The Dollar Index begins the new week on the front foot, rebounding from the 104.01 area on the back of upbeat US Macroeconomic data.

Dollar

The Dollar begins the new week finding renewed buying interest around the key 104.01 area. Factors driving this exuberance in the early part of the week can be linked to the upbeat data coming from the US in the form of the ISM Services PMI for the month of November, which saw the data come in higher than anticipated by the market at 56.5 as opposed to the expected 53.1. This data is significant as it measures the level of demand for products by measuring the amount of ordering activity emanating from different factories across the country. While the figures indicate that the US economy is still very resilient and healthy, it gives the FED a headache in terms of their decision on interest rates in the coming weeks.

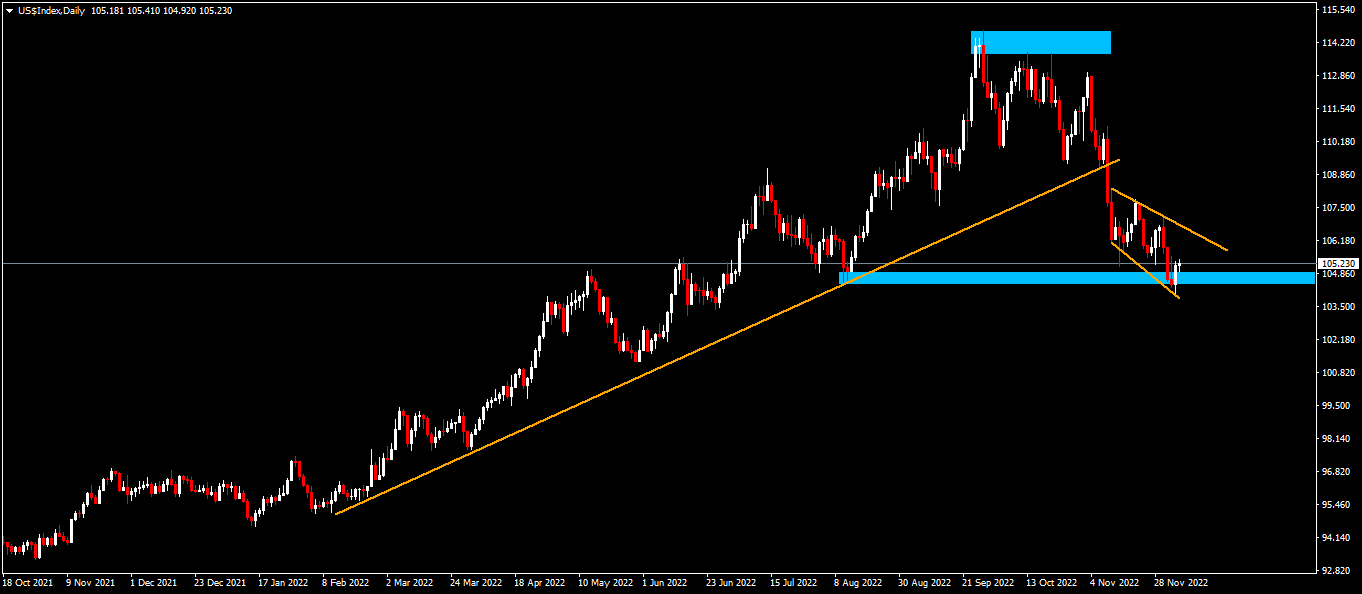

Technical Analysis (D1)

In terms of market structure, price has come to a significant juncture by invalidating the uptrend drawn from Feb 2022. Since then, price has been moving to the downside and sellers have reached a key level of interest located around the 104.01 area where the previous higher-low was formed. The nuance to be noted, however, is the corrective nature of the approach to the area in the form of a descending channel. If bulls can defend this area, the narrative could still remain bullish, however the opposite applies if the area is invalidated by sellers.

Euro

The Euro kicks off the week under pressure, as it pulls back sharply from the 1.06 area. This selling pressure in the European common currency was driven by a larger-than-expected drop in retail sales figures in the Eurozone which had a big impact on the currency’s momentum. This data is a key macroeconomic indicator in that it forms a good indicator of the pulse of the European economy and its projected path towards expansion or contraction and has the net effect of influencing how the ECB will react in this current inflationary environment with respect to their interest rate decisions. As it stands members of the ECB have conflicting views, with some in favour of a 50-basis point rate hike, and others believing that inflation has peaked in the fourth quarter.

Technical Analysis (D1)

In terms of market structure, price has invalidated the longer-term downtrend formed from mid-May 2022 and has done so in an impulsive break of structure. Since then, the bulls have been driving price, creating higher-highs and higher-lows. Current price has bounced off a key level in the 1.06 area, and if defended by the bears, price could potentially reverse. Conversely if the bulls can sustain the pressure, price could break above the level.

