EURUSD,Daily

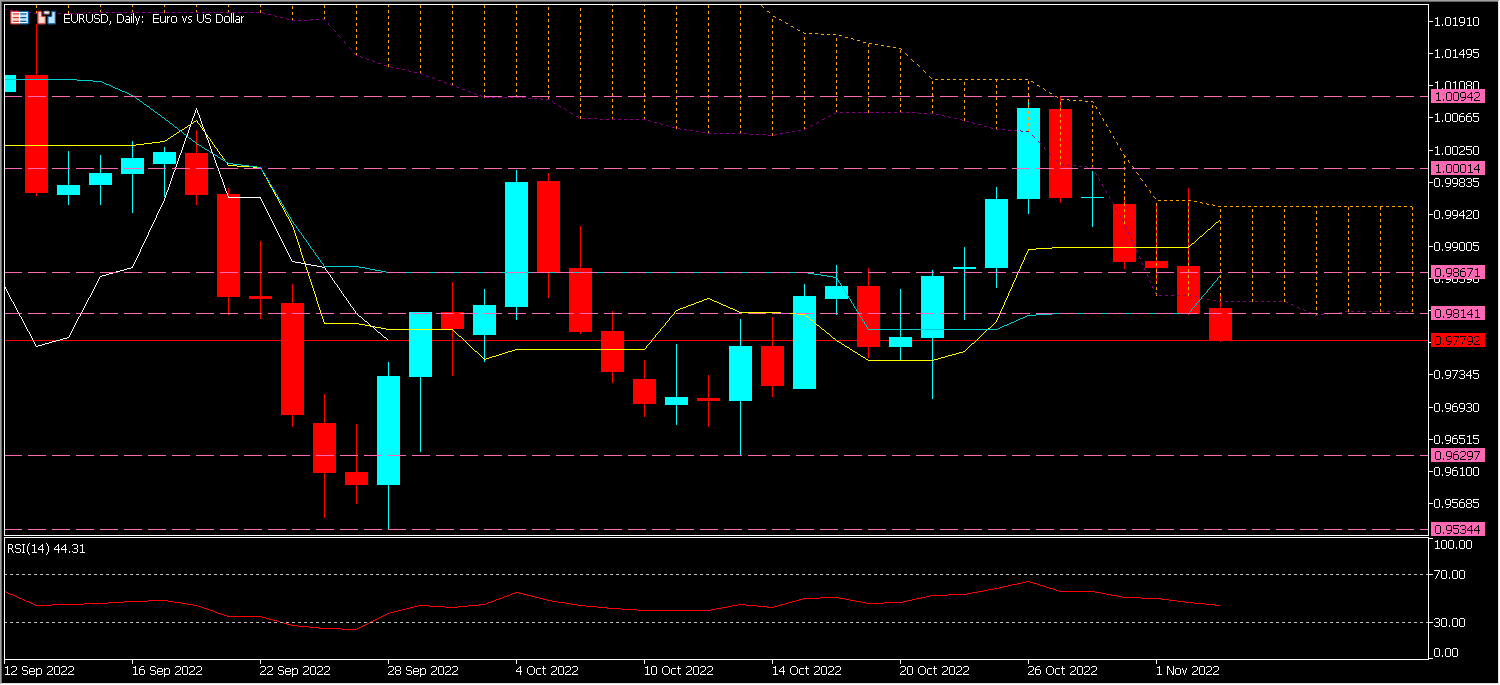

EURUSD, like many other assets, had a mixed reaction to the Fed meeting last night. Indeed, the US Central Bank’s statement sent the pair surging to a high of 0.9976 before falling during Jerome Powell’s press conference to hit a low of 0.9810. The double-edged message of this sent EURUSD volatility skyrocketing. Today the pair trends lower and currently holds north of 0.9750 support.

Indeed, the American Central Bank is preparing for a gradual slowdown in rates, causing a depreciation of the US Dollar, which has automatically been interpreted as a clear signal in favor of a rise in the EURUSD pair.

However, during Fed Chair Jerome Powell’s press conference, EURUSD reversed its gains and more. Indeed, the Governor of the Central Bank has repeatedly declared that inflation is too high, emphasizing that price stability is essential to the American economy and reaffirming that the FED will maintain its current position “until the job is done”.

