European economies are suffering as the energy crisis looks increasingly serious and central banks are forced to remove stimulus in order to try and prevent overshooting inflation from becoming entrenched. Confidence readings are heading south, prices continue to rise and the ECB and BoE remain on course for half point moves at their next meetings.

With markets increasingly concerned that aggressive central bank action will send the global economy into recession, the prospect of further rate hikes hasn’t done the Euro any favors. EURUSD dropped below parity, bottoming at 0.9915. Fed Chair Powell’s comments at the Jackson Hole meeting are the key event for currency markets now and EURUSD is likely to remain depressed this side of his speech. Uncertainty over Russia’s gas supply to Europe, along with a significant slowdown or even recession in Europe, which would mitigate inflationary pressures, will keep prices underpinned.

The S&P Global Composite PMI for the Eurozone dropped to 49.2 in the preliminary reading for August. The index provides a further sign that the economy is sliding into recession, though the number wasn’t quite as bad as feared, largely thanks to an unexpected improvement in the German manufacturing reading. The enthusiasm among services providers following the re-opening of the economy quickly gave way to concern about rising cost pressures and struggles to find staff following pandemic related lay-offs. The manufacturing sector meanwhile reported declining demand against the background of markedly higher prices, though the survey suggested that confidence in the year-ahead outlook was not as cautious as in July. Yet clearly, with energy shortages looming and the ECB set to hike rates again, the numbers tie in with expectations of contracting activity over the winter.

Elsewhere, the UK manufacturing PMI plunged to 46.0, which dragged the Composite down to 50.9 in August from 52.1 in the previous month. The UK composite remains above the 50-point no-change mark despite the fact that GDP actually contracted in the second quarter. It seems the survey is finally catching up with the reality of an economy that is already in recession.

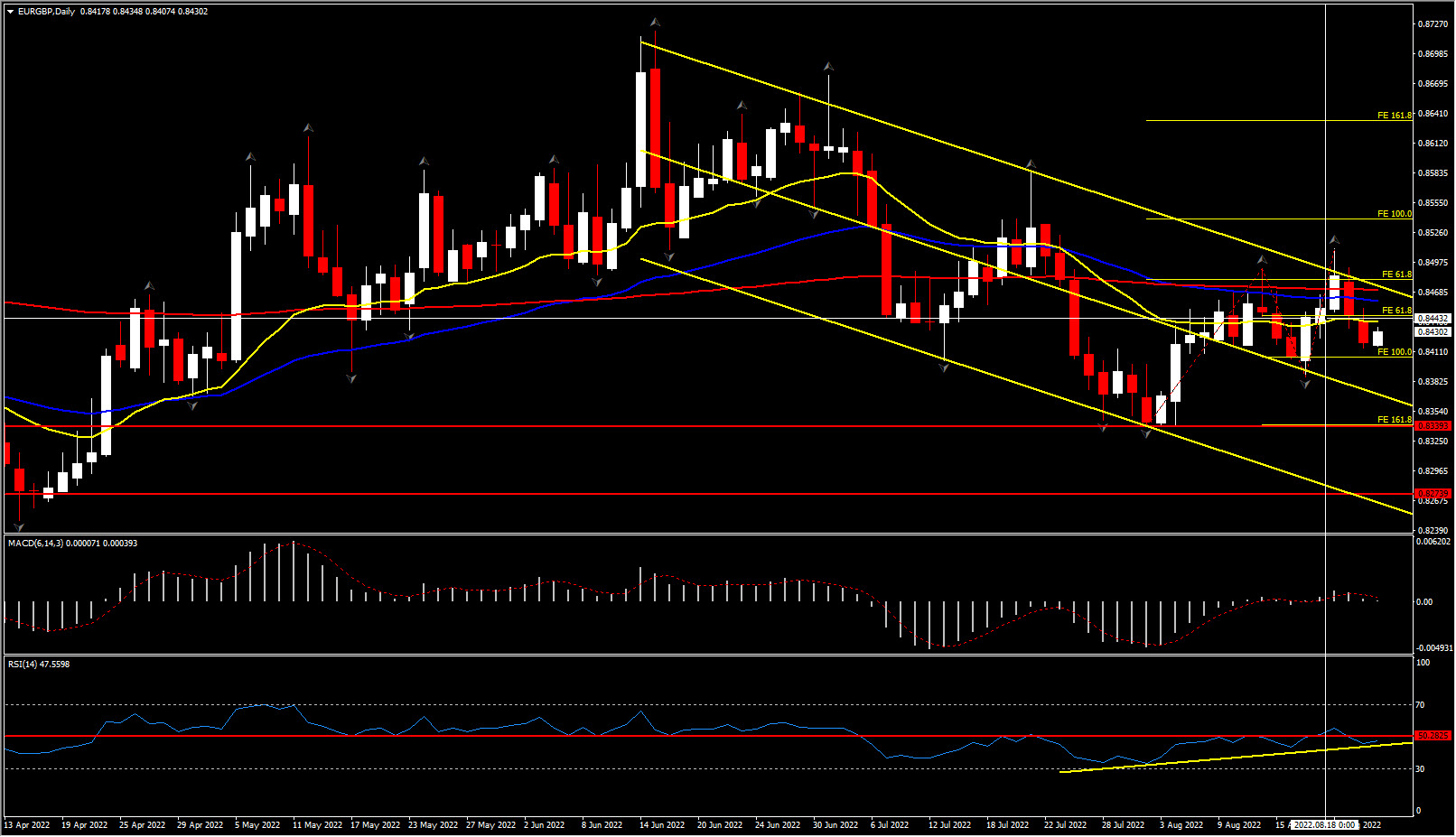

As in the Eurozone, the prospect of higher rates is not helping Sterling. EURGBP found a floor this week at 0.8400 since yesterday, holding well above the month’s low at 0.8339. However the failure in August to advance the 200-day EMA and the turn below all MAs are increasing the risk for a downtrend resumption. The pullback could follow the latest bullish correction if the asset fails to hold above the 0.8400 area.

The RSI is just a breath below the 50 level, having posted higher lows since the end of July, while the MACD lines are rising but still negatively configured, with both indicators and the flattened daily EMA indicating that the near term bullish bias might run out of steam. Yet, as long as the indicators keep sloping neutral and the EURGBP holds below 200-day EMA and the 0.8500, the base scenario is for the pair to keep diminishing.

In summary, with markets increasingly concerned that aggressive central bank action will send the global economy into recession, the prospect of further rate hikes hasn’t done the Euro or the Sterling any favors. Both the ECB and BoE, like other central banks, are in a difficult position as they faces slowing growth and rising prices. However, with inflation hitting double digits, the risk of second round effects and sizable wage growth is even higher in UK than in the Eurozone.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.