The new week begins, and the Dollar pulls back from 113.95 amid a risk-on mood.

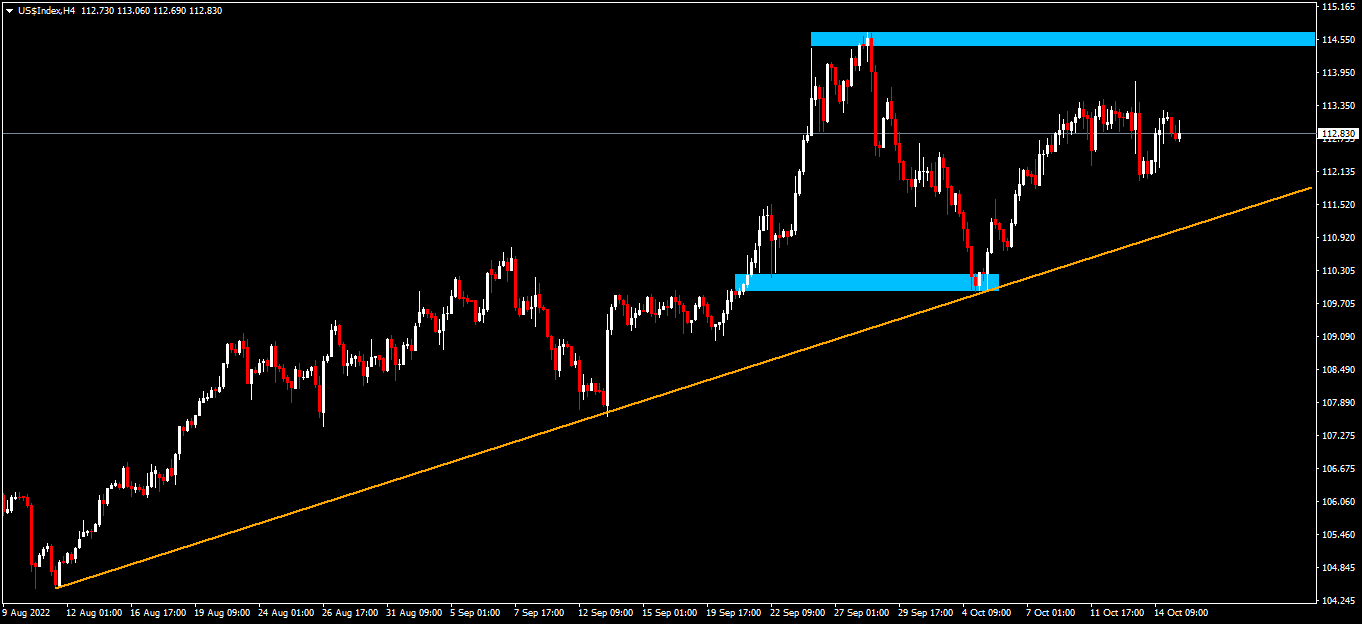

Dollar

The Dollar begins the new week holding onto the gains made in the latter half of last week. Factors driving this continued strength are linked to higher-than-expected US CPI data that came out on Thursday, giving the FED the greenlight to continue its current regime of interest rate hikes. What the inflation data suggests is that the FED is now more likely to go for a 75-basis point rate hike at their next meeting. All the above prompted a sell-off in US stocks and the Dollar was the main beneficiary of the “safe-haven play”.

In terms of market structure, price is in an uptrend, printing higher-highs and higher-lows. Current price action is locked in a range between 109.95 – 114.55, with the bulls mostly in control of the dynamic, however, the potential of revisiting the 112.00 area is still in play before price heads to the top of the range again.

