BTC has had a rough year with its price falling more than 70%, with rising inflation that has forced a tightening of monetary policy by the US Central Bank which is expected to raise rates by 75 basis points this Wednesday for the 4th time in a row and an extremely strong Dollar creating an explosive cocktail that presages the cryptomoney.

As of October 24, BTC began its bullish rally to the $21,097 level by taking advantage of the USIndex pullback and the market rally; the US30 for example had its 4th consecutive week of gains (its best month since 1976). Major players anticipating a more measured FED action and a less hawkish speech from its chairman Jerome Powell contributed to the success of BTC, which was able to successfully break through resistance at the $20K level.

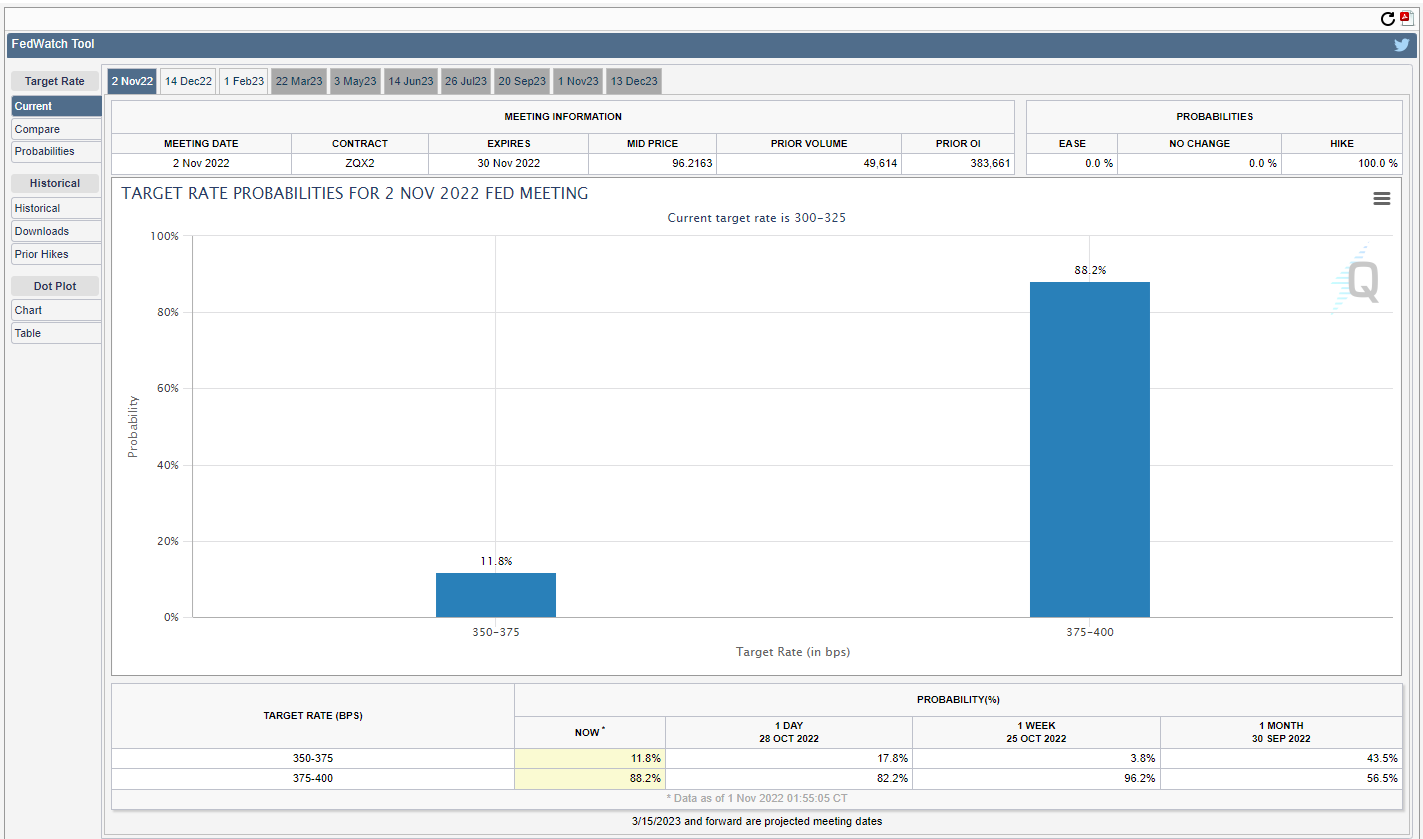

The fact that expectations of central bank policy remain high (see chart below) and that the bull run in the markets is reaching key levels brings back caution as we await Jerome Powell’s speech.

The FOMC meeting which takes place today and tomorrow (see chart below) will bring more answers. The policy of the US Central Bank and its role in steering the economy will be crucial: on the one hand the data indicates that the peak of inflation in the United States has been reached, which would favour a less aggressive action from the FED, while on the other hand, an early easing of its action could boost inflation, an unthinkable solution for Jerome Powell whose goal is to bring it back to 2%.

A purely technical and interesting factor concerns the volatility of BTC, as reaching historically low zones could cause a strong reaction of the cryptomoney. History shows us that the reaction of the price of BTC is as violent in one direction as it is in the other. (see below).

Technical Analysis:

BTC price is currently in its cloud at $20,564, above its Kijun (L. V) and Tenkan (L. J), its Lagging Span (L.B) is above its consorts and is currently working the Kijun (L. V) which indicates a hesitation in price. In the case of an uptrend the price could retest $21,097 and then $21,823. In the opposite case the price could test the resistance of 20K and then reach the level of its Kijun towards $19,430. (See below)

Click here to access our Economic Calendar

Kader Djellouli

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.