During a chaotic trading day on Wall Street on Tuesday, palladium prices fell by more than 5.5%. Palladium performed poorly throughout 2022, which has continued into February 2023, and it is now trading below 1,700, the lowest since December 2021, amid expectations that interest rates around the world, and especially in the US, will remain higher for longer, hampering global growth and demand for palladium. In addition, the metal’s price surge has prompted automakers to replace it with cheaper platinum.

Palladium’s decline yesterday follows Ford Motor Company’s announcement of plans to build factories using Chinese technology, as well as a series of upcoming layoffs in Europe.

Ford Company said on Monday it will collaborate with Chinese suppliers on a new $3.5 billion battery plant for electric vehicles in Michigan, despite tensions between the US and China. Ford’s plan hinges on the consideration that lower costs and faster recharging will attract many customers, including commercial fleet buyers, to accept the limitations of lithium iron phosphate (LFP) batteries. Ford also decided to produce LFP batteries in the United States at a wholly-owned plant to avoid the political risk of relying on Chinese technology partners.

Meanwhile, Ford is planning layoffs over the next three years targeting 2,300 employees from the administrative division in Germany, 1,300 from the UK and another 200 positions from Ford’s European branches.

Although the move adds to Ford’s long list of layoffs after cutting thousands of workers over the past year, the company stated that this decision was forced to be taken so that Ford could boost revenue from the production of electric vehicles.

Technical Review

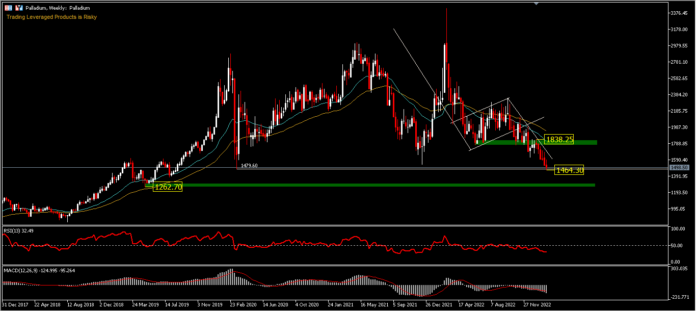

Palladium printed a new low of 1464.30 in Tuesday’s trading (14/02). The downside bias has been dominant, ever since the 1768.35 June 2022 rebound failed to sustain the rally and stalled at 2340.63. Since then, the price of this commodity has fallen back to today’s fresh 4-year low. The price position of this commodity is below the 26-week moving average with RSI and AO in the sell area. Continued weakness is likely to test 1262.72 as further support. While on the upside it will be held at 1768.35 and 1838.25 resistance.

Bank of America expects palladium to trade at $1,865 per ounce in 2023, down from $2,126 last year; ANZ Research projects palladium to rise to $2,150 in December 2023 from $1,927 in December 2022, helped by better automotive growth prospects, and before dropping to $1,600 in December 2024.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.