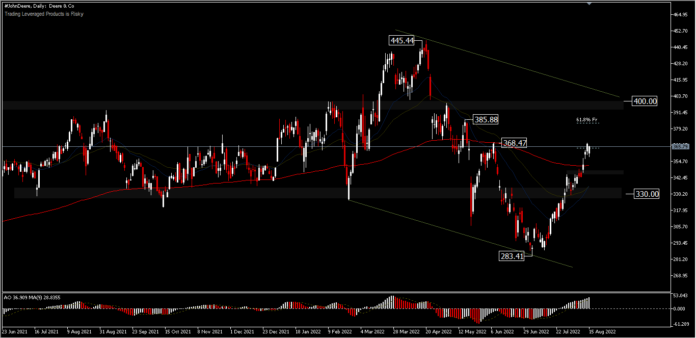

The #JohnDeere price has recovered 50% from its April peak drop of $445.44. The rebound of $283.41 has yet to show any downside ripples and the bullish momentum is still being maintained above the 200-day exponential moving average. The current price position is below the $368.47 resistance. Further rebound will test the 61.8% retracement level around $385.88. And a better report would bring the possibility to test the average monthly high around $400.00 seen from the price peaks formed in May & August 2021, February & May 2022. On the downside, downside ripples are likely to test the EMA 200 days around $350.00 and a disappointing report could lead to liquidation of long positions with a possible test for the monthly average low around $330.00.

Technical indicators are broadly still validating price moves, with the 26-day EMA seen crossing the 52-day EMA and oscillation in the positive area; The RSI is at the level of 71.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.