The US indices ushered in optimistic gains mid-week following an ease over debt ceiling concerns. However, there was a plot twist on Friday when negotiations seemed to stall again. Despite Fed Chair Powell hinting that the “rates may not have to rise as high as before”, fears over the banking crisis reignited after Treasury Secretary Janet Yellen pointed out that more bank mergers may be necessary. This has pressured US bank stocks in general, dragging down the US indices at the same time. As of market close, US500 was down -0.7% to 4185.51, shortly after it had touched above 4200.

A recap of Tesla’s 2023 shareholders meeting!

Despite many stocks under pressure, the share price of electric vehicle behemoth Tesla continued to climb higher up to $180, a level not seen since 19th April. The company held a shareholders meeting last week. Despite stating there are many uncertainties in macroeconomic aspects, CEO Elon Musk expressed confidence over the company’s sales revenue and profit, “we’re going to get better every year”.

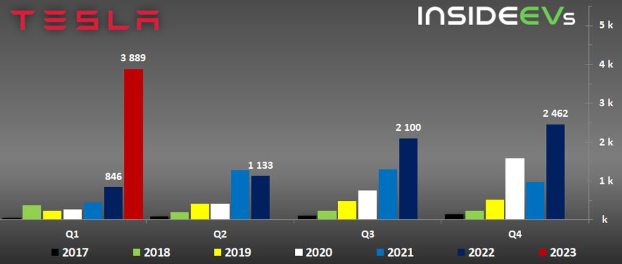

For the full calendar year 2022, Tesla reported over 1.3 million in its global production and deliveries of electric cars, up +47.2% from those in 2021. Among which, Model Y was ranked 3rd as the best selling passenger car globally. Its cars have even started to catch up (and probably become a threat) with other traditional car brand companies, mainly due to its excellent production ramp and recent price cuts of its vehicles.

Musk is confident that “model Y will be the best-selling vehicle in the world this year”, while at the same time he also pointed out that a revamped version of Model 3 (under project Highland) will be able to compete better with other EV makers, especially those in China. In Q1 2023, the company produced over 440,000 vehicles and delivered over 422,000 vehicles.

In addition, Musk promised that the Cybertruck will be delivered this year – “the production is expected to reach 250,000 to 500,000, or even more”. Also, the next-gen Roadster may be completed with new engineering and design this year, and will “hopefully” start production in 2024. The CEO predicted that the two models above shall bring about 5 million sales. In the more distant future, Musk expected to see 20 million output of Tesla vehicles (that was almost one times more than the world’s highest selling car maker Toyota, which sold slightly over 10 million vehicles in 2022).

The company cut prices of its Model Y and Model 3 for the sixth time this year. To compensate for the impact of lower prices on profitability, Tesla is working to improve the ability of fully autonomous driving (FSD) by developing a stronger neural network. At that time, the utilization rate of the car may increase by about 5 times, which is equivalent to a 5-fold increase in the vehicle value.

Lastly, Musk also mentioned the huge prospects of battery energy demand, which could further benefit the company’s energy storage business. In Q1 2023, Tesla reported total battery energy storage deployment at nearly 4000 MWh (up 360% y/y), thanks to its ongoing Megafactory ramp. Revenue generated from this segment was $1.53B (6.6% of the total revenues), up 148% from the same period last year.

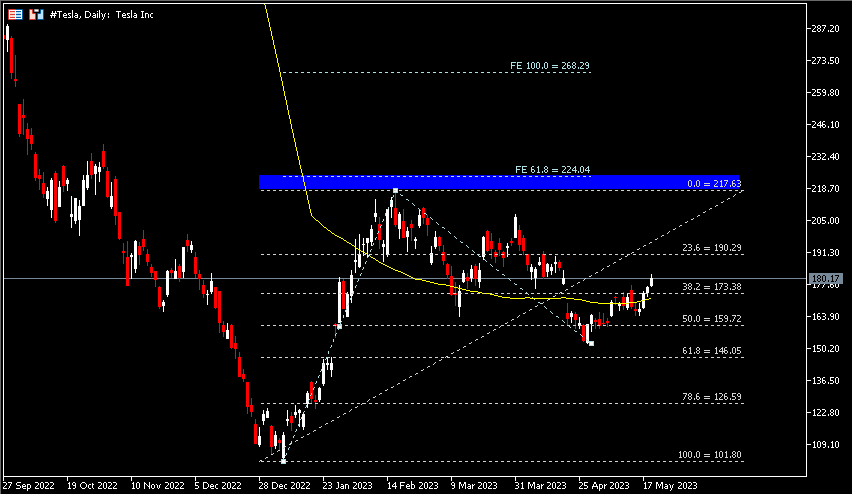

Technical Analysis:

The #Tesla (Tesla) share price hit its YTD highs in the first quarter, at $217.63, before retracing lower in the second quarter. As of its close last week, the asset remains supported above the 100-day SMA and $173.40 (FR 38.2% extended from the lows to the highs of 2023). As long as these two supports remain intact, a bullish force may extend the price further, testing resistance $190.30 (FR 23.6%). The level near the high formed on 31st March ($207.78) may serve as a minor resistance. Breaking above would encourage upside pressure, towards resistance zone $217.63-224.05. Otherwise, if the asset price closes below the 100-day SMA and $173.40, the next support to watch would be $159.70 (FR 50.0%), an important level which may indicate bearish continuation.

Click here to access our Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.