Gold on Tuesday (23/05) closed higher by 0.15% and Silver continued its second day of decline by -0.76%. Higher global bond yields and a stronger USD on Tuesday weighed on precious metals. US 10-year T-note yields rose to a 2-month high of 3.7%, the highest since mid-March, as traders assessed the outlook for monetary policy and the debt ceiling impasse in the US. The 10-year German Bund yield rose to 2.4%, mainly fuelled by market expectations that the ECB will persist in its efforts to tighten monetary policy in response to concerns about inflation, despite concerns about the potential impact on the financial system of a series of rapid rate hikes. The UK 10-year Gilt yield rose to 4.1%, its highest level since October 2022, fuelled by expectations of further policy tightening by the BOE. Governor Andrew Bailey recently admitted that if inflationary pressures persist, additional monetary policy tightening may be necessary.

However, the decline in metal prices is limited as the ongoing US debt ceiling impasse has fuelled safe-haven demand for precious metals.

Thin XAUUSD trades on Monday and Tuesday are likely to look neutral. A move above $1984 could target the 38.2% FR retracement level of the 2079.28-1951.87 drawdown in the $2000 round figure. Meanwhile a move below the recent low could extend the decline of the $2079.28 peak to test the 100-day EMA/ascending trendline around $1932. As long as the$1951 support holds, it could bring consolidation for a while.

