South Africa’s GDP shrank -0.7% quarterly in the three months to June 2022, compared to market forecasts of a -0.8% decline, as the devastating floods in KwaZulu-Natal and intense electricity rationing negatively impacted a number of industries. Meanwhile, Manufacturing production rose 3.7% from a year earlier in July 2022, below the market forecast for a 4% growth, following three consecutive months of declines. On a seasonally adjusted monthly basis, manufacturing output edged down -0.2% in July, after being revised up 2% in June, compared to the market forecast of a -0.7% decline.

The South African Rand is still showing weakness, amid the still strong US Dollar, due to expectations of aggressive monetary policy from the Fed and weakening commodity prices, especially gold. Throughout 2022, the South African Rand has weakened –7% against the US Dollar. And it has corrected to above the 61.8% FR level since the June 2021 rebound took place. In the previous week, Analysts from Credit Suisse raised their USDZAR target range to 17.00-18.00.

Technical Outlook

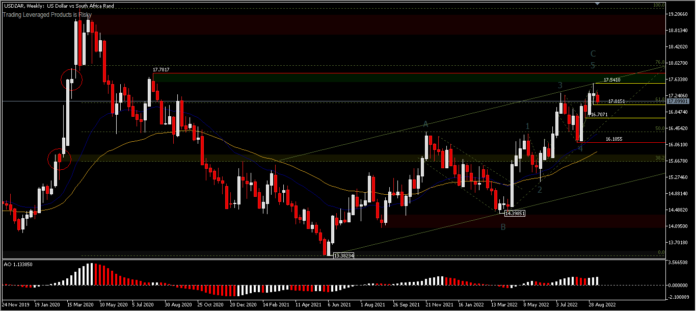

USDZAR – This exotic pair is still displaying a bullish dominance, as seen from the price movement. It is still above the 26-week and 52-week EMAs, despite rebounding at 13.3823 while seen stalling at 17.5410. On the upside, resistance remains at 17.7817 below the April 2020 peak.

