The holding company engaged in the manufacture and sale of cigarettes, tobacco and nicotine-containing products, Philip Morris (PM), is expected to report its earnings for the quarter ending March 2023 on Thursday (20/04), before the market opens.

In the previous quarter’s earnings report, the company reported EPS of $1.39 beating the consensus estimate of $1.29. The company had a negative return on equity of 127.24% and net margins of 11.22%, for revenue of $8.15 billion during the quarter, compared to a consensus estimate of $7.54 billion. During the same period the previous year, the company earned $1.35 EPS. The company’s quarterly revenue rose 0.6% compared to the same quarter last year. On average, analysts expect Philip Morris International to book $6 EPS for the current fiscal year and $7 EPS for the next fiscal year.

A widely known consensus outlook is important in assessing a company’s earnings picture, but a strong factor that may affect its short-term share price is how actual results compare to market estimates. It is important to have a good understanding of the possibility of a positive EPS surprise, although management’s discussion of the state of the business on a yield call will largely determine the sustainability of current price changes and future earnings expectations.

The company is expected to post quarterly earnings of $1.33 per share in upcoming reports, which represents a year-over-year change of -14.7%. Revenue is expected to be $8.06 billion, up 4.1% from the year-ago quarter. Over the past 30 days, the consensus EPS estimate for the quarter has been reduced by 0.8% to its current value, reflecting a collective re-evaluation of analysts’ initial estimates. Zacks gives a #3 (hold) rating on PM’s share price.

Technical Review

#PhillipMorris, D1 – In Q1 2023 the company’s share price underwent a downward correction of -3.96%, recording a new low of $89.80 and a closing price of $97.14 at the end of March. The rebound to $89.80 has rallied to the psychological range of $100.00 this week. The $100.00 level is seen as a support and resistance zone which is crucial as a determinant of the next price direction, whether the price will move to the upside, or reverse direction. Resistance is seen at $100.52, and a move above this level has the potential to test the January 2023 peak at $105.61.

While the movement is below the minor support at $97.99 (200 EMA), it will test the support at $96.81 first before moving further down. The price is currently moving above the 26 day EMA (blue line), in sync with the histogram rising to the buy area, while the RSI is seen at the 60 level and not yet overbought.

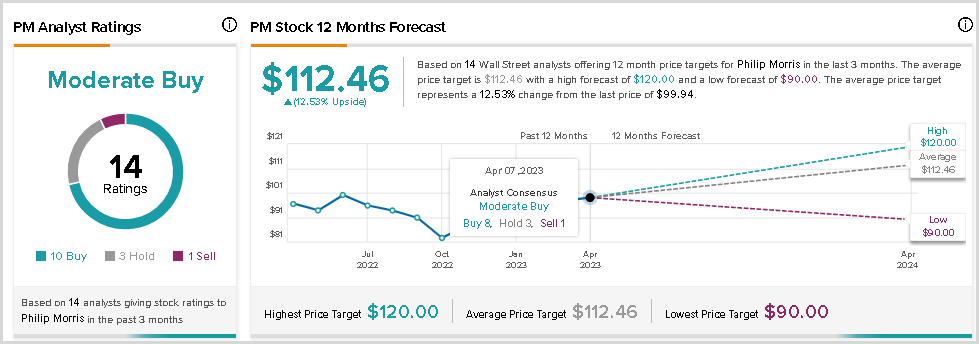

Goldman Sachs upgraded PM stock from neutral to a “buy” rating and raised their target share price from $95.00 to $120.00. The UBS Group upgraded PM’s stock rating from neutral to a “buy” rating and increased the share price target from $106.00 to $116.00. According to data from MarketBeat, the stock currently has a “Moderate Buy” consensus rating and a consensus price target of $110.36.

Based on 14 Wall Street analysts who offered 12-month price targets for Philip Morris in the last 3 months, the average price target is $112.46 with a high forecast of $120.00 and a low forecast of $90.00. The average target price represents a 12.53% change from the last price of $99.94. Source: Tipranks

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.