PNC Financial Services Group, Inc. is an American bank holding company and financial services company based in Pittsburgh, Pennsylvania with a market capitalisation of $49.2 billion. The company is scheduled to provide its Q1 2023 earnings report on Friday (14 April), before market open.

PNC Financial Services Group, Inc. is engaged in the provision of financial services. It operates through its Retail Banking, Corporate and Institutional Banking, Asset Management Group and Other segments. The Retail Banking segment offers deposit, lending, brokerage, investment management and cash management products and services to consumer and small business customers.

https://www.tipranks.com/stocks/pnc/earnings

PNC Financial Services Group last released its Q4 2022 earnings data, on 18 January 2023. The financial services provider reported $3.49 earnings per share for the quarter, lower than the consensus estimate of $3.95. The company had revenue of $5.76 billion for the quarter, compared to analysts’ expectations of $5.71 billion. Its revenue was up 12.4% compared to the same quarter last year. PNC Financial Services Group has earned $13.87 earnings per share over the past year ($13.87 diluted earnings per share) and currently has a price to earnings ratio of 8.8. Earnings for PNC Financial Services Group are expected to grow by 1.18% in the coming year, from $14.35 to $14.52 per share.

The company is considered not to have done enough to gain investor and market confidence during the quarter to be published. As such, the Zacks Consensus Estimate for Q1 2023 earnings of $3.61 has decreased slightly compared to the previous week, reflecting a pessimistic stance. Further, the figure indicates a 9.7% growth from the figure reported last year. The metric estimate is now $3.64. However, the $5.62 billion consensus expectation for revenue indicates a 19.7% increase from the previous year. The top line will decline 3% sequentially, according to management. The metric is estimated to be $5.63 billion.

The collapse of Silicon Valley Bank and rising recession fears, made the pace of loan growth during Q1 slow down compared to the previous quarter, due to the uncertain economic environment. According to the Fed’s latest data, demand for commercial and industrial loans declined during the quarter, while commercial real estate loans, credit card loans and other consumer loans edged up. This is expected to have a positive impact on companies’ average interest earning assets.

The recent massive rise in interest rates, however, is likely to limit any further positive impact on the company’s Non-Interest Revenues, which are anticipated to decline 1% to 2% sequentially. Moreover, the consensus forecast for NII (FTE) is pegged at $3.66 billion, indicating a 1.5% sequential decline. The company anticipates an increase in average loans by 1-2% sequentially. The average interest-earning asset value is expected to be $506.5 billion for the quarter, which represents a slight increase. The metric is estimated to be worth $506.3 billion. In addition, rising interest rates and high inflation are expected to increase transaction volumes and spending, thus supporting PNC’s card fees in Q1 2023. Meanwhile, the company’s capital markets-related revenue is likely to be negatively affected as long as global economic uncertainty persists.