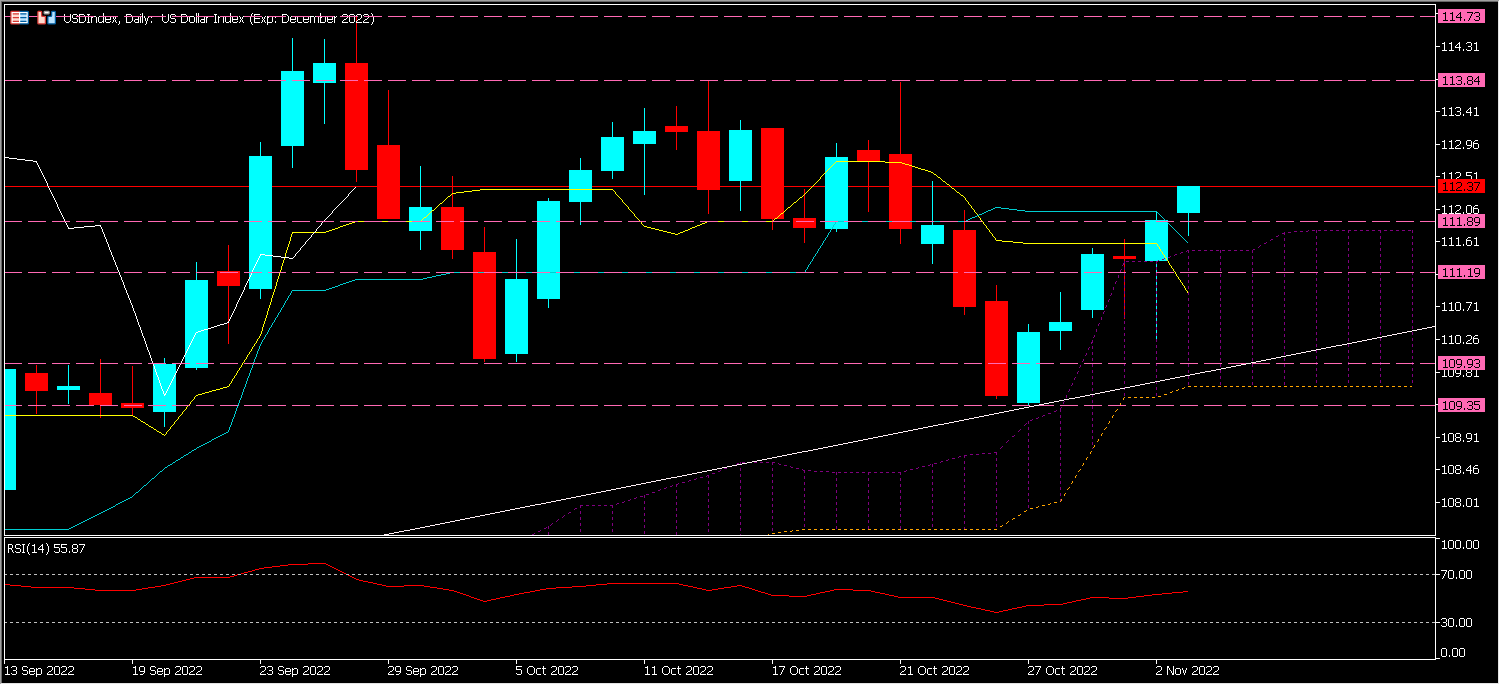

More importantly, he said “the ultimate level” of benchmark policy rates will be higher than previously estimated. According to some experts, this data could push the final interest rate above 5%, thus driving the Dollar higher and EURUSD lower. (See below)

To put it simply, during his speech, the Fed Chairman did not say what the market players who had anticipated a less hawkish monetary policy wanted to hear. On the other hand, the statistics on American employment which are expected today and especially tomorrow (NFP) could be the vector of a completely different dynamic, especially if the data are extremely far from the consensus, so paradoxically bad news would become good news for the markets.

Technical Analysis

The EURUSD price is currently at 0.9760, below its cloud, its Kijun (LV) and its Tenkan (LJ), while the Lagging Span (LB) is below its cohorts, but will have to cross the Prices to confirm a return to the downside. If confirmed it would first test the support which is at the level of 0.9629 then reach 0.9534. Conversely if the course recovers there could be a return towards parity (1.0000) initially then towards 1.0094.

Click here to access our Economic Calendar

Kader Djellouli

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.