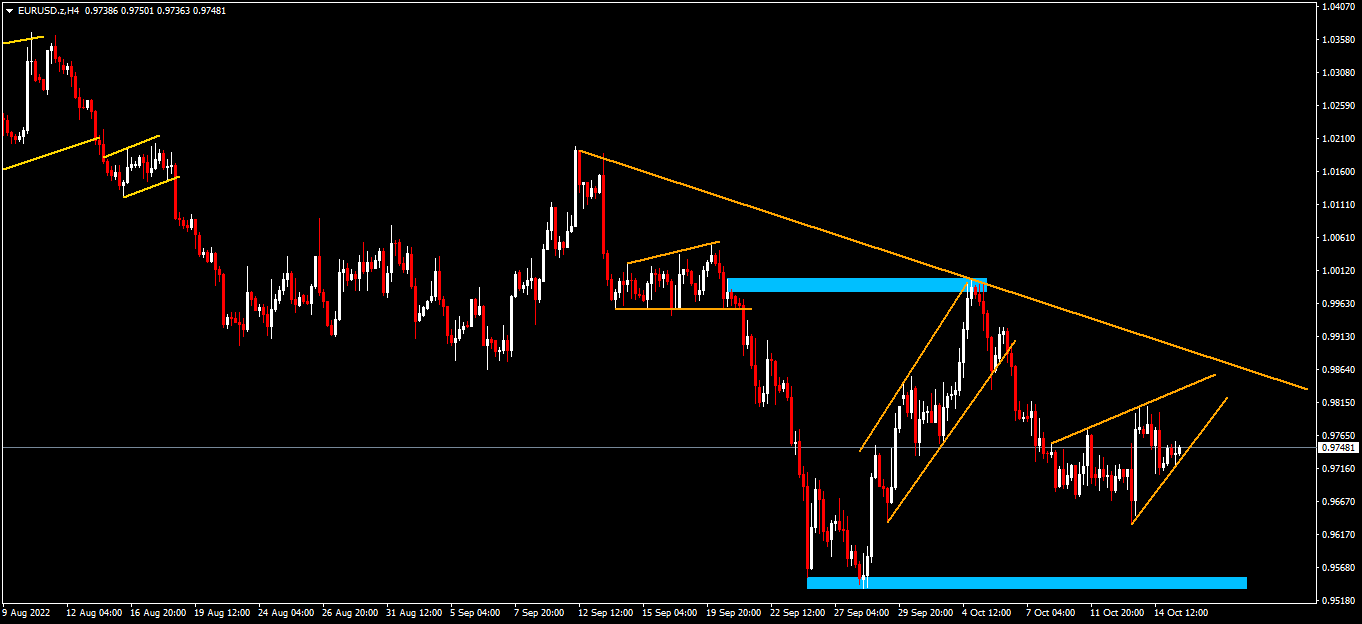

Euro

The Euro kicks off the week with renewed enthusiasm, clawing back some losses amid a risk-on mood in the market on Monday morning. Factors driving this pullback in price are mostly linked to dollar dynamics and rumours coming from a member of the executive board of the ECB, Phillip Lane, of a 75-basis point rate hike being advocated for at their next meeting.

Technical Analysis (H4)

In terms of market structure, price is in a downtrend, printing out lower-lows and lower-highs. Current price action is in a potential bearish continuation pattern (rising wedge) and will only be confirmed by an impulsive wave to the downside. If confirmed, sellers could drive price to the bottom of the range to test the 0.95 area.