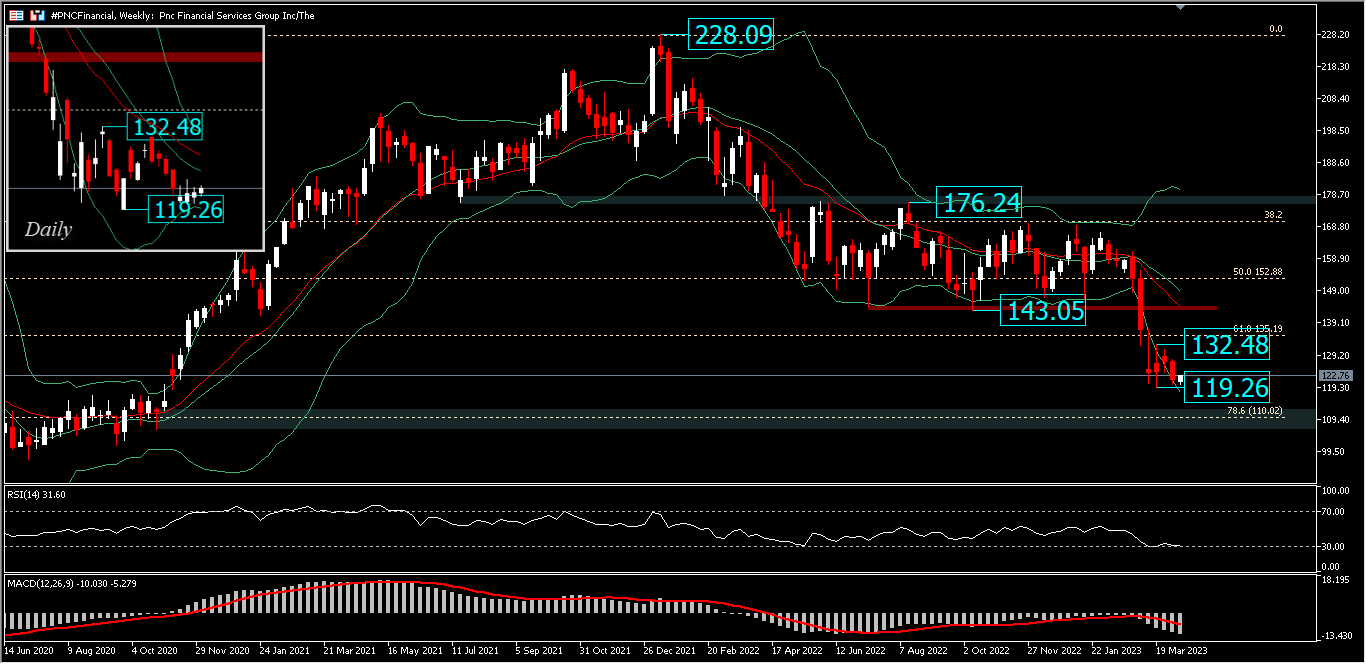

Technical Analysis

The share value of #PNCFinancial Service in Q1 2023 experienced a sharp decline of more than -20% and closed at 127.32 at the end of March 2023. At the beginning of April, #PNC’s price still looked weak, although it tended to fluctuate in a range above the 120.00 round figure. The March low, printed at 119.26, is temporarily a minor support for now. A move below this level could extend the correction wave from the 228.09 peak to the 78.6% retracement level (110.02).

A move above the 132.48 resistance would confirm a short-term rebound to the 143.05 handle first, before moving further to the upside. RSI is at oversold level and MACD is in the selling area which is still dominant and bearish bias is still strong with price movement below 20-day EMA (red-line). However, the downward momentum is starting to hold, and although the price movement is still in the lower band, the BB looks increasingly conical signalling a pause in the decline and that consolidation will take place, before the real direction is formed.

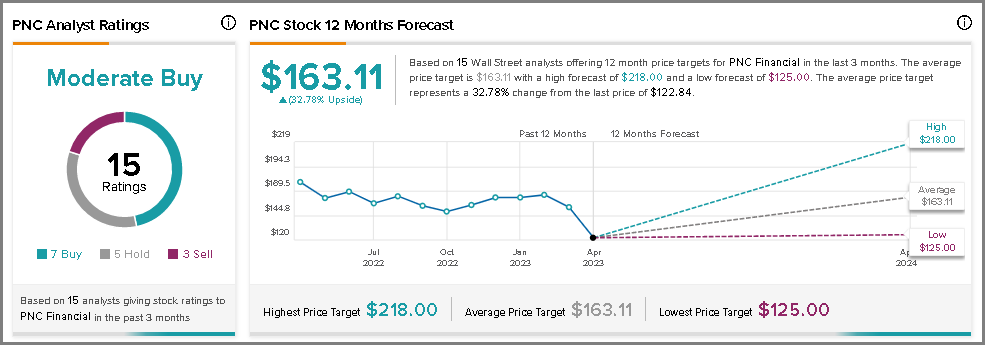

Based on 15 Wall Street analysts that offered 12-month price targets for PNC Financial in the last 3 months, the average price target is $163.11 with a high estimate of $218.00 and a low estimate of $125.00. The average price target represents a 32.78% change from the last price of $122.84.

JPMorgan Chase & Co. lowered its price target for PNC from $175.00 to $151.50 in a research note issued to investors on Monday, The Fly reported. The JPMorgan Chase & Co. price target indicates a potential upside of 24.30% from the company’s current price. Source:msn.

A number of other equity analysts also weighed in on the company. UBS Group downgraded PNC from a “buy” rating to a “neutral” rating and lowered their price target for the stock from $190.00 to $176.00. Deutsche Bank Aktiengesellschaft raised PNC shares from a “hold” rating to a “buy” rating and lowered their price target of $200.00 to $190.00. Bank of America raised its price target on the stock from $157.00 to $160.00. Morgan Stanley lowered their price target on PNC from $163.00 to $137.00 and set an “underweight” rating on the stock in a research note on Wednesday, April 5th. Meanwhile, according to MarketBeat, the company has a consensus rating of “Hold” and an average target price of $174.13.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.