Johnson & Johnson is a stock that naturally attracts a lot of investor interest because it is a component of the S&P 500 and one of the 30 stocks that make up the Dow Jones Industrial Index.

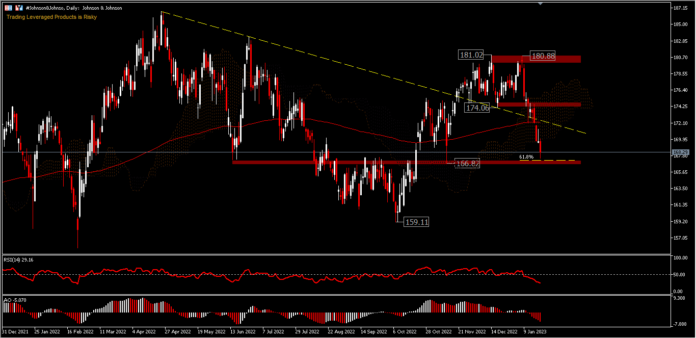

J&J’s rebound from 159.11 erased some of the losses started in April 2022, but the rebound stalled at 181.02 in December. Even though in January there was an attempt to match the December high, it was only recorded as far as 180.88, before sliding beyond the 174.06 support. It is now trading in the range of ±168.00.

Johnson & Johnson stock has declined more than 6% over the past 2 weeks. There is information circulating that the company has limited production of its Covid-19 vaccine, lagging behind those developed by competitors Pfizer and Moderna. Despite these circulating issues, it is unlikely that investors will rush to sell the stock with institutional quality and a market valuation of $443 billion in a panic.

Johnson&Johnson will report earnings before the market open and hold a conference call on Tuesday 24th January. Analysts expect single digit earnings growth for the company. Strong company sales from the pharmaceuticals division helped beat expectations last quarter, but this quarter may be impacted by Covid-related headwinds and other macroeconomic factors. Historically, Johnson & Johnson has beaten earnings expectations 95% of the time and the stock average is up 0.27% on earnings day, although it fell after the last two reports were released.

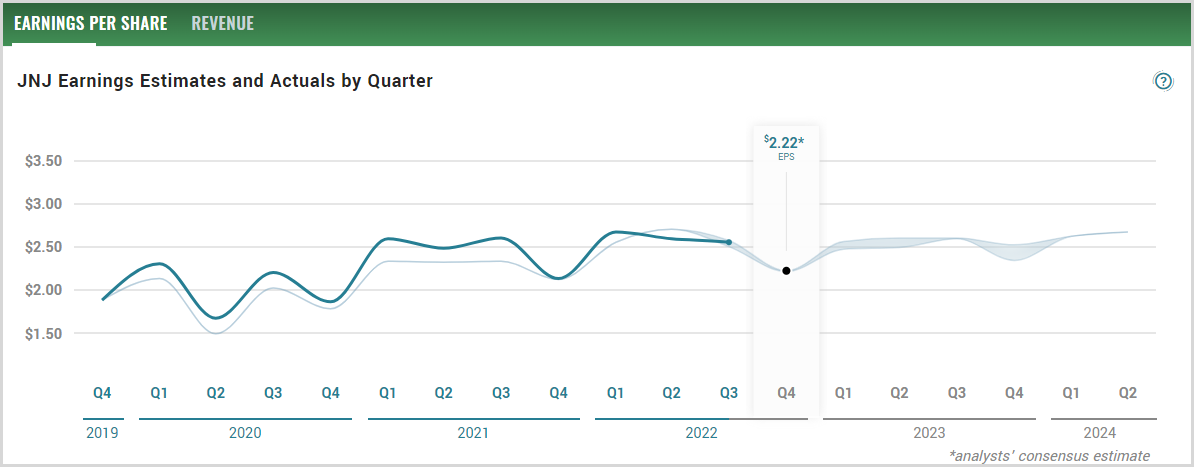

Johnson & Johnson last released quarterly earnings data on October 18, 2022. It reported EPS of $2.55 for the quarter, beating the consensus analyst forecast of $2.49. The company had revenue of $23.79 billion for the quarter, compared with analyst estimates of $23.44 billion. Its revenue for the quarter was up 1.9% compared to the same quarter last year. Johnson & Johnson has generated $7.18 earnings per share over the past year ($7.18 diluted earnings per share) and currently has a price-to-earnings ratio of 23.5. Johnson & Johnson’s earnings are expected to grow by 1.89% in the coming year, from $10.04 to $10.23 per share.

According to Zacks Investment Research, based on 7 analyst estimates, the consensus EPS forecast for the quarter is $2.22. Reported EPS for the same quarter last year was $2.13. Zack gave Johnson & Johnson a #3 (hold) rating.

The J&J Pharma segment is expected to contribute to the top line, led by increased penetration and market share gains from key products such as Darzalex and Stelara. Other core products such as Invega Sustenna and new drugs, Erleada and Tremfya, may also contribute significantly to sales growth. Sales of COVID-19 vaccines were negligible in the fourth quarter. International sales are expected to account for the majority of sales of COVID-19 vaccines. However, lower sales of its main drug Imbruvica and generic/biosimilar competition for drugs like Zytiga, Procrit/Eprex and Remicade are likely to hurt the top line.

Meanwhile, Trefis estimates J&J’s Q4 2022 revenue to be around $24.2 billion, reflecting a 2% y/y decline. This compares with a consensus estimate of $24.0 billion. J&J posted 2% y/y sales growth in Q3 2022, as a 3% increase in pharmaceuticals and 2% growth for the MedTech segment was partly offset by a <1% drop in Consumer Healthcare sales.

J&J’s adjusted Q4 2022 earnings per share (EPS) is estimated at $2.24, slightly above the consensus estimate of $2.23. This compares to the $2.13 EPS the company reported in Q4 2021. J&J’s $6.8 billion adjusted net profit in Q3 2022 reflects a 3% decline y/y. This can be attributed to a drop in net margins of nearly 150 bps. Operating margins are expected to face headwinds from inflationary pressures and increased marketing costs in Q4. Looking ahead, for the full year of 2023, adjusted EPS is expected to be higher at $10.38 compared to $9.80 in 2021 and forecast at $10.05 in 2022.

Overall, currency headwinds are expected to significantly hurt J&J’s top line in the fourth quarter. Supply constraints, inflationary pressures and rising input costs will continue to pressure margins in the fourth quarter of 2022 and also in 2023.

Technical Analysis

#Johnson&Johnson recorded a loss of -3.3% last week and closed at 168.29, after bouncing from 61.8% FR. The price bias tends to move to the south, with the possibility to test the support at 166.82, and a break of this level could continue the decline to test the support at 159.11. The 200 day EMA (172.20) and neckline double top (174.06) will be a barrier on the upside, if there is an increase. RSI is at the oversold level (29.16) and AO is in the sell zone.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.