America’s biggest banks – JPMorgan Chase, Citigroup and Wells Fargo – will report third-quarter earnings this Friday (October 14) before the market opens.

Overall, US bank stocks have been buoyed by uncertainty and recession fears, although recent nonfarm payrolls results raised expectations for the Fed to continue its hawkish monetary stance in the upcoming FOMC minutes. The outlook remains uncertain.

JPMorgan

“Geopolitical tensions, high inflation, weakening consumer confidence and uncertainty surrounding the Fed’s ‘unprecedented’ rate hike activity are likely to negatively impact the global economy going forward.”

Jamie Dimon, CEO of JPMorgan Chase

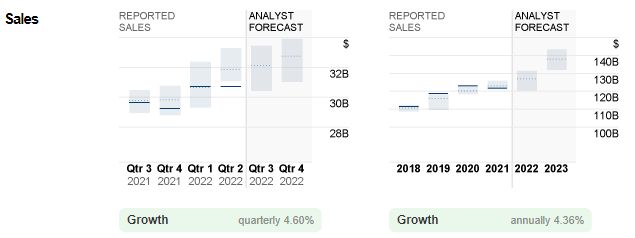

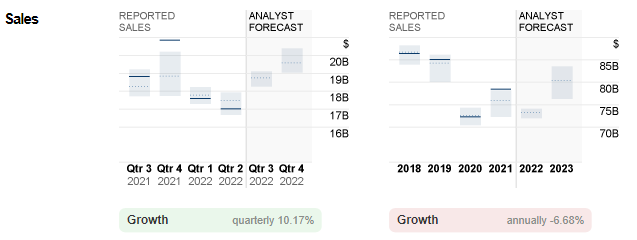

Figure 1: JPMorgan’s reported sales versus analyst forecasts. Source:money.cnn

Figure 1: JPMorgan’s reported sales versus analyst forecasts. Source:money.cnn

Last year, JPMorgan reported sales of $121.7 billion, missing consensus estimates. Sales in both the first and second quarters of 2022 came in at $30.7 billion, the latter missing consensus estimates ($31.9 billion).

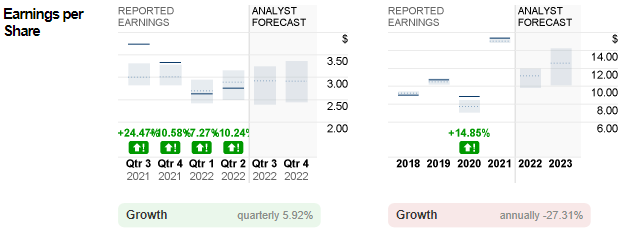

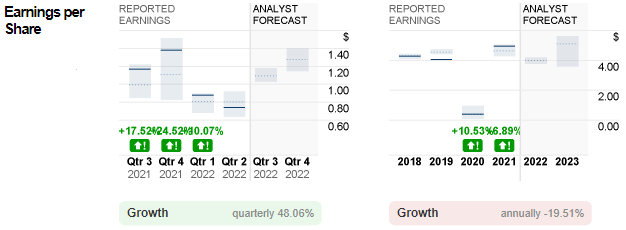

Figure 2: JPMorgan’s reported EPS versus analyst forecasts. Source: money.cnn

Figure 2: JPMorgan’s reported EPS versus analyst forecasts. Source: money.cnn

JPMorgan’s 2021 EPS hit $15.36, nearly double 2020’s. Reported earnings per share for the first and second quarters of this year were $ 2.63 and $2.76, respectively. Both numbers are in line with consensus estimates.

In the upcoming announcement, analysts forecast JPMorgan’s sales to reach $32.1 billion, up 4.56% from the previous quarter and up 8.45% from a year earlier. Earnings per share are expected to be $2.92, up 5.80% sequentially but down nearly -22% from the year-ago quarter.

Citigroup

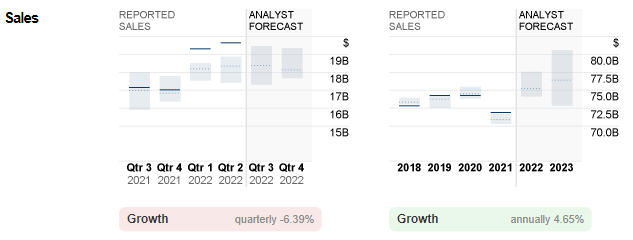

Figure 3: Citigroup reported sales versus analyst forecasts. Source: money.cnn

Figure 3: Citigroup reported sales versus analyst forecasts. Source: money.cnn

Citigroup reported sales of $71.9 billion last year, higher than expected but lower than sales in past years. In 2021, Citigroup continued to beat consensus estimates, reporting sales of more than $19 billion in both quarters.