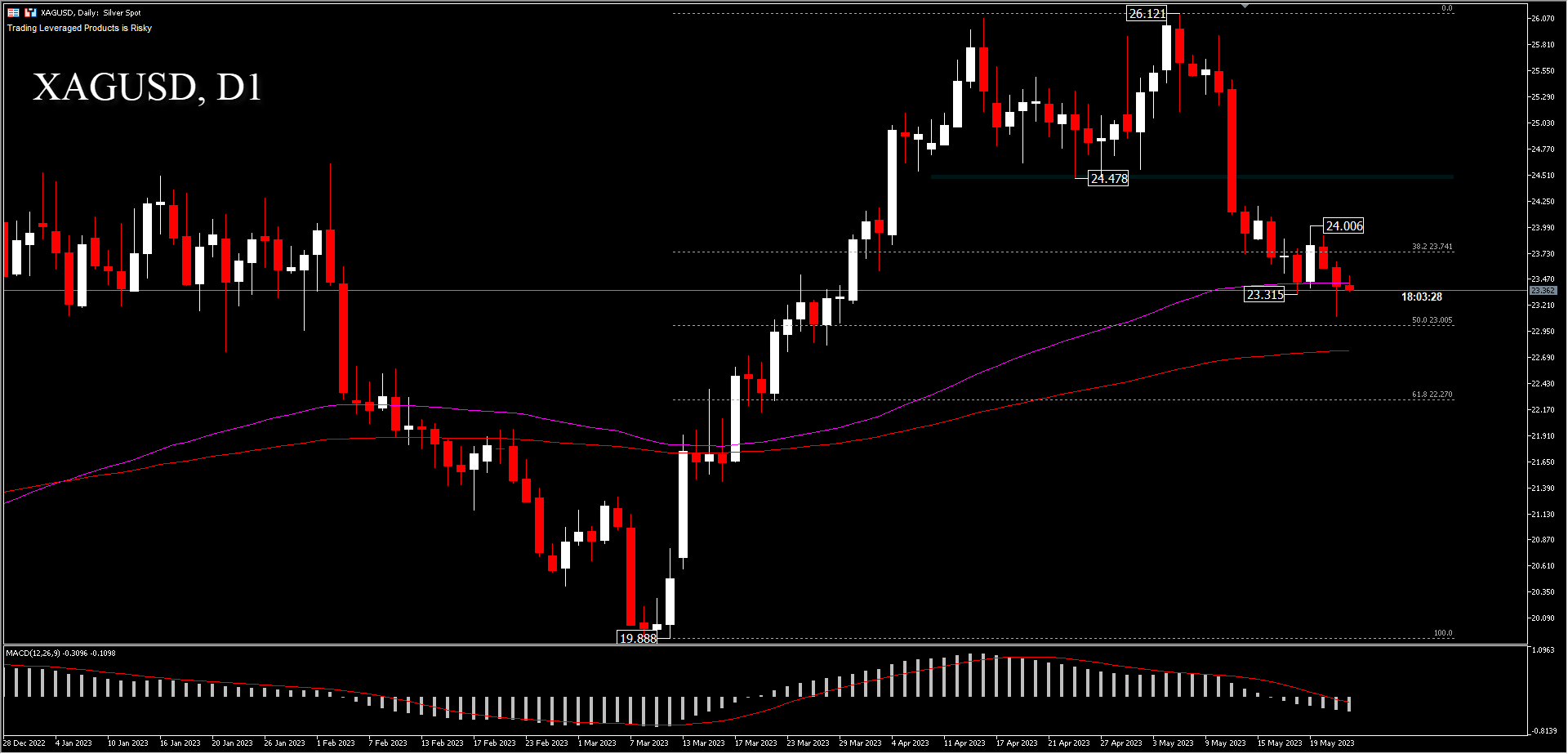

Silver prices were also weighed down on Monday and Tuesday, by industrial metal demand concerns, after March Eurozone construction production fell the most in more than 2 years. Construction output in the Euro Area fell by 1.5% compared to the same period last year in March, following downwardly revised growth of 2.1% in the previous month. This marked the sharpest contraction in construction output since August 2021, driven by declines in building activity (-1.3% vs. 2.1% in February) and civil engineering works (-2.2% vs. 2.3%).

On a monthly basis, output shrank by 2.4% in March, reversing two consecutive months of expansion. In addition, America’s May S&P manufacturing PMI fell more than expected and the Eurozone’s May S&P manufacturing PMI unexpectedly contracted at the sharpest pace in 3 years fueling Tuesday’s price declines.

The XAGUSD price has moved below the April opening price and is currently held above the 100-day EMA. A move below the $23.31 support could resume the decline to test the 50% FR level of the 19.88–26.12 retracement at $23.00 and 200-day EMA at $22.75. Meanwhile, a move above the daily resistance of $24.00 could test the neckline resistance at $24.47.