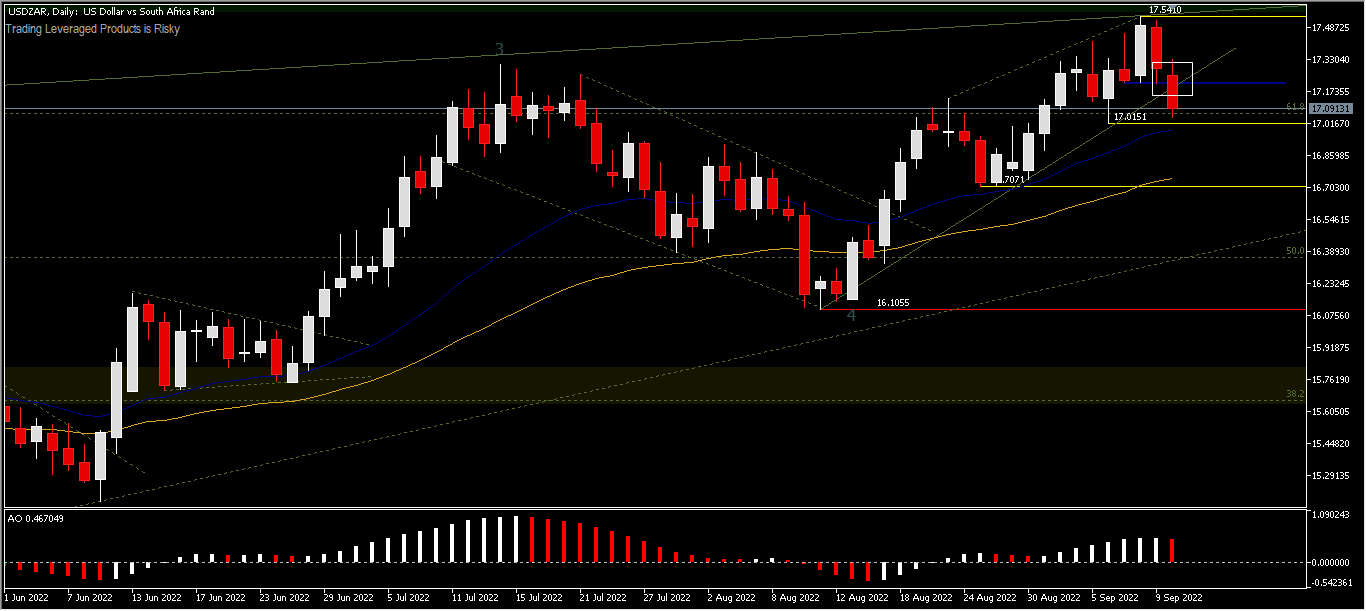

In the Daily timeframe, Friday’s decline continued on Monday by breaking the lower trendline of the rising wedge pattern for a while. The price movement is currently blocked by the minor support at 17.0151. A move below this price level, the pair could test the next support at 16.7071 (52 EMA). The prospect of a medium term bullish trend is not over yet, if the price still moves above the important support of 16.1055. While on the upside, a move above 17.3291 will re-test the recent high of 17.5410 and the Rand’s continued weakness still leaves the resistance at 17.7817.

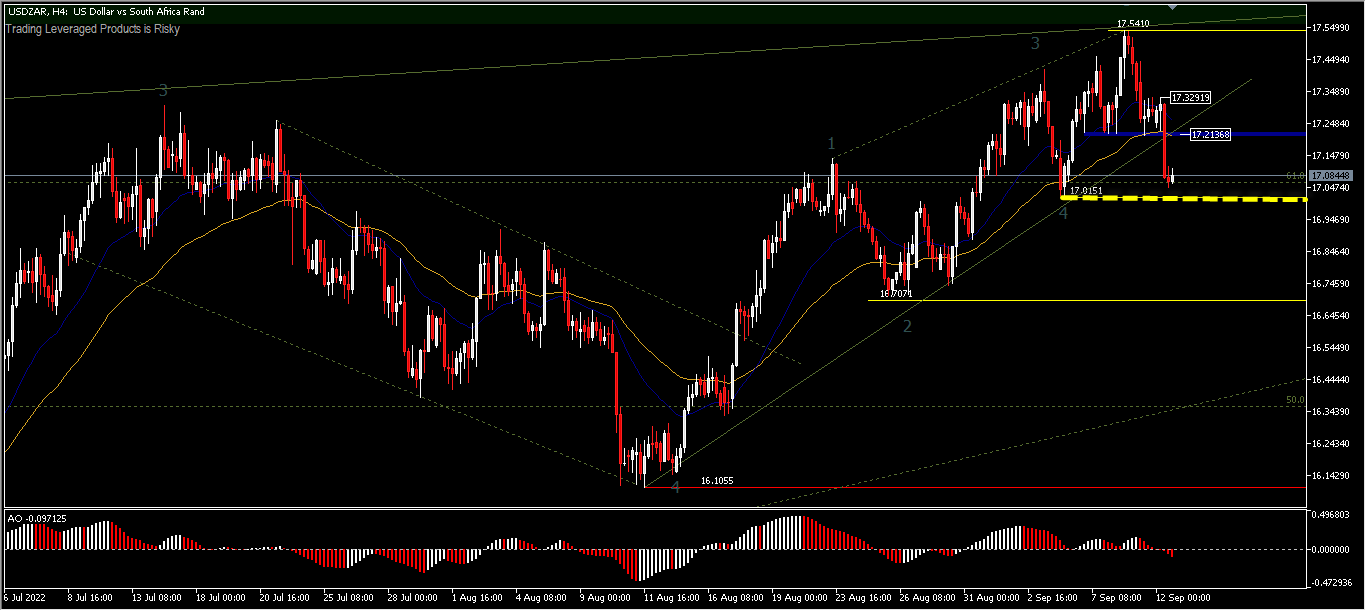

In the H4 period, the minor support of 17.0151 will be the concern of intraday traders, as a break above this level could result in a short-term decline, with the possibility of testing 16.7071 and further to the key support of 16.1055. Indications of oscillation indicators and EMA tend to reflect the newly created bearish momentum in Friday and Monday trading. On the upside, the price levels of 17.2136 and 17.3291 will hinder the rally that is trying to rebuild.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.