Markets continue to doubt the BoE’s strengthening measures to lower risks related to the UK’s financial stability. To ensure an orderly completion to the emergency bond buying programme that ends on Friday, the BoE announced new measures by raising the amount of bonds it will buy this week. But as the emergency plan’s deadline approaches, markets are concerned that once the scheme is completed, volatility will increase once again.

The BoE’s plan to tackle rapidly rising borrowing costs is likely to be only temporary, as its main focus remains on withdrawing stimulus and tightening monetary policy in the fight against near double-digit inflation. It remains unclear, after all, how it will end its emergency bond-buying plan.

Today’s huge jump in 30-year yields puts the pressure back on the BoE to come up with a bolder plan, or risk letting GBPUSD slide towards parity. The yield on 30-year debt has risen to a high of 4.75%, close to the post-intervention peak of 5.12%. The 10-year yield also rose further to 4.3% moving closer to the 14-year high of 4.5% reached on 28 September, as measures announced by the Bank of England and the UK government failed to boost investor confidence.

Meanwhile, Chancellor Kwarteng said he will present his fiscal budget with economic forecasts backed by the budget watchdog on 31 October, almost a month earlier than planned.

Technical Analysis

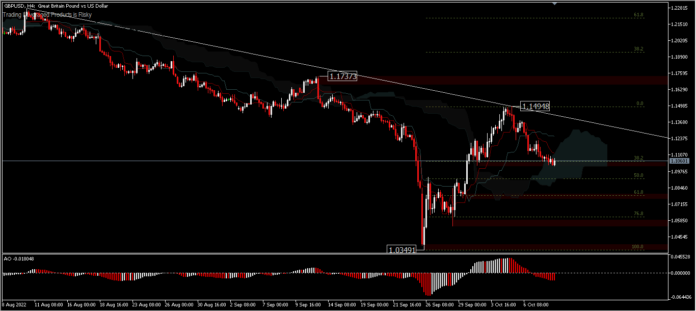

GBPUSD intraday bias remains neutral after narrow trading on Monday. On the downside, a break of the 1.1023 minor support would suggest that the rebound from 1.0350 is over. Intraday bias will return to the downside to test the 61.8%FR retracement level (1.0783) and if it persists it could test the 1.0538 support and 1.0350 low. On the upside, a strong break of 1.1495 resistance and descending trendline will open the way to 1.1737 and 1.2292 resistance. Oscillation indicators are still validating the recent downside movement in the sell zone, while the current price position is at the top of the bullish Kumo.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.