Procter & Gamble Co (PG.s) is a leading multinational company that, together with its beauty division, offers consumer packaged goods and various beauty products to consumers worldwide under well-known brands such as Head & Shoulders, Pantene, Rejoice, Olay and Old Spice, among others. The company has a capitalization of $357.5M and is expected to release its Q2 2023 earnings report on Thursday, January 19, 2023 before the market opens.

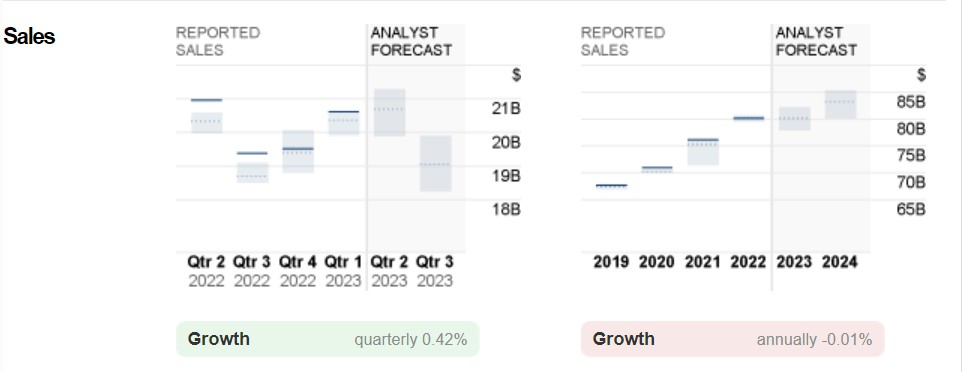

Zacks positions Procter & Gamble Rank #2 (Buy) in the Top 26% position #64/250 of the Soap and Cleaning Materials industry. EPS of $1.58 is expected for this report (same as for Nasdaq) with an ESP of 0.28%, marking a year-over-year low of -5.0%. For the current fiscal year, the consensus earnings estimate is $5.83. A profit of $20.57B is expected, which would be a contraction of -1.82% q/q. Stocks have returned -1.4% over the past month versus a +1% change for the Zacks S&P 500 Composite.

The estimate has no downward revisions and 3 upward revisions in the last 60 days. PG boasts a P/E ratio of 25.86 and a PEG ratio of 4.32. The company has reported results above the estimate 19 times out of the last 20 reports, the only negative coming in July 2022. Procter & Gamble has an earnings quality rating of “high” for the 11th consecutive week, according to Nasdaq.

Last quarter the company reported EPS of $1.57 and revenue of $20.61B, beating expectations by $0.03 and $266.97M respectively.

Expected -6.1% decline in operating profit, -4.7% drop in gross profit, -6% drop in business performance, +4.9% increase in organic sales growth, according to Zacks.

Factors to consider

The current gloomy stock market environment, a result of high inflation, is putting pressure on most businesses due to the shift in consumer spending. P&G stock is down 5% in the last year, so you can see the company has a good resilience to the current headwinds compared to many other companies that have fallen much more. That loss is reduced by 50% for shareholders who collect their dividend.

The company also recently declared a quarterly dividend, which was paid on Tuesday, November 15 at $0.9133 per share. This is a favorable change from P&G’s previous quarterly dividend of $0.91. This represents an annualized dividend of $3.65 and a 2.43% dividend yield. The current P&G payout ratio is 63.26%.

Despite the good run in its latest reports, the company reduced its outlook due to various factors, including the strength of the Dollar, which puts pressure on sales abroad, since approximately 50% of these come from outside the US. However, with the Dollar falling, earnings should strengthen.

Persistently high demand for cleaning products has benefited the company. The results are expected to reflect the continued strength of the cleaning and similar product brands supported by their improved sales strategy and increased productivity.

Inflation has also affected the company, increasing the costs of raw materials and supplies along with freight logistics affecting the company’s performance, which is expected to be a negative factor for the report. In addition, the company mentioned in the last report that this will persist through 2023.

The increase in packaging and product investment is also expected to have an impact on the company’s gross margins; however, it is expected that the focus on marketing and general cost savings plans thanks to the productivity program, commercial investments and efficiency improvement in all sectors of the business could underpin them.

“Inflation is testing Americans’ loyalty to Procter and Gamble’s big brands” – Wall Street Journal.

P&G Beauty, the beauty division of P&G, has acquired hair care brand Mielle Organics for an undisclosed amount. The companies have now invested $20M in the Mielle Cares Foundation, an NGO whose goal is to support the education and economy of the African American and Latino communities.

