USOIL, Daily

The Energy Information Administration (EIA) reduced it’s oil price forecasts for 2023, and it also cut estimates for US crude production.

According to the Short-Term Energy Outlook report for March 2023, the average price of West Texas Intermediate (WTI) crude oil is expected to record an average $77.10 per barrel in 2023, which represents a decrease of 1%, compared to $77.84 in it’s February estimates.

Meanwhile the EIA kept its expectations for Brent and West Texas crude next year (2024) at $76.58 and $71.57 a barrel, respectively, according to the report seen by the Energy Research Unit.

Regarding oil price expectations the EIA reduced its estimates for the price of Brent crude by 0.8%, to reach the level of $82.95 a barrel during the current year, compared to $83.63 a barrel in the previous forecast.

The reduction in oil price expectations in 2023 comes with the rise in global oil stocks to an expected level of 2.893 billion barrels by the end of the fourth quarter of 2023, compared to 2.774 billion barrels in the same quarter of 2022.

In the past year (2022), it is estimated that Brent crude recorded a level of $100.94 per barrel, while US crude reached $94.91 per barrel, and the average oil production in the United States decreased to 12.44 million barrels.

USOIL, H4

Oil prices declined negatively, breaking $77.05 levels and settling below it, and now prices are under negative pressure. It is expected that prices are on their way down to test $74.99 levels, noting that exceeding this level will push the price to more losses and head towards $73.71 in the near term and $72.35, while consolidation above it will lead the price to start recovery attempts, targeting a visit to $80.90 levels .

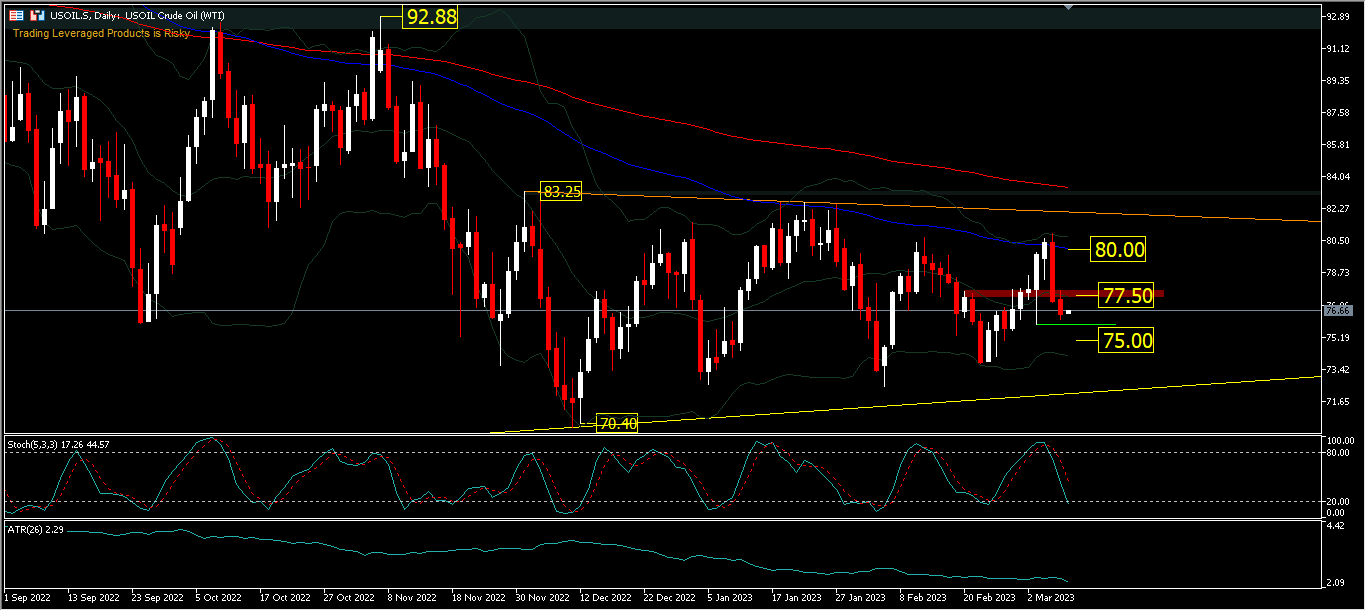

USOIL, Daily

Daily prices are still trading within the range of $70.40 and $83.25 which are getting narrower in a symmetrical triangle pattern. Prices tend to fluctuate between $75.87 as minor support and $80.93 as minor resistance. Currently, USOil is below the BB middle line and the 100-day EMA (blue line). Stochs. are very stable in the dominant sideway range. A move below $75.87 could test $73.76 and $70.40 , while a move above $80.93 could test $83.25 and a move above the 200 day EMA (red line), could pursue the neckline around $92.00.

Click here to access our Economic Calendar

Shereen Rami & Ady Phangestu

Market Analysts

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.