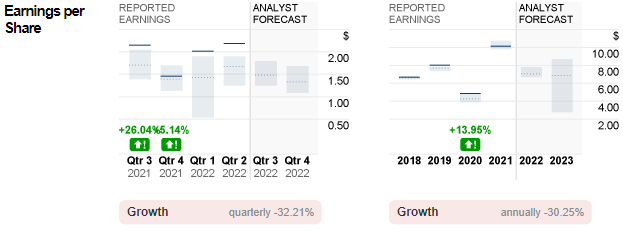

Figure 4: Citigroup reported EPS versus analyst forecasts. Source: money.cnn

Figure 4: Citigroup reported EPS versus analyst forecasts. Source: money.cnn

EPS fell slightly last year ($10.12 vs. $10.14), but was much better than 2020 ($4.87). The bank continued to beat market expectations in the first half of 2022, at $2.02 and $2.19, respectively.

Market forecasts for Citigroup’s first-quarter sales were $18.4 billion, down -6.52% from the previous quarter but up nearly 7% from the same period last year. Earnings per share are expected to reach $1.48, down more than -30% from the prior quarter and the year-ago quarter.

Wells Fargo

Figure 5: Wells Fargo’s reported sales versus analyst forecasts. Source: money.cnn

Figure 5: Wells Fargo’s reported sales versus analyst forecasts. Source: money.cnn

Wells Fargo reported that sales rose 8.58% year over year last year. This year, the bank missed market expectations for two consecutive quarters, reporting $17.6 billion in the first and $17 billion in the second.

Figure 6: Wells Fargo’s reported EPS vs analyst forecasts. Source: money.cnn

Figure 6: Wells Fargo’s reported EPS vs analyst forecasts. Source: money.cnn

Earnings per share in 2021 were recorded at $4.95, a 12-fold increase from the previous year. In 2022, results remain mixed so far, reaching $0.88 in Q1 (meeting expectations) and $0.74 in Q2 (below expectations).

Analysts expect the bank’s sales in the upcoming earnings report to be flat with last year at $18.8 billion, up 10.59% from the previous quarter. Earnings per share are expected to reach $1.10, up 48.65% from the prior quarter, but slightly lower than the year-ago figure of $1.17.

Technical Analysis:

On the Weekly chart, all three bank stocks are currently under pressure below the 100 SMA.

#JPMorgan (JPM.s) has been trending down since the last quarter of last year. To date, the cumulative loss has exceeded 60%. Shares of the bank are currently testing support at $104. A break below this level would give the bears a bigger chance to extend to the next support at $97 and then $88. Conversely, in the event of a rebound, the most interesting resistance levels to watch are $113 and then $118. A break above these levels could suggest bulls extending gains to $125, or FR 50.0% from the March 2020 low to the October high of the same year.

#Citigroup (C.s) continues to lose money since the second half of 2021, topping out at $80.28. The asset is trading within a descending channel with a higher high (HH) forming around the FR 23.6% at $69.10, followed by a lower high (LH) below the FR 50.0% at $54.55. Shares of the bank are currently testing FR 78.6% at $42. A break below this level could suggest asset prices will extend their losses to a 2020 low of $32, followed by FE 200% at $23.70. On the other hand, a firm rally above $42 could signal a short-term technical correction to test the nearest resistance at $46.40, then $50.45, then LH $54.55.

#WellsFargo (WFC.s) is trading in a consolidation zone between $36 (FR 61.8%) and $45 (FR 38.2%). Last week, it closed above FR 50.0% ($40.53), the most interesting support level. The asset needs a successful break above the 100 SMA and $45 to regain its upside bias, with the next resistance at $51 (FR 23.6%). Otherwise, a close below FR 50.0% could push the bears to continue pushing the price lower to the $36 (FR 61.8%) and $29 (FR 78.6%) support levels.

Click here to access our Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.