As the technology competition between the two major economies of the US and China continues to intensify, the main focus is increasingly shifting to Artificial Intelligence. Following restrictions on US microchip exports to China, the Ministry of Commerce announced that it will control the export of some metals widely used in the semiconductor industry. Although the reason is to protect national security and interests, the Chinese Government requires exporters to seek prior permission from the authorities to ship some products such as gallium and germanium.

The United States and the Netherlands are likely to put pressure on Chinese chipmakers this summer by further restricting the sale of chipmakers’ equipment, arguing to prevent their technology from being used to strengthen China’s military.

China’s controls, from 1 August, will apply to eight gallium-related products, namely gallium antimonide, gallium arsenide, gallium metal, gallium nitride, gallium oxide, gallium phosphide, gallium selenide, and indium gallium arsenide. Then for six germanium products, namely germanium dioxide, germanium epitaxial growth substrate, germanium ingot, germanium metal, germanium tetrachloride and zinc germanium phosphide.

Meanwhile, equity markets diverged slightly on Tuesday as investors assessed the latest escalation in US-China tensions over access to advanced semiconductor technology. Companies such as Advanced Micro Devices, Nvidia and Intel closed thin and mixed, at +0.5%; – 0.5% and +0.4% respectively, caught in the US-China economic and technology access tensions.

Last year, US officials ordered Nvidia to stop exporting its top two AI chips to China to limit the country’s technological capabilities. A few months later, Nvidia launched a new advanced chip called A800 in China to fulfil export control rules. The new restrictions being considered by the Commerce Department will also include a ban on the sale of Nvidia’s A800 chip without a US-specific chip export licence.

Nonetheless, this is not a no-win policy, there are always loopholes available for third-party players. Chinese businesses have found various ways to access AI-enabled technology other than using Nvidia chips that were once legally restricted. Chinese tech companies have leased access to regulated chips through the cloud, as restrictions only apply to the physical export of chips. Leading cloud providers Amazon (AMZN), Microsoft (MSFT), and Alphabet (GOOGL) have long offered remote access to AI chip computing capacity through leasing. Since the restrictions were imposed last year, China has been utilising these offerings at an increasing pace.

Nvidia announced in March this year that it also intends to lease supercomputing power to Chinese companies, preparing to capitalise on their desire for top-tier technology. Source: Reuters; Barron’s; Cnbc.

Restricting sales of data centre graphics processing units to China will have an impact on future financial results, but the company does not expect additional restrictions to have a direct material impact on its results. In AI data centres run by Amazon, Alphabet and Microsoft, Nvidia controls about 80% of the accelerator chip market. China accounts for about 22% of Nvidia’s total revenue, with data centre chip sales to the country accounting for between 7% and 10% of the overall total.

Nvidia is by far the best performing component of the S&P500 this year. Shares of the leading AI chipmaker surged more than 180% in the first half. The other six largest American tech companies Apple, Microsoft, Alphabet, Amazon, Tesla and Meta were each among the top 50 returns in the S&P, adding a combined market capitalisation of $4.1 trillion. Nvidia also led a broader rally for mega-cap tech.

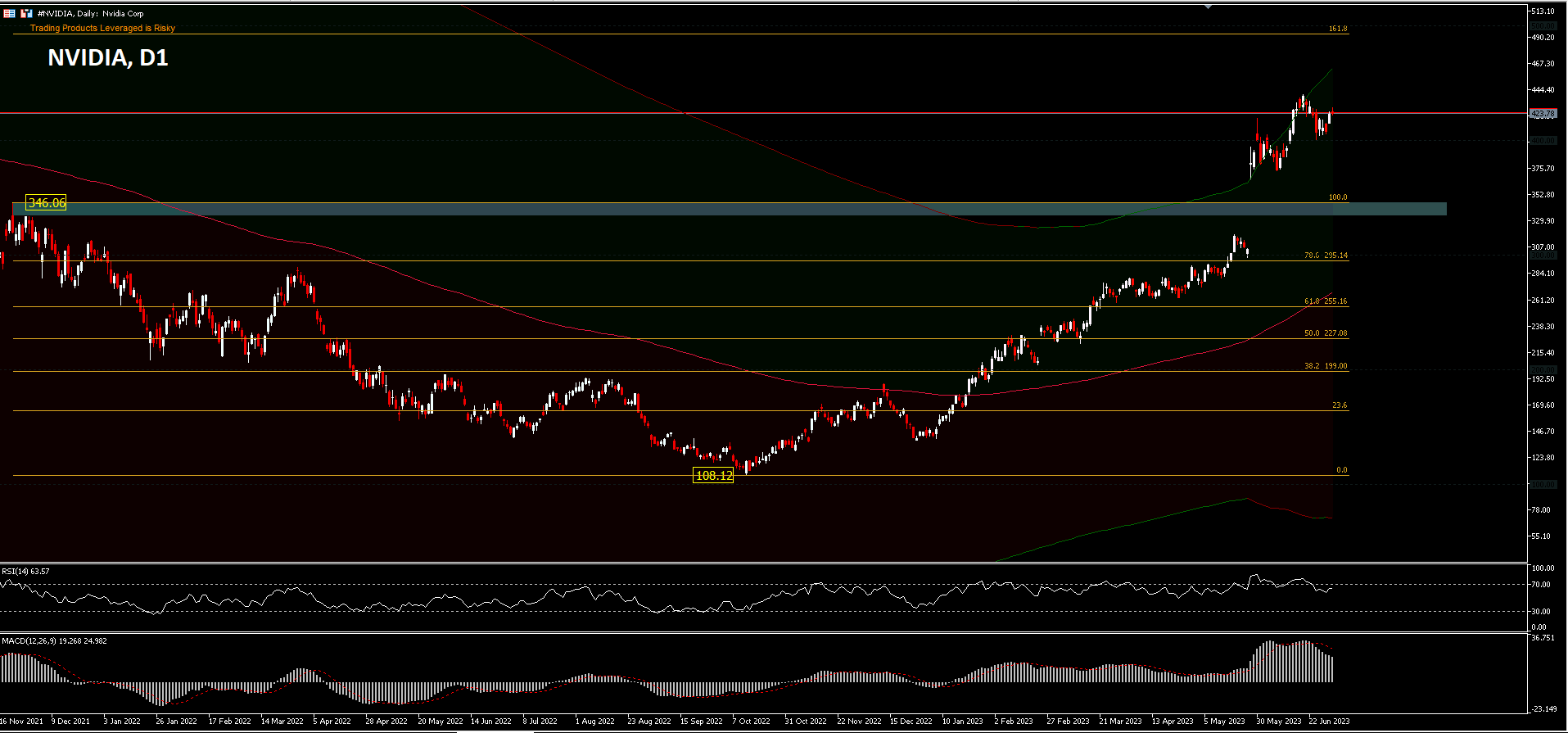

#Nvidia attempted to rally back in October last year from the $108.12 level and the price has even surpassed the $346.06 resistance price level which was recorded as the high price in November 2021.

The breakout of the resistance further strengthens #Nvidia’s position for rally expansion up to the 161.8%FR expansion level around $493 to $500, in case of positive growth and beyond the minor resistance of $439.85. On the downside, a correction could possibly test back to the $346.06 resistance level which has now become support.

A decline in the rally’s momentum doesn’t look threatening yet, with RSI staying away from overbought levels and MACD in the buy zone still validating the recent moves.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.