After the Emperor’s birthday passed, the Yen had limited movement. On Tuesday, the BOJ maintained its YCC limits, buying ¥400bn worth of bonds, and Kazuo Ueda as Kuroda’s successor is expected to testify at the upper house of Japan’s parliament this Friday.

Ueda’s comments before parliament could follow the similar dovish line that Kuroda laid down during his time at the helm. While he may agree academically, that ultra-low interest rates are a long-term problem, how to change policy without harming the economy is a much more complex question going forward.

Due to external forces, especially the rising cost of products and services, inflation has been rising in Japan. The large drop in the value of the Yen last year amplified the effect, making imported goods much more expensive. Such inflation is considered unhealthy because it is not fuelled by rising domestic demand from a booming economy. In fact, rising prices may cause the economy to suffer more. This makes it difficult for the BOJ to start raising interest rates like other central banks. And the stark interest rate differential will still pose a risk to the Yen in the future.

Technical Review

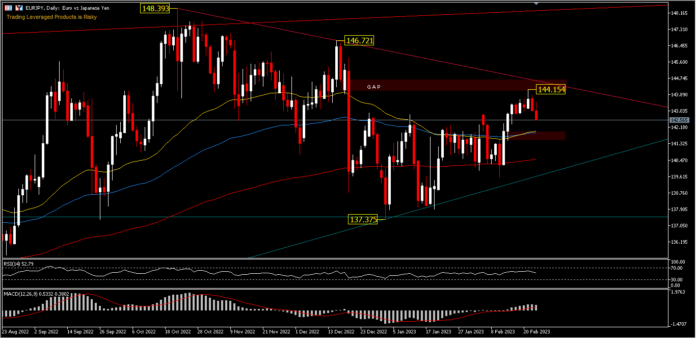

EURJPY, D1 – A temporary peak was recorded at 144.15 and the daily period price bias still shows a tendency towards the upside, despite the decline in the last 2 days of trading. The price is currently above the neighbouring 52-day and 100-day EMAs, and surely these 2 EMAs will be the dynamic support around the price of 142.00. For now, the corrective decline from 148.39 looks completed at 137.37. A move above 144.15 could extend the 137.37 rebound to the 146.72 next resistance. However, sustained trading below the 52- and 100-day EMA would indicate that the correction from 148.39 is still in progress and could move closer to the 200-day EMA, around 140.50. RSI showed weakening rally momentum, turning lower before touching overbought levels, while MACD is still dynamically above the buy zone

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.