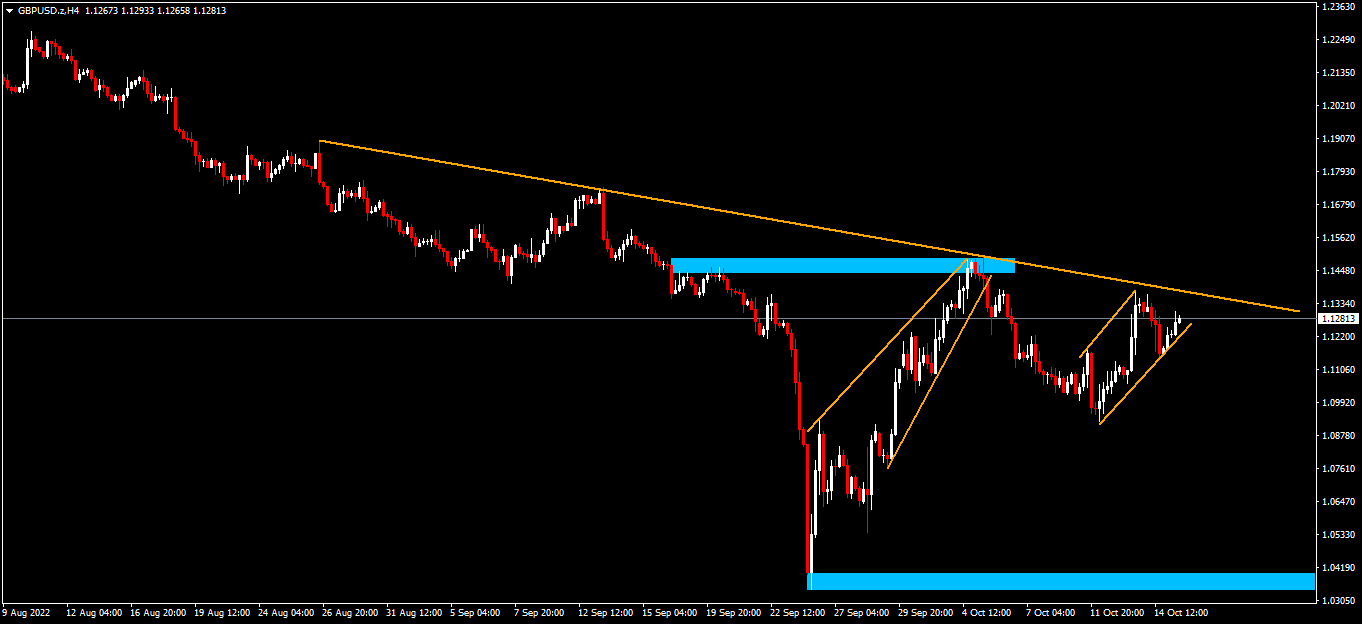

Pound

Sterling begins the week regaining some of the losses incurred from the previous week. Factors driving this exuberance are keenly linked to a slightly weaker Dollar amid a risk-on mood in the markets at the beginning of the week. Though the Pound seems to be a beneficiary of this, the upward movement lacks any bullish conviction ahead of the new UK Chancellor’s speech centred around fiscal plans.

Technical Analysis (H4)

In terms of market structure, price is in a downtrend, printing lower-lows and lower-highs. Current price action is printing out a potential bearish continuation pattern (ascending channel), which will only be confirmed by an impulsive break of structure to the downside. If the aforementioned scenario is confirmed, sellers will drive price back down to revisit the 1.041 area.

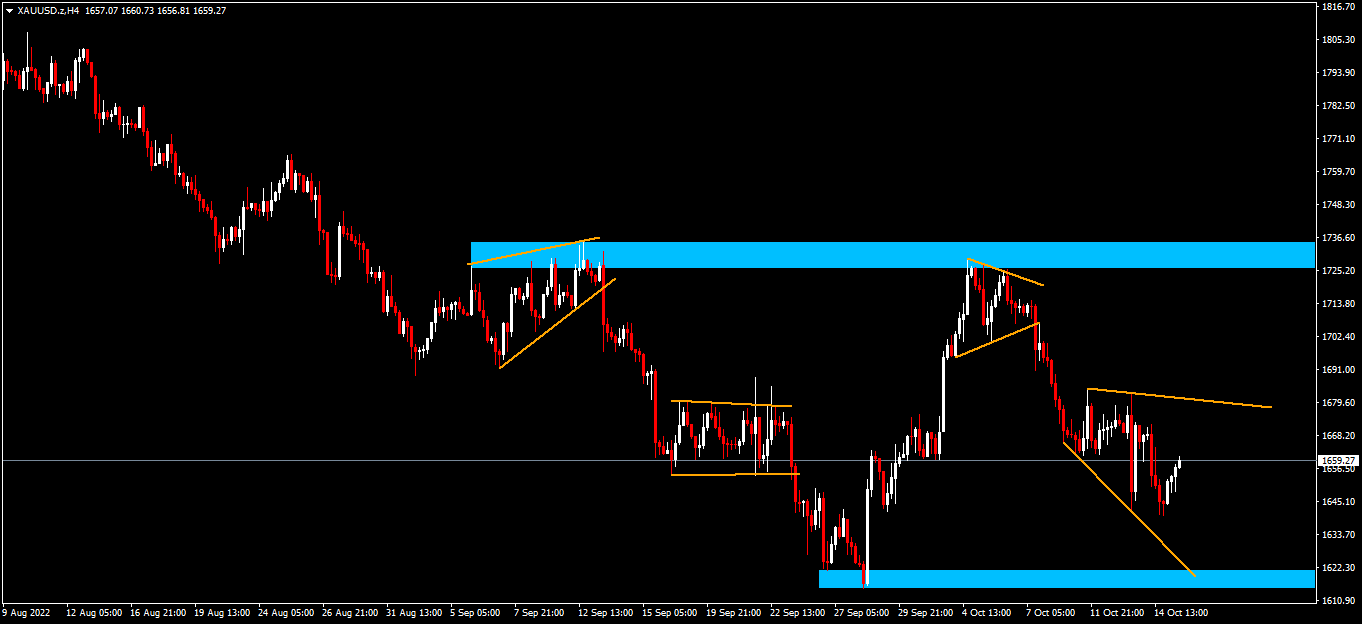

Gold

Gold heads into the new week bouncing from a 13-day low to recover some of the losses seen in the preceding week. Factors driving this renewed buying interest go against the grain amid increasingly hawkish Central Bank rhetoric around the globe, and it seems this exuberance is linked to easing concerns around the UK economy as well as risk-on sentiment amid a slightly weaker Dollar at the beginning of the week.

In terms of market structure, Gold is still in a downtrend and continuing to print out subsequent bearish continuation patterns. The price action correctively approached the high of the range located around the $1 727 area in the form of a symmetrical triangle. The reversal pattern was confirmed by an impulsive break of structure which validated that sellers are in control of price and are likely to challenge the low of the range located around the $1 620 area.

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.