The BoC overnight only raised interest rates by 50bp to 3.75%, below market expectations of 75bp. Bank rate and deposit rate were 4.00% and 3.75% respectively. The central bank maintained its tightening bias and noted that the policy rate needs to rise further.

In the new economic projections, GDP growth was lowered from 3.5% to 3.3% in 2022, from 1.8% to 0.9% in 2023, and from 2.4% to 2.0% in 2024. The CPI inflation forecast was also lowered from 7.2% to 6.9% in 2022, from 4.6% to 4.1% in 2023, and from 2.3% to 2.2% in 2024.

During the press conference, Governor Macklem said that the central bank is getting closer to the end of tightening but not there yet. In addition, he noted that the BoC is still far from its target of low, stable, and predictable inflation. Macklem was noncommittal in terms of where Monetary Policy is headed next. Therefore, traders should pay close attention to the data to determine where the price is headed next.

Technical Overview

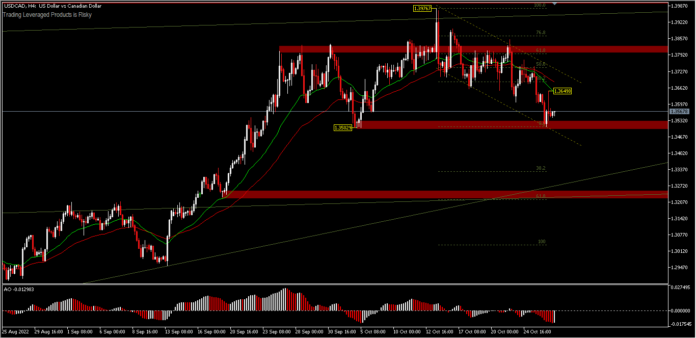

Technically, on the intraday period the USDCAD pair formed a rounding top format. Rounding tops are generally found at the end of an extended uptrend and may signal a reversal of long-term price movement. But is it working this time?

In the last 5 weeks the price of this pair has been trading between 1.3502 – 1.3976. And there has been no catalyst to push the pair out of this range. The market seems a bit disappointed with the BOC’s decision, as seen by the price’s acceleration to the upside, after the interest rate announcement which came in below expectations. However, rising oil prices might contribute to the strengthening of the Canadian Dollar.

A price move below 1.3502 support could result in some bullish trend correction to test the ascending trendline drawn from the August-September low around 1.3300. As long as the 1.3502 support holds, consolidation will likely still prevail. Currently, the price is still moving below the 26- and 52-period EMA on the H4 period, and the price bias tends to be neutral at the moment.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.