The Swiss State Secretariat for Economic Affairs (SECO) revised down its inflation forecasts for 2022 and 2023. For 2022, CPI is projected at 2.9%. The previous September forecast was 3.0%. The 2023 CPI is expected to be 2.2%, down from 2.3%. For 2022 GDP growth was unchanged at 2.0%, while 2023 GDP growth was slightly lowered from 1.1% to 1.0%. SECO said this would indicate sluggish growth in the Swiss economy, but not a severe recession.

Meanwhile, Europe’s energy situation is projected to normalize after the winter of 2023-24. At the same time, inflation rates are likely to ease around the world and the global economy will gradually gain momentum, thus triggering a recovery in Switzerland, with GDP growth of 1.6% by 2024, and inflation back below 1.5% on average.

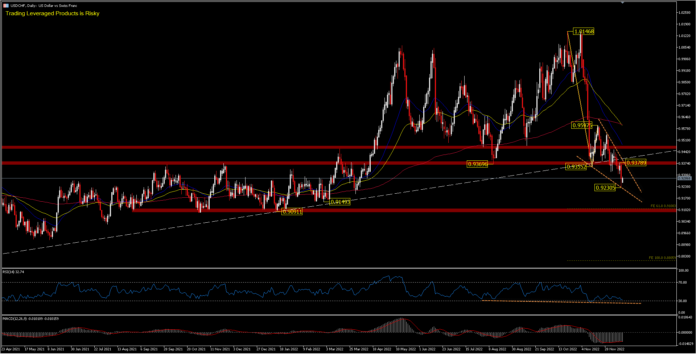

Meanwhile, after yesterday’s US Inflation Report, the USDCHF currency pair was seen continuing its decline to 0.9230 before closing at 0.9284. In this morning’s Asian session, it was seen rallying slightly, but the initial bias remains neutral ahead of the Fed rate decision. Meanwhile, on December 15th the SNB is expected to raise the policy rate by 50 basis points to 1%, in an effort to control inflation. It is currently running at 3% and the SNB has been clear in its determination to lower it. But the podium is temporarily occupied by the Fed.

The central bank lifted the policy rate 75 bps to 0.50% in September, bringing the rate out of negative territory after the 50 bp hike in June to -0.25% from the record low -0.75% as late as March. Rates still look pretty low and we expect the central bank to signal that another rate hike in March is likely. The SNB can afford to pause at a lower rate than the ECB though, as economic weakness in the rest of Europe is curbing demand and inflation pressures in Switzerland are not as severe as elsewhere, and thanks to an energy policy that is far less reliant on cheap Russian gas than Germany’s.

USDCHF’s decline from 1.0146 resumed yesterday and the intraday bias is back to the downside. The decline is currently projected at the 61.8% FE level, at 0.9108, from the 1.0146-0.9355 drawdown. Movement to the upside will be capped by 0.9369 resistance which was previously support. A move above this resistance is required to show a short-term bottom. Otherwise, the outlook will remain bearish, despite the recovery. The RSI is flattening above the oversold level and the MACD signal is in line with the histogram.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.