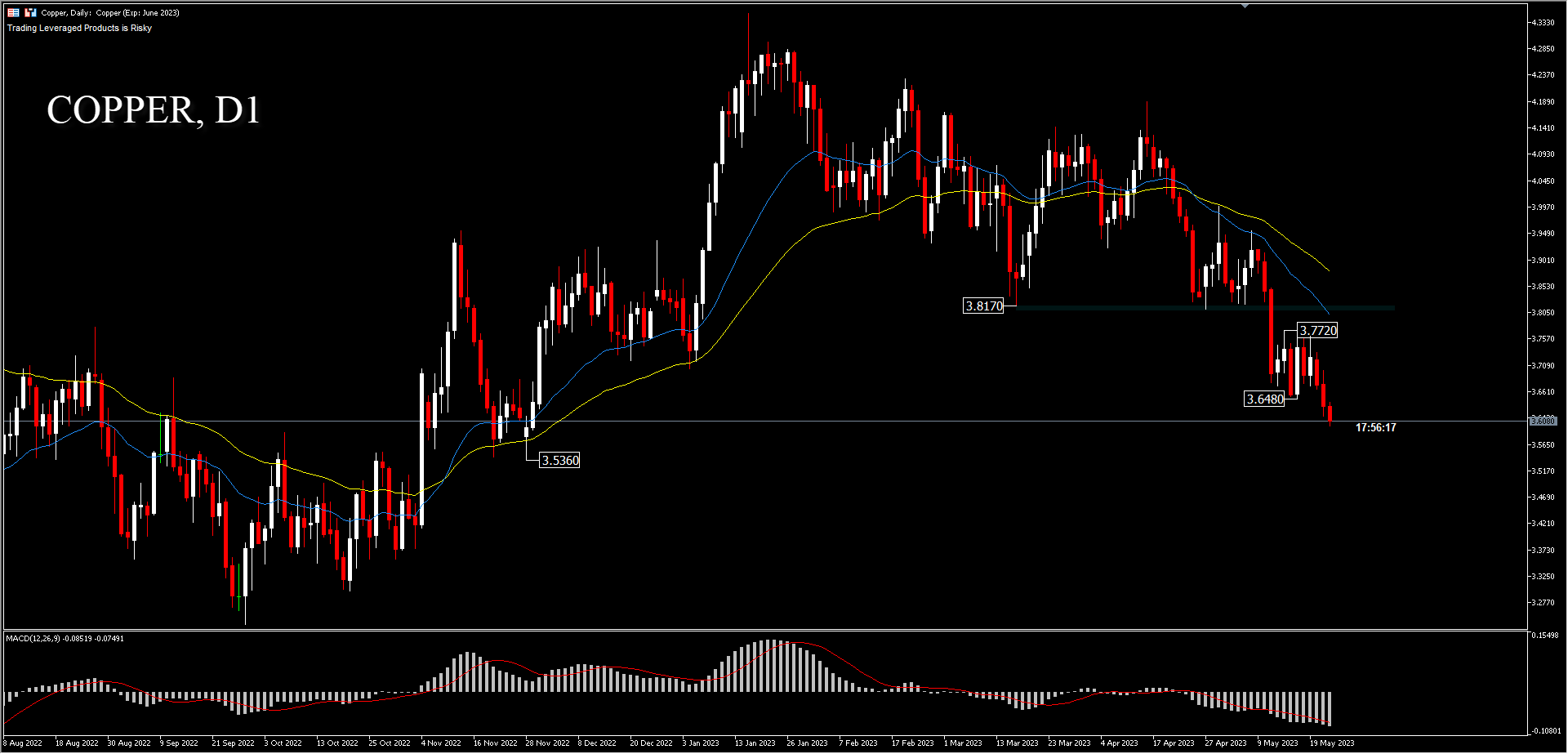

Copper – Disappointing Chinese data has painted a mixed picture for the world’s second largest economy after an upbeat start to the year, with a weaker-than-expected rebound pushing Copper to trade near its lowest level so far in 2023. Copper prices are still maintaining a decline below $3.64 in early week trading. Prices are seen to have left the $3.64-$3.77 consolidation. A sputtering recovery in China has dragged copper prices to a five-month low, delaying one of the most anticipated bull runs in the commodity market. Poor industrial demand prompted China to lower copper import quotas. Technically, bear pressure is very strong as reflected by the steepness of the 26-day EMA. Continued downside movement after surpassing the $3.64 support could test the $3.53 support, while upside movement would find barriers at $3.77 and $3.81.

