GBPUSD (D1)

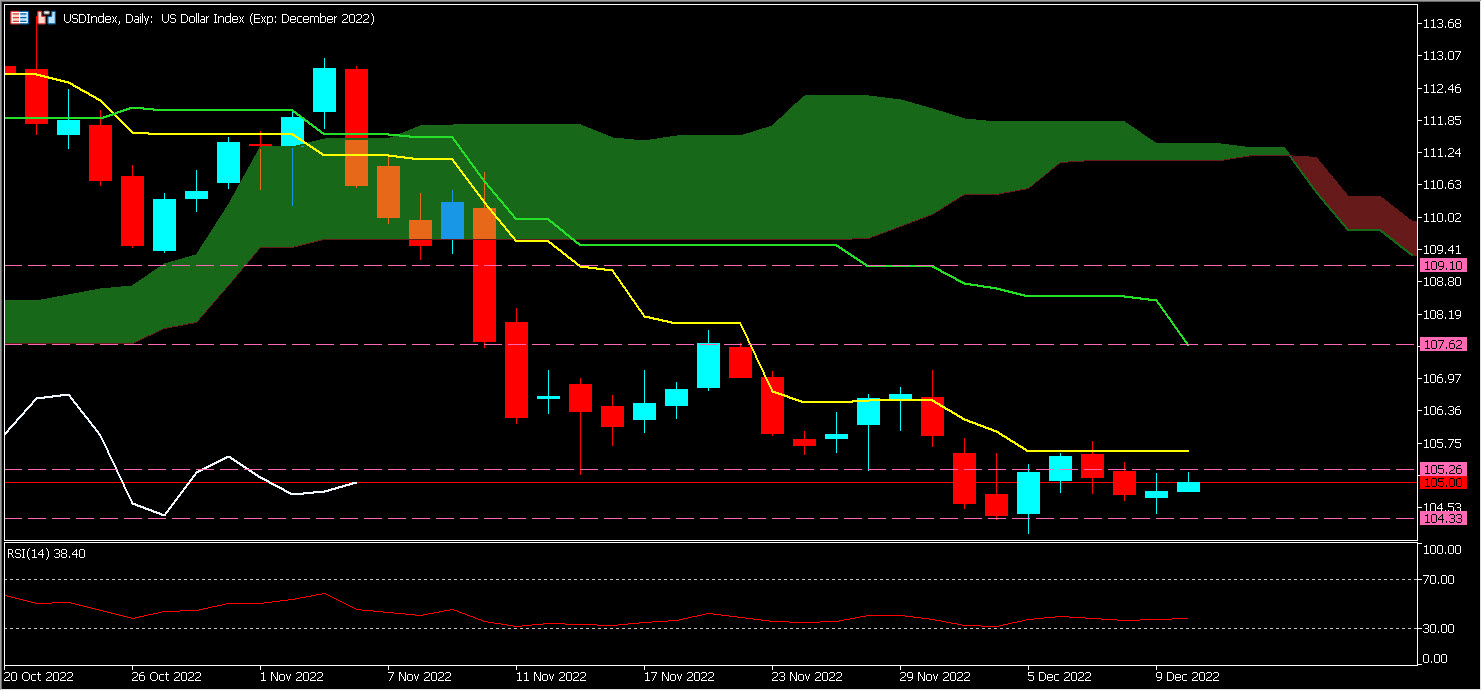

GBPUSD fell to near 1.2200 after failing to break above resistance at the 1.2300 level, and currently sits at 1.2270, as market sentiment took a more conservative direction ahead of the monetary policy meeting. The US Federal Reserve (Fed) may be less inclined to optimism following the release of October’s inflation report as well as the PPI data coming in line with forecasts. This result benefits the Dollar, which however failed to hold above the key resistance level of 105.00, the Futures price being at the level of 104.77.

The S&P500 took a beating on Friday and is likely to remain cautious going forward as further rate hikes by the Fed will heighten recessionary concerns in the US economy. At the same time, 10-year US Treasury yields are looking to break above the 3.60% mark , as expectations of hawkish policy from the Fed will reduce demand for US Treasury bonds.

However, Fed Chairman Jerome Powell may be less belligerent due to the unexpected decline in inflation observed in the October report, and the decline in household consumer spending, as well as data relating to the economy in the producer price index (PPI) published on Friday. The price index for finished products was revised downwards to 7.4%, in line with expectations. A reduction in the price of finished goods signals a drop in demand, forcing producers to be flexible in making decisions about prices for their finished goods .

