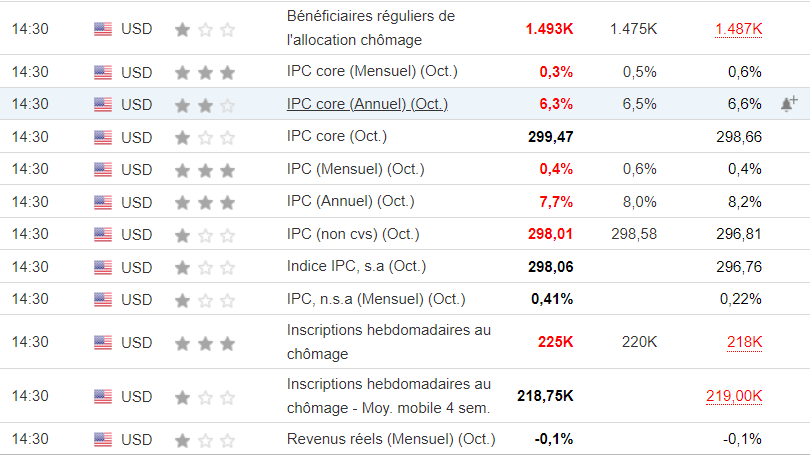

The US100 is a technology-heavy index that is extremely sensitive to interest rate hikes due to the fact that tech companies have to constantly innovate in order to stay competitive. This means they have to borrow a lot of money. Last week the US100 rose by 8.8%, the most in over two years. The US markets reveled in October’s inflation figures of 7.7% year-on-year (see below).

These figures triggered a butterfly effect, causing a huge rally in risk assets, stocks and bonds. The two-year Treasury yield fell 30 basis points on Friday, its biggest drop since 2008, as markets anticipated a policy shift by the US central bank.

source:cmegroup

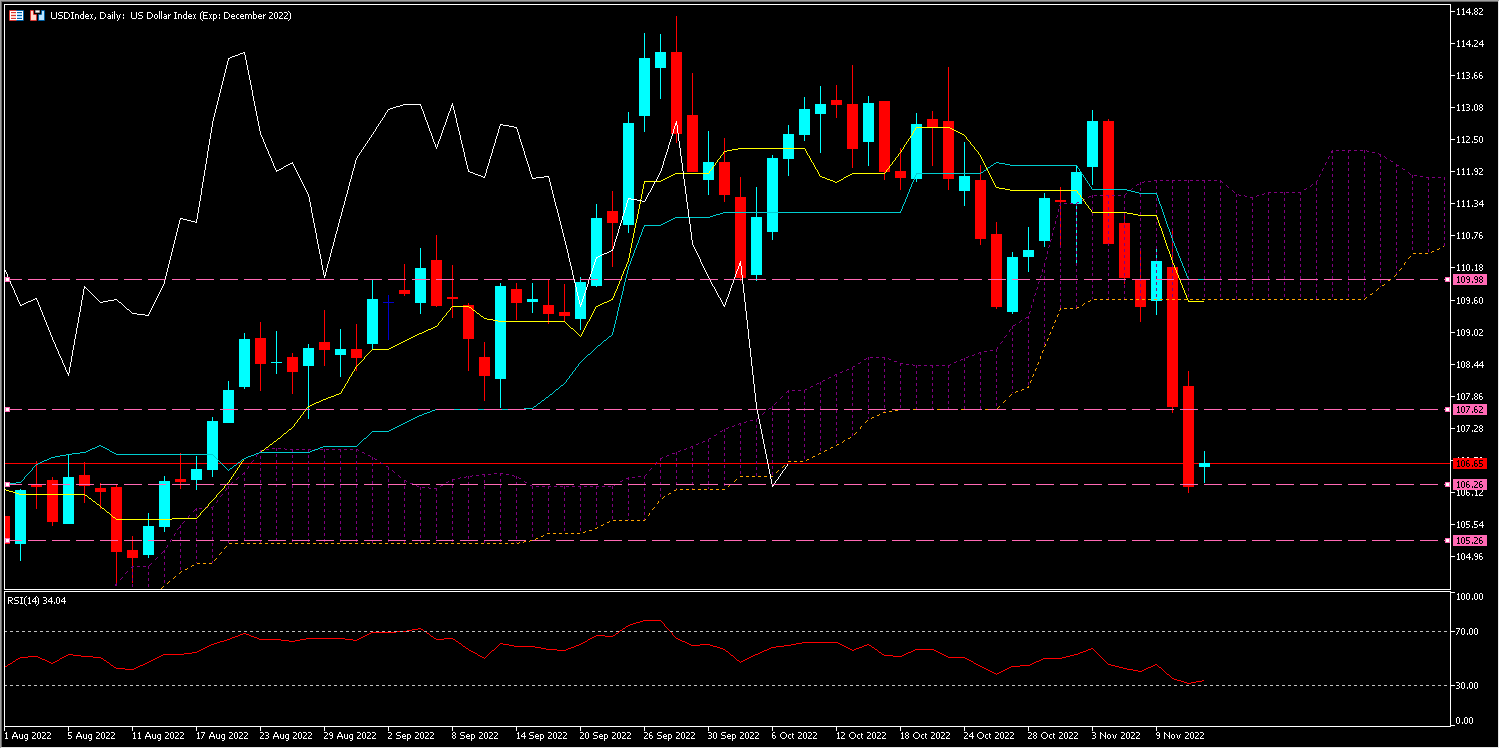

The USDIndex fell 4%, its fourth biggest weekly decline on record, loosening its grip on technology stocks. Market participants probably saw a sign that inflation has peaked and that the FED’s action has had the expected impact and will therefore lead to a loosening of central bank monetary policies.

At first glance, it would appear that the skies have suddenly cleared and the bullish rally can still continue, but the bears could rightly argue that the market had already anticipated the decline in inflation causing this rebound, plus it seems clear that next year will be marked by a global recession.

On Sunday Federal Reserve Governor Christopher Waller gave unexpected support to the bearish with his comments at an economic conference hosted by UBS in Australia: “We’re at a point where we can start to think about maybe moving to a slower pace”, but “we’re not going soft… Stop paying attention to the pace and start paying attention to where the end point is. Until we reduce inflation, that end point is still a long way off.“

Market participants could reassess their bullish stance and wait for the Mid-Term results to come in as the promised Republican tsunami has turned into a ripple, with the Democrats having already retained control of the Senate late on Saturday and pledged on Sunday to tackle the national debt ceiling in the coming weeks. The meeting between US President Joe Biden and Chinese leader Xi Jinping at the G20 summit in Bali today could influence the markets, as a warming of relations between the two superpowers could bring positive sentiment for investors.

Technical Analysis

The US100 is currently at $11770 in the cloud and is above the Kijun (L v) and Tenkan (L j); the Lagging Span (L b) is between the two signifying hesitation as to future direction. In the case of a bullish momentum the price could reach $11842 and then $12074, otherwise the price could test its Kijun at $11250 and then test $11058.

Click here to access our Economic Calendar

Kader Djellouli

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.