- USDIndex – Spiked to 113.80 following hot reading for CORE CPI and then reversed sharply into 112.20 as Stocks staged a record reversal (from -3% to +over 2%) on short covering, technical floors being tested and ? perhaps assumptions that the top is finally in for inflation (Headline fell for 3rd consecutive month). Yields also whipsawed, with at one point, all major maturities above 4%. (US 10yr closed 3.902% & the 2/10 year rate inversion {a sign of recession} sits at 51bp). 75 bp fro Nov 2 fully priced in, and a 71% chance of a further 75bp in December. (This will take hikes since March to 450 bp).

- The UK’s new fiscal policy remains squarely under threat as Chancellor Kwarteng returns from the IMF meetings a day early (last person to do that was the Greek Fin. Min. in 2011 and many are predicting a similar outcome both politically and economically). The BOE’s Bond-Buying programme ends today, uncertainty swirls as tax U-turns become priced in. Sterling rallied and then rallied again, but Gilts remain fragile. Asian markets follow Wall Street higher (Nikkei +3.25% Hang Seng +2.64%) & European FUTS also higher.

- EUR – rotated through 0.9700, down to 0.9632 before rallying to 0.9800.

- JPY – rallied to new 32-year (1990) highs at 147.67 and with no signs of BOJ action! Suzuki and Kishida remain committed to accommodative policy. Trades at 147.35 now.

- GBP – Sterling rallied from .1.1075 to over 1.1300 to 1.1375. Immense pressure on PM Truss & Chancellor Kwarteng to reverse tax cuts as successors are rumoured and the Tories are 30% behind in opinion polls.

- Stocks – Wall Street dove on the data given the jump in rates and as the market priced in greater risk for a hard landing. The NASDAQ plunged over -3.0%, with the S&P500 over -2.25% lower, and the Dow down almost -1.90% before turning around to end with solid gains. The Dow rallied to close with a 2.83% gain, a 1400 point round-trip, while the S&P 500 was up over 3% before ending with a 2.60% gain. US500 3577. BLK (assets tumbled but earnings beat)+6.58%, BAC +6.13%, NFLX +5.27%, APPL +3.36%. US500 FUTS trades at 3706 now.

- USOil – declined again on the CPI data & global recession worries into $85.51, before reversing sharply to $89.50 as USD weakened and risk aversion dipped.

- Gold – plunged to $1642 before recovering to trade at $1668 now but remains pressured.

- BTC – plummeted to $17.9K yesterday, trades at $19.8k now.

Today – US Retail Sales, US University of Michigan Prelim Survey, Speeches from BOE’s Bailey, Fed’s George, Cook & Waller. Earnings from Wall Street banks JPM, Citi, MS Wells Fargo.

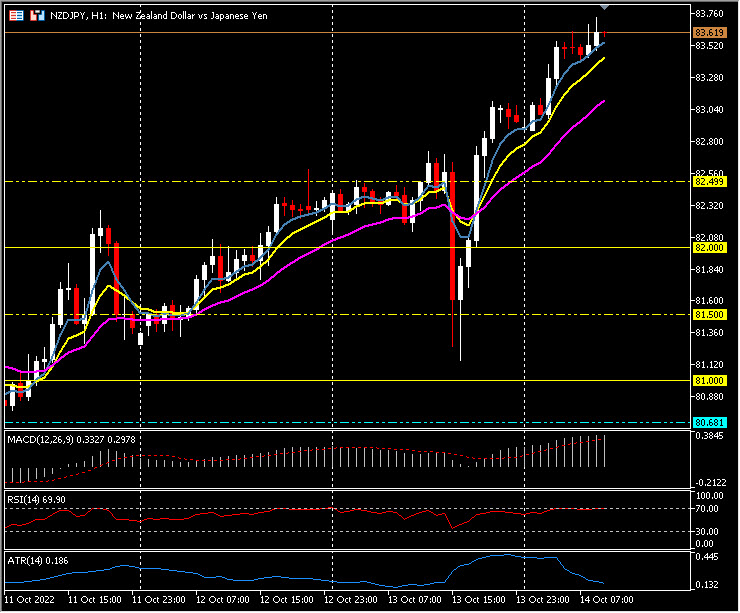

Biggest FX Mover @ (06:30 GMT) NZDJPY (-0.96%) rallied from sub 81.20 lows yesterday to 83.75 highs today. MAs aligned higher, MACD histogram & signal line positive & rising, RSI 70.00, OB & rising, H1 ATR 0.186, Daily ATR 3.201.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.