This week, investors shall eye-on earnings from the two behemoths of the retail trade sector – Home Depot and Walmart. In general, Home Depot sells tools, construction produces, appliances and services while Walmart operates a chain of hypermarkets, discount department stores and grocery stores. By market capitalization in the global retail sector, both were ranked 3rd and 2nd respectively, right after Amazon.

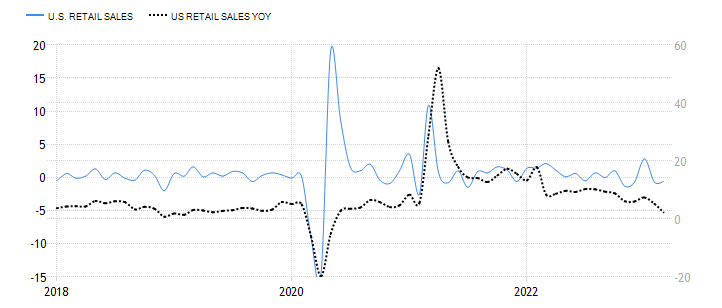

Fig.1: US Retail Sales. Source: Trading Economics

The March 2023 data displayed US retail sales fell for two consecutive months, at -0.6% (was -0.7% in February), affected by the Fed’s restrictive monetary policy as a mean to combat rising inflationary pressures. Despite the year-on-year data which increased 2.3% (was 5.2% in February), it was still the smallest gains since May 2020 – which could imply the outlook for the retail sector remains bleak.

Home Depot

The company shall release its Q1 2023 earnings result on 16th May (Tuesday), at pre-market open.

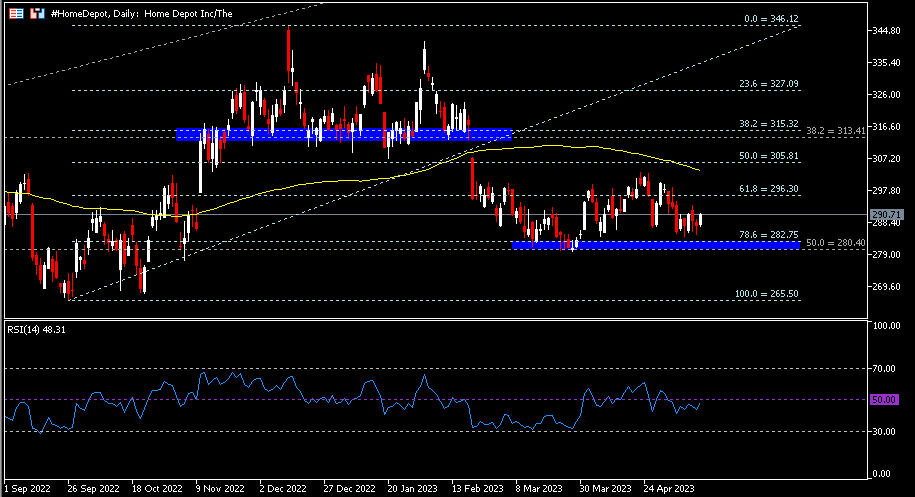

Fig.2: Reported Sales of HD versus Analyst Forecast. Source:CNN Business

Fig.2: Reported Sales of HD versus Analyst Forecast. Source:CNN Business

Home Depot posted its sales revenue that slightly shy off consensus estimates for the first time since November 2019, at $35.8B (also the lowest print since Q4 2022). This was due to a slowdown in home improvement category as consumers became more wary of their spending in the midst of tough macroeconomic situation. The overall sales in 2022 were reported at $157.4B, up over 4% from a year ago. Its net income was $3.36B, up only 0.3% from a year prior.

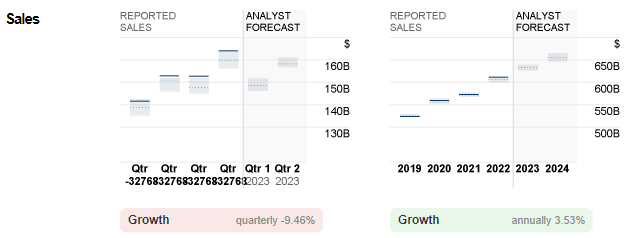

Fig.3: Reported EPS of HD versus Analyst Forecast. Source:CNN Business

Fig.3: Reported EPS of HD versus Analyst Forecast. Source:CNN Business

Similarly, it recorded the lowest EPS throughout the year, at $3.30. It was down over -22% from the previous quarter, but up over 15% from the same period last year. The final EPS in 2022 hit $16.69, up over 7% from that in 2021.

The management projected the demand for home improvement to be in “moderation” throughout the year, following a shift in consumer spending. Its decision to raise hourly wages recently (which shall incur $1 billion this year) under circumstances of tight labor market with low unemployment, would have pressured on the gross margin and expenses in the near term.

In the coming announcement, market participants expect HD’s sales to reach $38.3B, up nearly 7% from the previous quarter, but down -1.54% from the same period last year. Consensus forecast for EPS stood at $3.81, up 15.5% from the previous quarter, but down -6.85% from the same period last year.

