- FX – USDIndex rallied from 101.09 lows to 101.95 highs following weak data in China and US, trades at 101.85 now. EUR tested into 1.0900 and trades at 1.0925 now. JPY slipped below 134.00 again, before recovering to 134.75 now. Sterling collapsed to test 1.2500 yesterday, down from 1-year highs, at 1.2670 earlier this week, and is at 1.2515 currently.

- Stocks- US markets closed mixed (-0.66% to +0.18%). GOOGL +4.34%, TSLA +2.10% (Musk said he’d found CEO for Twitter & cut prices in US), PACW -22.07%, (more deposit outflows) PTON -8.9% – US500 closed -7.02pts 4130, FUTS are trading at 4150, below key resistance at 4175.

- Commodities – USOil – Futures have lost $3 a barrel from yesterday, declining from $73.50 to $70.50 today, after US Energy Secretary said strategic reserve oil purchases could begin on June 1. Gold – declined from $2040 yesterday to under $2008 today on the stronger USD.

- Cryptocurrencies – BTC continued to decline, breached the $26.75k lows from Wednesday & trades at $26.20k now.

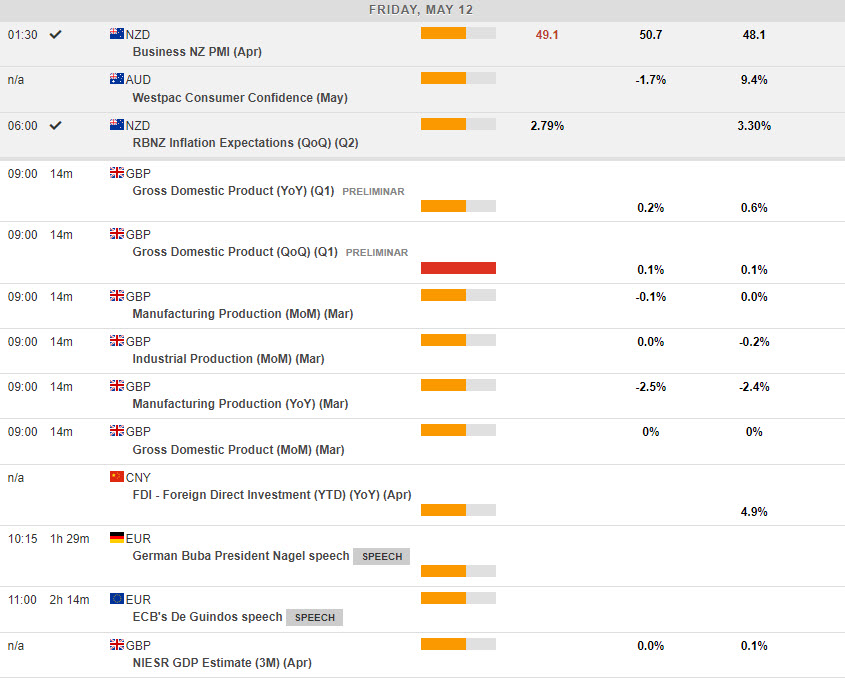

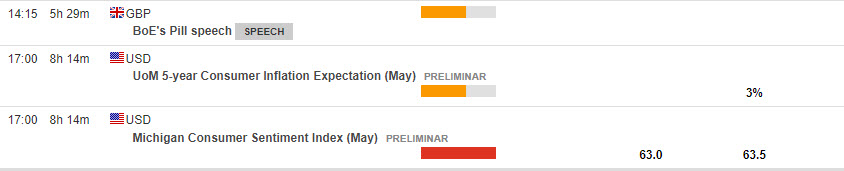

Today – US Export/Import Prices, Uni. of Michigan, Inflation & Consumer Sentiment, Treasury Secretary Yellen, Fed’s Bullard & Daly, BoE’s Pill, ECB’s de Guindos.

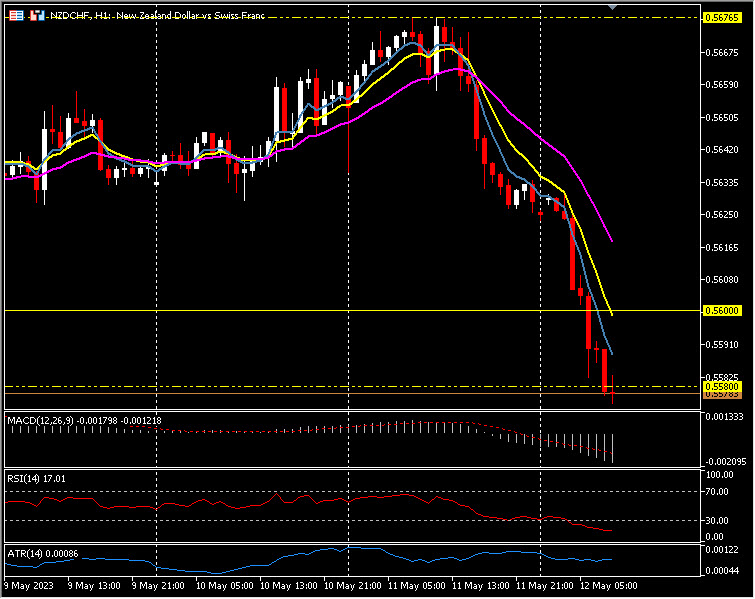

Biggest FX Mover @ (06:30 GMT) NZDCHF (-0.88%). From yesterday’s biggest gainer to today’s biggest loser. Declined from 0.5675 highs yesterday, back under 0.5600 to 0.5580 now. MAs aligned lower, MACD histogram & signal line negative & falling, RSI 17.01 OS but still falling, H1 ATR 0.00086, Daily ATR 0.00520.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.