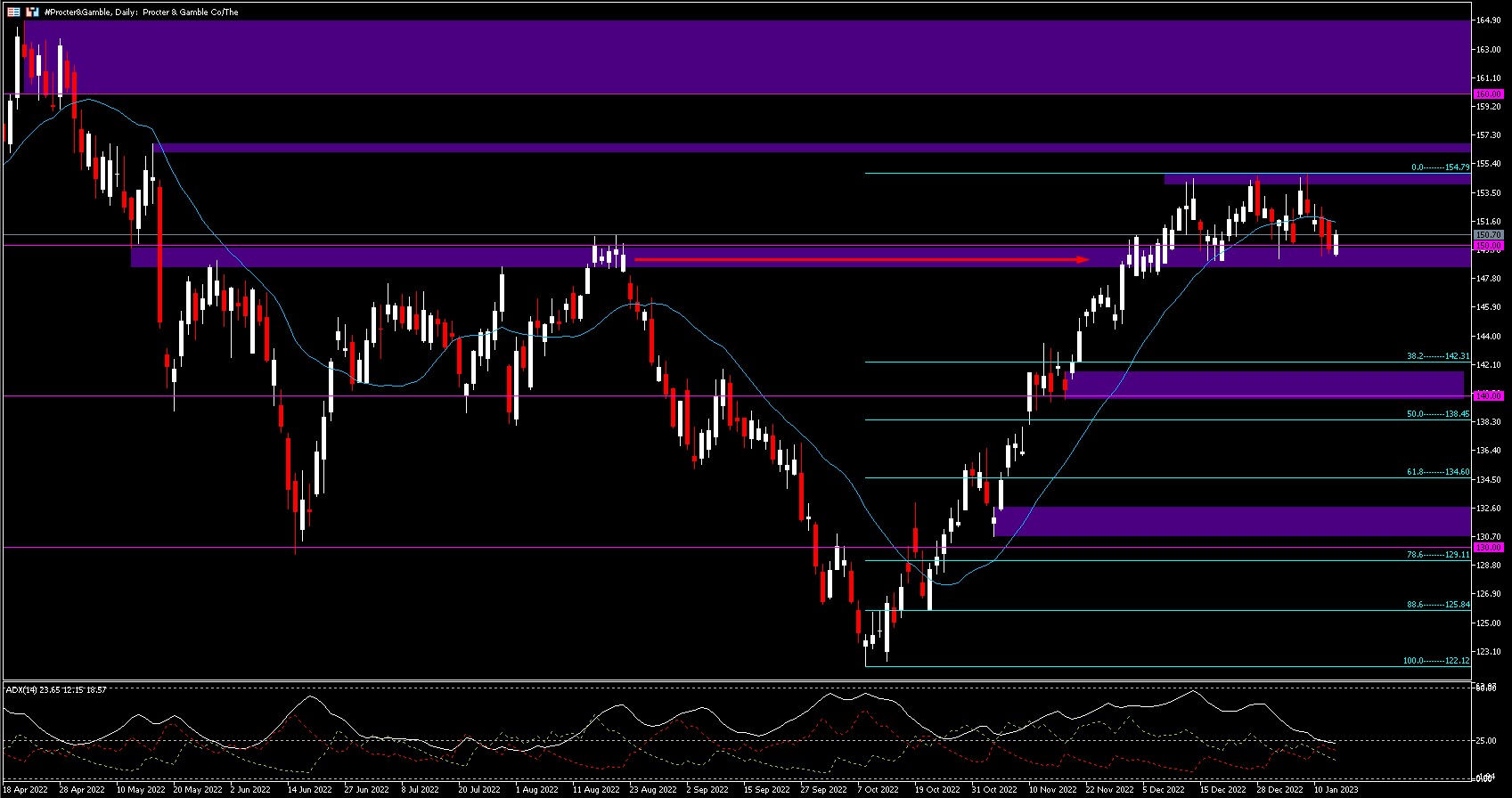

Technical Analysis- #Procter&Gamble D1 – $150.70

#Procter&Gamble has remained range bound after breaking the August highs at the psychological level of $150.00, holding between $148.00-154.79 pending the earnings report. In the case of a positive result, we could see the price range break to the upside in search of the May 17 highs at $156.74 and even continue to the April 21 highs at $164.88. The 20-Day SMA is above the price at $151,54.

In the event of an unfavorable result, we could see the price break the range downwards and look for support at the 38.2% Fibo at $142.31 up to the psychological level of $140.00, where the lows of November 17 are, and even after breaking these, look for the lows of November 3 at $130.69 below the Fibo 61.8% at $134.60. Impulse lows at $122.12.

ATR stands at 23.65 with +DI at 12.15 and -DI at 18.57 showing a cooling off of the latest bullish momentum seen on the chart.

Click here to access our Economic Calendar

Aldo W. Zapien.

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.