- USDIndex above113 as haven demand picks up after dropping to 112.16. Yields are rising and stock markets remain under pressure, with indexes in the red across Asia and Europe and US futures also selling off. The 10-year yield rose 12 bps to test 4.24% before finishing at 4.228% (12-week strike of increases). Selling picked up after the break of 4.10%.

- PM Truss announced her resignation. While the markets cheered that news initially on hopes for some stability, it was more hawkish Fedspeak, better than expected jobless claims, a tepid 5-year TIPS, the announcement of $120 mln in new supply, and mixed earnings that ultimately weighed on Treasuries and Wall Street into the close. UK yields dropped on the Truss resignation, and Treasuries followed suit. But the gains in Treasuries were soon undone amid as hawkish comments from Harker.

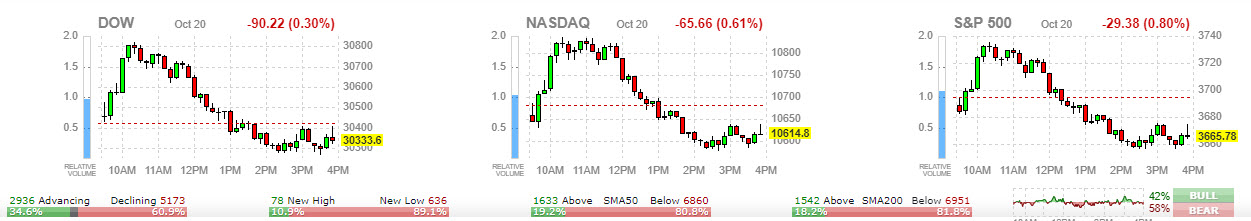

- Stocks – Stocks stumbled through the afternoon and closed at the day’s lows with the US500 -0.8% in the red, back under 3700. The US100 was down -0.6% and the US30 was -0.3% underwater.

- EUR – 3-day consolidation at 0.9760.

- JPY – has now cleared the psychologically important 150 mark and is at 150.43.

- GBP – is struggling amid the political turmoil and ongoing uncertainty over the political and fiscal future of the country. Cable has dropped back to 1.1182. UK retail sales plunged -1.4% m/m in September.

- USOil – steady at $84.

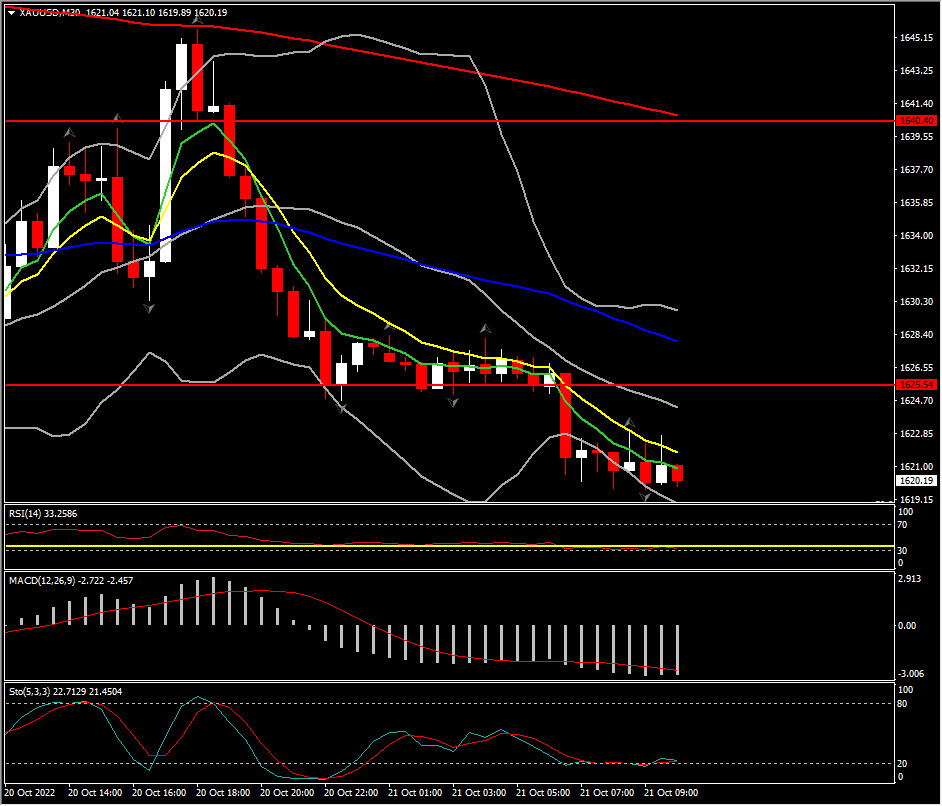

- Gold – fell to $1620 & set for a 2nd weekly decline as US Treasury yields rose to multi-year highs.

Today – Canadian Retail Sales & EU Oct. Consumer Confidence.

Biggest FX Mover @ (06:30 GMT) XAUUSD drifted to 1620. MAs aligned lower along with southwards BB lines, MACD histogram & signal strongly bearishly configured, RSI 33.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.