Pound

Sterling begins the week pulling back from the key 1.229 area as risk-on sentiment enters the market. Factors driving this decline in the British currency can be attributed to strong dollar dynamics driven by a healthy non-farm payroll as well as healthy US PMI data which has essentially increased the sentiment that the FED could likely go further in terms of their interest rate peak. This sentiment was affirmed by Chicago FED President Charles Evans on Friday as he stated, “we are probably going to have a slightly higher peak to the FED policy rate even as we slow pace of rate hikes”.

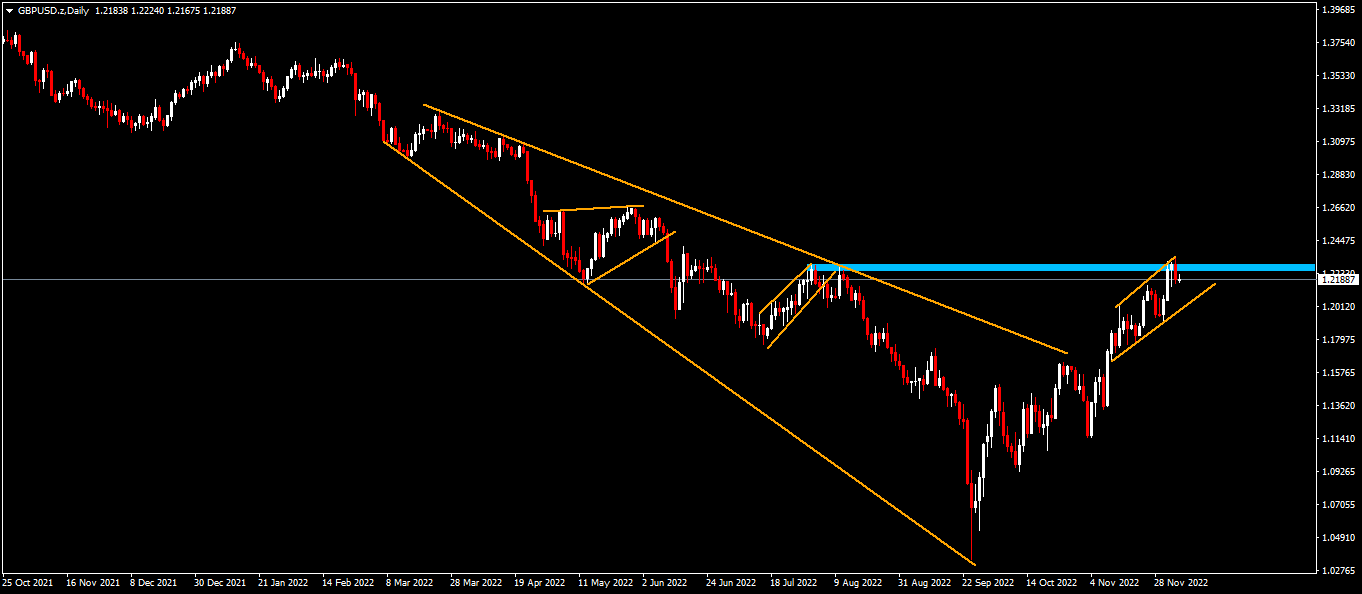

Technical Analysis (D1)

In terms of market structure, price has invalidated the longer-term trendline. Since then, the bulls have been in control of the narrative and have tested the key 1.229 level. The nuance to note at this juncture is the corrective nature of the approach to the area in the form of an ascending channel, which means price is coming under pressure as sellers enter the market and buyers take their profit off the table. If the area is defended it will result in the reversal pattern being validated. Conversely, if buyers break above the area, price will continue to remain bullish in the near term.

Gold

Gold heads into the new week fighting to hold onto its bullish momentum as safe-haven appeal holds up amid a potential relaxation of the lockdown in China. This development in the narrative around China is important as the country is the largest consumer of Gold in the world, and the sheer demand that is expected to re-enter the market if the lockdowns are relaxed is giving investors optimism around the yellow metal. Furthermore, dollar dynamics will be influencing price, as US inflation expectations challenge the Hawkish hopes of the FED and will govern the short-term directional bias of the pair.

Technical Analysis (D1)

In terms of market structure, Gold has broken out of the outer trendline on the downtrend, and since then, bulls have been in control of price. Currently price action has pulled back from a significant resistance at the $ 1 809 area in the form of a potential reversal pattern (rising channel). If sellers can defend this area it will confirm the reversal pattern, however if buyers maintain their interest, price could break above and remain bullish.

Click here to access our Economic Calendar

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.