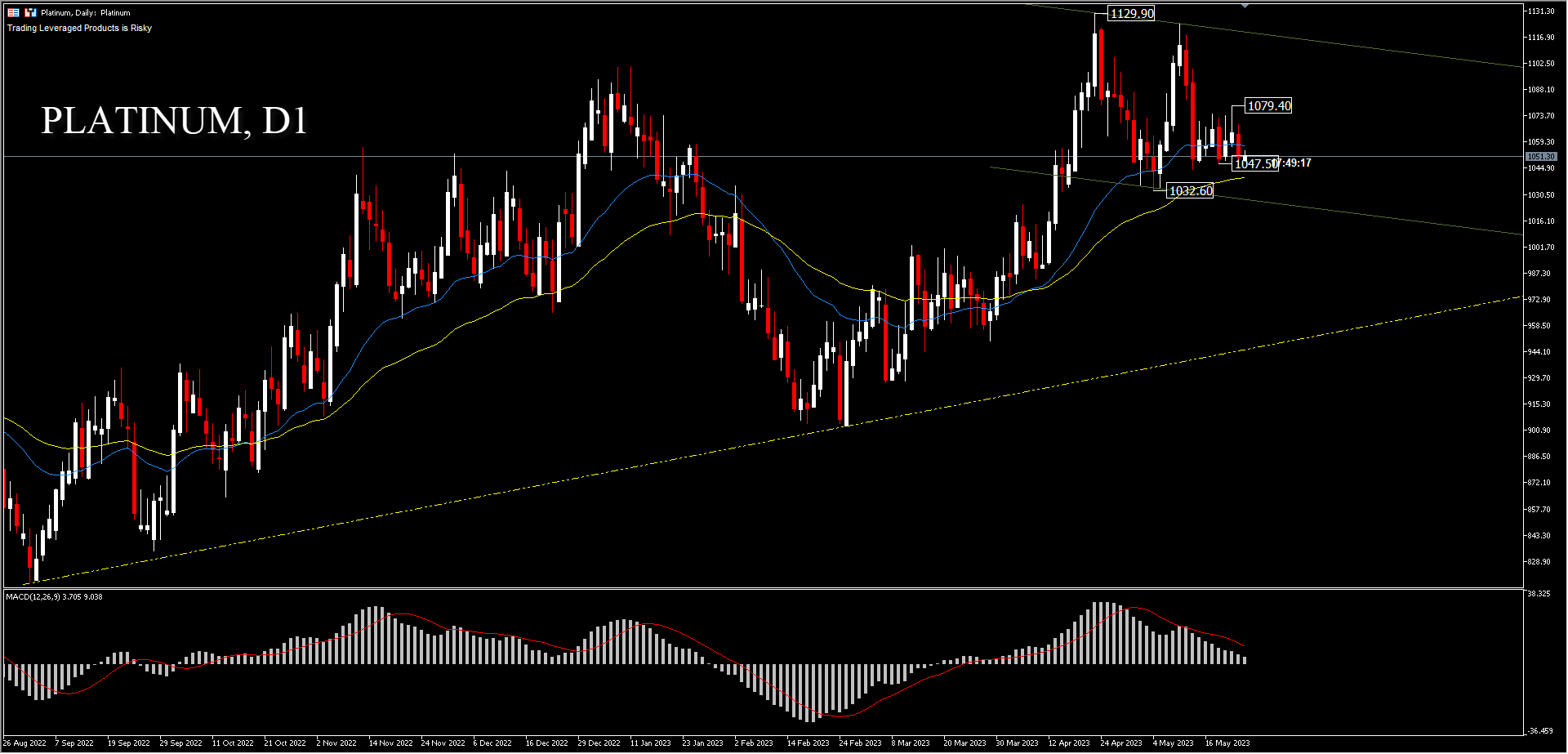

Gold has emerged as the best-performing precious metal in 2023 amid economic uncertainty and geopolitical tensions fuelling demand for the yellow metal. In contrast, Platinum and Palladium have underperformed, with around +0.5% and -14% respectively. However, both should gain significant traction, due to the increasing pressure around climate change. Known for their unique catalytic properties, high melting point and purity, they are used in a wide range of medical, industrial and electronic applications, from the automotive sector and electric fuel cell technology to luxury goods.

Platinum is still trading between its 26-day EMA average. It consolidated in the last 7 days, trading between $1047.50 and $1079.40. A double top has formed signalling hesitant bull interest to sustain the rally momentum. A move below $1047.50 could test the $1032.60 support and a move below this level could confirm the short-term downtrend. On the upside, a move beyond the $1079.40 resistance would open the door for a retest of the $1129.90 peak.

Palladium has continued to consolidate above the $1338.55 price floor in the last 2 months. The highest price it managed to record was seen at $1643.15 in April. The current outlook is relatively stable, and there is no clear direction yet, until the price moves above the resistance of $1643.15 to confirm the start of a bullish trend or moves below $1338.55 to signal that the strength of the bears is not over.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.