Walmart Inc. is the world’s largest employer both by revenue and by numbers employed with over 2.2 million globally. It is a general merchandise discount retailer founded in 1962 by Sam Walton and remains a closely held family owned company to this day. The Department Store Management Giant with a market capitalization of $393,490,095,879 is scheduled to report earnings for its fiscal quarter ending January 2023 on February 21, 2023 prior to the market opening.

The company last reported quarterly earnings in November last year, with $1.50 earnings per share (EPS) for the quarter, beating consensus estimates of $1.32; Net margin 1.49% and return on equity 19.54%. The business had revenue of $152.80 billion during the quarter, compared with a market estimate of $146.80 billion. During the same period last year, the company posted $1.45 EPS. The company’s revenue rose 8.8% on an annual basis. According to Walmart management, these strong results were supported by strong performances across all of its business segments Walmart US, Walmart International and Sam’s Club, despite high inflation in most goods and aggressive monetary tightening leading to a weakening of consumer demand throughout 2022.

Walmart Inc. will likely post the highest gain from last year’s respective fiscal quarter readings, when it reports Q4 earnings. Zacks’ Consensus Estimates for quarterly revenue were pegged at $158.9 billion, indicating growth of about 4% over the figure reported in the previous fiscal quarter. The forecast for quarterly earnings has risen 1 cent in the last 30 days to $1.51 per share. However, this represents a decrease of 1.3% from the figure reported in the previous year’s fiscal quarter.

For Q4 2022, consolidated operating income growth is expected to be between a 1% decrease and a 1% increase. Adjusted earnings per share (EPS) tend to decline 3-5% in Q4. Management’s fiscal 2023 guidance for consolidated operating income and EPS view suggests a decline from last year’s period reported numbers. Management estimates that consolidated adjusted operating profit will decrease by 6.5-7.5%. Excluding divestments, management estimates a decrease in consolidated adjusted operating income of 5.5-6.5%. Fiscal 2023 EPS is expected to fall 6-7%, and 5-6% excluding divestments.

As of Q3, Walmart US had 4,600 pickup locations and more than 3,900 same-day delivery stores. The company’s attractive pricing strategy has also helped amid a rising inflationary environment. Walmart expects nearly 5.5% consolidated net sales growth for fiscal 2023. These factors bode well for Q4.

Continuous innovation and expansion are expected to be the biggest contributors to Walmart’s revenue amid intense competition. Walmart is benefiting from the growth of its e-commerce business and omnichannel penetration. Aggressive efforts to thrive in the booming online grocery space are becoming a major contributor to e-commerce sales. Innovation in the supply chain, adding capacity and building the business, strengthening its delivery branches are all part of Walmart’s efforts to maintain its existence.

Technical Review

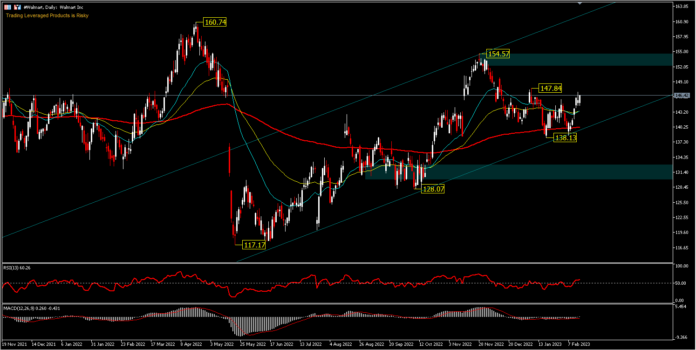

#Walmart shares opened at 144.51 on Monday. The yearly low is at 117.17 and the yearly high is at 160.74. The 50-day exponential moving average is at 143.40 and the 200-day exponential moving average is at 140.22. Price bias tends to show to the upside, with possible testing of the minor resistance 147.84 and a move above this level could test the resistance 154.57 which was recorded as November 2022 high. The support 138.13 will halt the price fall, should the Q4 earnings report disappoint. If there is movement under support 138.13, stock price could test the support at 128.07.

In the interim, the move above the 126.52 level and 200 day EMAs is a positive sign for #Walmart. The RSI is at 60 and MACD is in the buy zone with the average price movement still in the rising channel.

Jefferies Financial Group has a “Buy” rating and a target share price of $165.00 for Walmart. Citigroup raised their target price from $162.00 to $169.00. Goldman Sachs has set a target price of $160.00. According to data from MarketBeat, the stock currently has a “Moderate Buy” average rating and a consensus price target of $162.09.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.