Overnight – Australian Employment sector disappointed (higher unemployment and low employment change). Japanese imports declined for the first time in more than two years in April. Global chipmakers signal plans to expand in Japan.

- FX – USDIndex spiked to 102.93. EUR down to 1.0892. JPY breached 137.74. Sterling pull back to 1.2450. AUD weakened dragging down NZD.

- Stocks – JPN225 broke 30000 and breached 30660. The US30 was 1.24% higher, the US500 advanced 1.19% and the US100 surged 1.28%. #Western Alliance’s shares gained 10%, a move mirrored in a 7.3% gain for the KBW Nasdaq Regional Banking Index, its largest percentage increase since 2021. #Target shares climbed too, gaining 2.6%, after the retailer beat analysts’ first-quarter profit expectations. #Tesla jumped 4%, #Amazon was up 1.5% and #Alibaba rallied by 2.16%.

- Commodities – USOil – has nudged up to $73.61 per barrel, Brent added 2.7%.

- Gold has extended yesterday’s losses to 1974.98.

Today – BOE Governor Andrew Bailey, BOC Governor Macklem & ECB President Lagarde speeches, US jobless claims and Philly Index on tap while Swiss financial markets are closed.

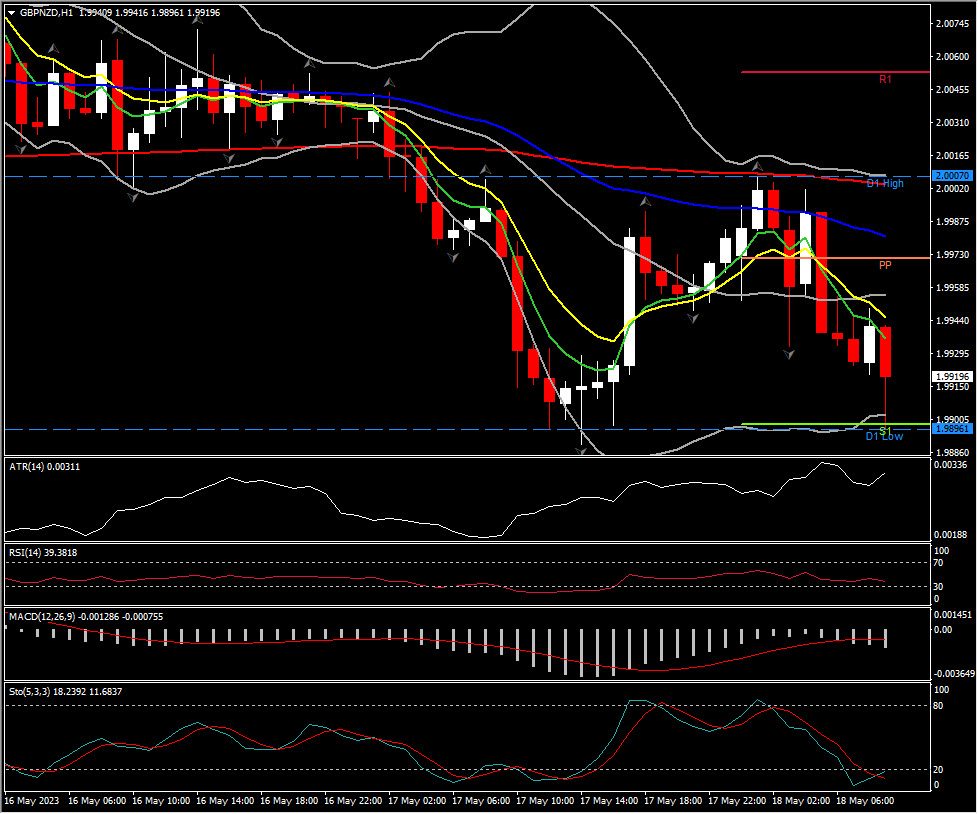

Biggest FX Mover @ (06:30 GMT) GBPNZD (+0.35%). Dipped to S1 at 1.9896. MAs aligned lower, MACD and RSI are negatively configured. H1 ATR 0.00299, Daily ATR 0.01568.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.