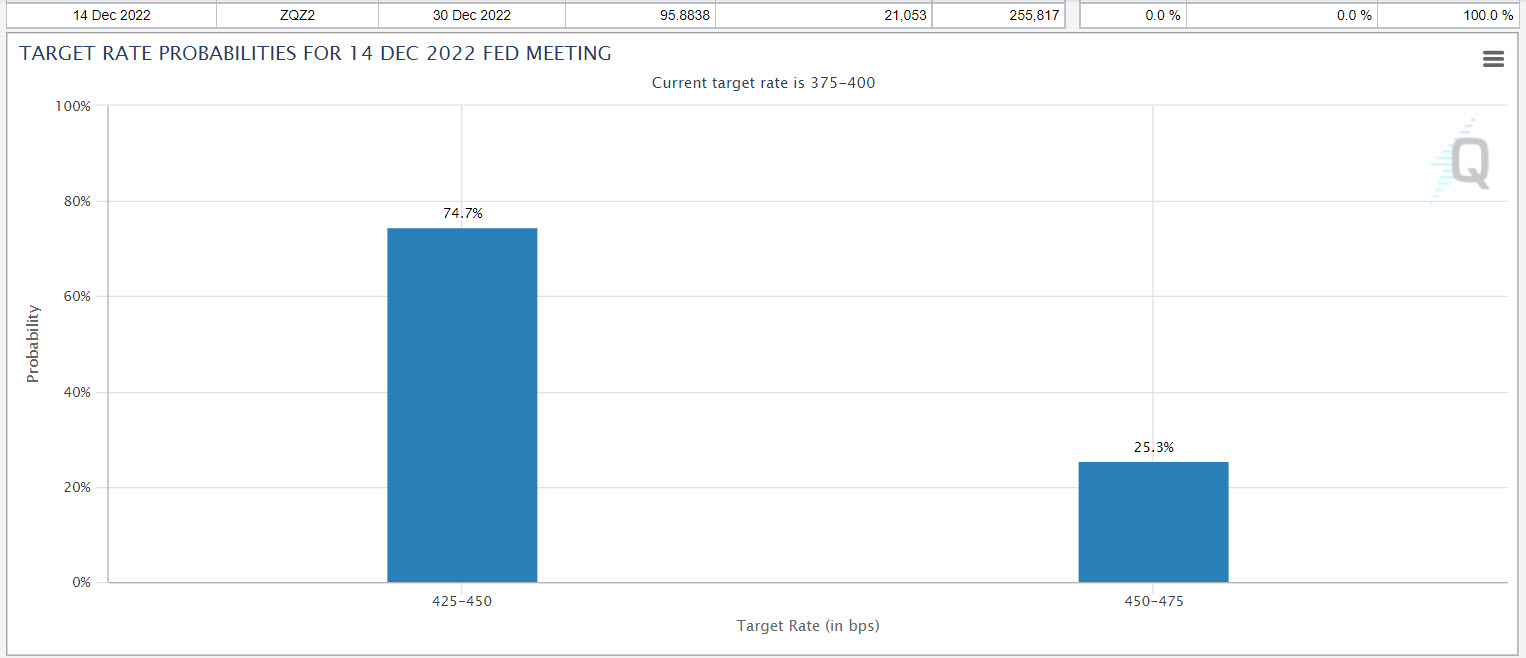

According to CME Group, 74.7% of investors expect the Federal Reserve to slow the pace of rate hikes to 0.5% as of Dec. 14.

As for Cable, it came under selling pressure, with market players concerned about upcoming monetary policy releases from the US Federal Reserve (Fed) and the Bank of England (BOE). Regarding the BOE, which will hold its meeting on Thursday, the deterioration in the economic outlook should not prevent the Bank from raising its rates by 50 basis points to bring them to 3.5%, which would mark the absolute record for the rate since 2008.

The UK is due to release consumer price index (CPI) figures for November on Wednesday, which are likely to show inflation has run rampant after hitting a 41-year high at 11 .1% in October, more than five times the target set at 2% . This surge is largely due to the energy price shock caused by the war in Ukraine , but other factors such as labor shortages caused by Brexit or the COVID-19 pandemic could cause inflation to slow down. The British economy is on the way to recession and households are facing a considerable reduction in their standard of living following the severe budgetary measures adopted by the British government with a view to restoring the image of the country, particularly on the fiscal level.

Technical Analysis (D1)

GBPUSD is currently above its cloud, its Kijun (Lv) and its Tenkan (Lj) at the level of 1.2254; the Lagging Span (Lb) meanwhile is above its peers and the cloud clearly signifying bullish momentum, which means the price could reach 1.2299 then 1.2410. Conversely, if the price starts to fall again, it could reach 1.2027 and then around 1.1840.

Click here to access our Economic Calendar

Kader Djellouli

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.