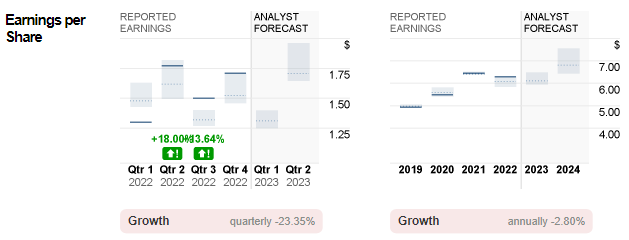

Technical Analysis:

#HomeDepot (HD.s) share price remains traded in consolidation after breaking below 100-day SMA, printing a yearly high at $341.40. The RSI indicator hovered near 50, suggesting a lack of direction at the moment. $296.30 (or FR 61.8% extended from Sept low to Dec high in 2022) serves as the nearest minor resistance, followed by the dynamic resistance 100-day SMA and $305.80 (FR 50..0%). A strong bullish breakout above the latter could mean a shift in major trend. Otherwise, as long as these levels remain intact, the bears are looking to push the asset price lower, towards support zone $280.40-282.70, followed by the Sept low in 2022, at $265.50.

—————————————————————————————————

Walmart

The company is expected to report its earnings for Q1 2023 on 18th May (Thursday), at pre-market open.

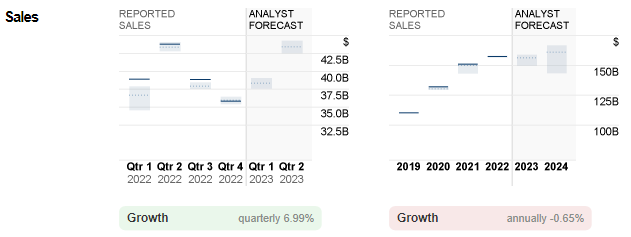

Fig.4: Reported Sales of Walmart versus Analyst Forecast. Source: CNN Business

Walmart posted better-than-expected results in the previous quarter. About 50% of its $164B sales was contributed by higher-income groups.It ended the year with total sales recorded at $611.3B, up 6.72% from 2021. In general, the company’s solid sales growth was backed by broad-based strength in all segments, stores and e-commerce operations.

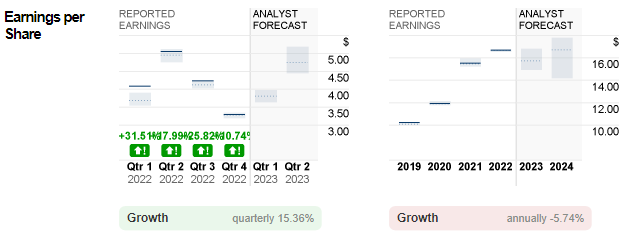

Fig.5: Reported EPS of Walmart versus Analyst Forecast. Source: CNN Business

EPS was reported at $1.71, up 14% from previous quarter, and up 23% from the same period last year. The final EPS in 2022 stood at $6.29, slightly down -2.63% from those in 2021. Similar to the case in Home Depot, the management sees muted growth this year, as the economy continued to be hurt by an increase in expenses, including net interest expenses, non-controlling interest and effective tax rate. In fact, the company has closed many of its physical stores following inevitable headwinds. Consensus estimates for sales and EPS in the coming quarter are $148.5B and $1.31, respectively.

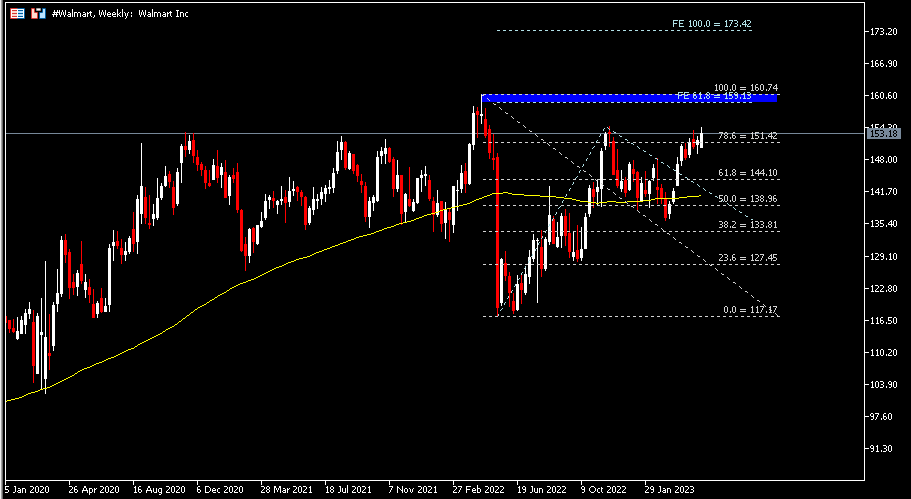

Technical Analysis:

#Walmart (WMT.s) share price last closed at $153.18, slightly below the highs seen in November last year ($154.57). Previous resistance $151.40 has now turned to support. A better-than-expected earnings report may serve as a positive catalyst to drive the stock price higher, towards the next resistance zone $159.10 – $160.74 (ATH). On the other hand, a retrace below the said support may suggest a short-term price correction, towards $144.10 and the dynamic support 100-week SMA.

Click here to access our Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.