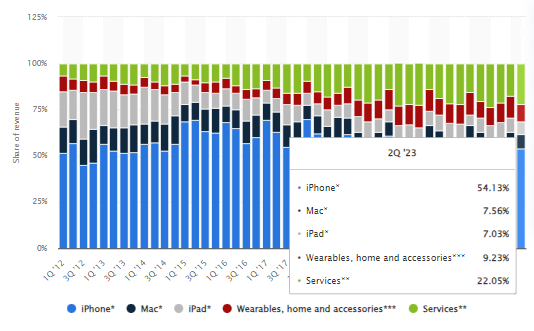

Apple,Inc., an American multinational technology company which specializes in the design, manufacture, and sale of smartphones (iPhone), personal computers (Mac), tablets (iPad), wearables and accessories (Apple Watch, Airpods, Apple Beats), TVs (Apple TV) and other varieties of related services (iCloud, digital content stores, streaming, licensing services), shall release its Q3 2023 earnings result on 3rd August (Thursday), after market close. What lies ahead for this conglomerate with the largest market capitalization at over $3 trillion?

In the previous quarter, Apple.Inc reported a second consecutive quarterly drop in sales revenue, by -3% (YoY) to $94.8B. Despite the challenging macroeconomic factors, the company reported a March quarter record for iPhone and an all time record in Services (both made up the major portion of total revenue, 54.13% and 22.05%, respectively). The company remains fundamentally solid following strong operating cash flow ($28.6B), dividend payout (up 4% to $0.24 per share) and share repurchases worth $90B.

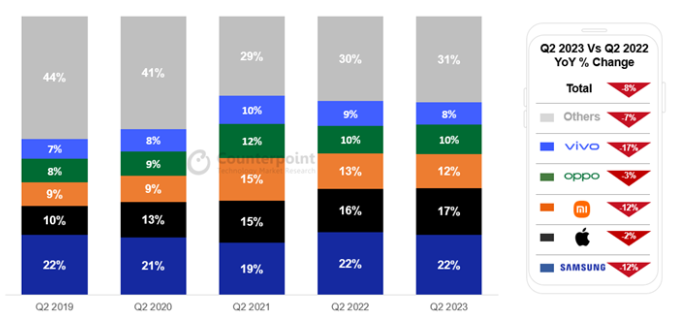

As of April 2023, the US phone maker leads the global competition with market share over 30%, followed by Samsung (26%) and Xiaomi (11.7%). Nevertheless, Apple device sales have remained stagnated in the past few years, despite more active users being added each year.

Recently, Samsung reported a decline in its smartphone shipments, eventually resulting in a slip in revenue and operating profit. Compared to Samsung (and also other competitors), Apple experienced the smallest decline in shipments (-2% YoY in Q2). According to the International Data Corporation (IDC), following consumer demand recovery that is much slower than expected in all regions, global shipment of smartphones is expected to decline -3.2% this year (previous forecast was -1.1%). However, iPhone sales revenue managed to grow from the year-ago quarter, following parts shortages and supply chain issues that had finally abated.

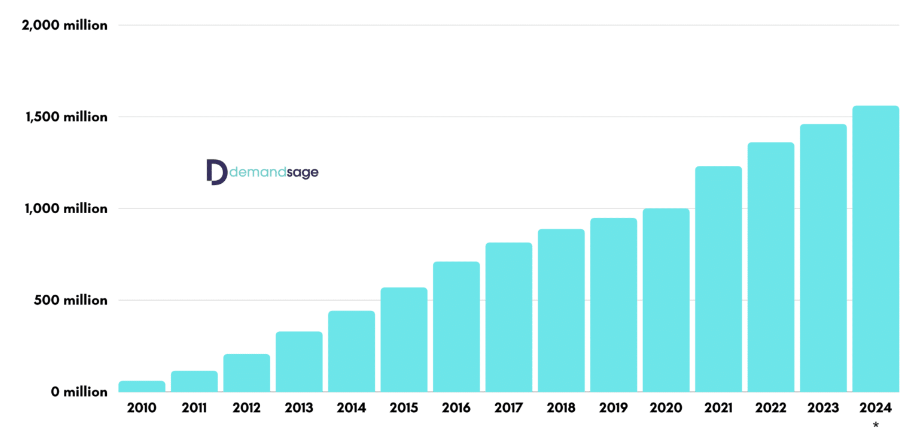

Paid subscribers for digital services (App store, Apple Pay, Apple TV+, Apple Music and iCloud) reached over 975 million, up 150 million over the past 12 months. It is worth noting that Apple.Inc is at the centre of a $1B lawsuit following the tech giant’s 15%-30% charges to app developers which are claimed to be “excessive”. The company is at risk of being liable for any order of damages and costs.

Recently, Apple.Inc has opened up applications for Vision Pro developer’s kits – this would include setting up the device and providing code-level technical support, as well as compatibility evaluation of apps and games. On the other hand, Unity – a leading platform for creating and operating interactive, real-time 3D content – has announced the release of PolySpatial technology which will help to strengthen the deep integration with Apple’s visionOS. The application can run together with other applications in the Shared Space. Developers could easily create content on Apple Vision Pro by combining Unity’s authoring tools with RealityKit’s managed application rendering.

Apple Pay Later has gobbled up a huge chunk of market share from its competitors since its launch in March this year, at nearly 19% in the first three months, just behind PayPal (39%) and Afterpay (33%). By leveraging its brand and its consistency in delivering quality technology products, coupled with its existing global network and vast resources, Apple Pay Later held a strong competitive advantage compared to other BNPL lenders.

In addition, Apple’s savings account which launched in April this year also brought in success for the company. The account which offers 4.15% annual interest rate attracted $990 million in deposits in less than a week! Nonetheless, it is reported that Goldman Sachs is seeking to cut ties with Apple, after the bank reported net losses in its Platform Solutions businesses. American Express could be the next bank to take over the business.

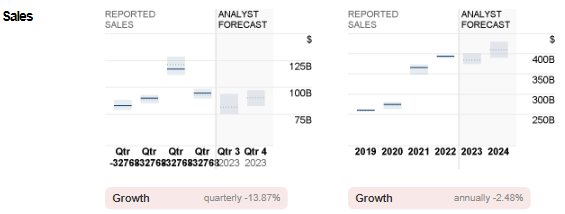

Consensus estimate for sales stood at $81.7B, down –13.8% from the previous quarter, and down –1.6% from the same period last year.

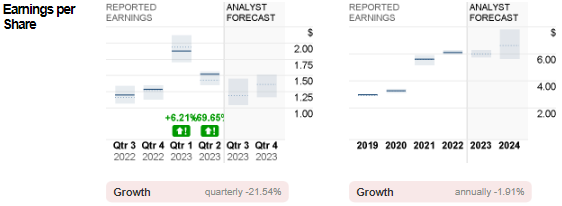

On the other hand, EPS is expected to hit $1.19, down 35 cents from the previous quarter. In Q3 2022, the figure was $1.20.

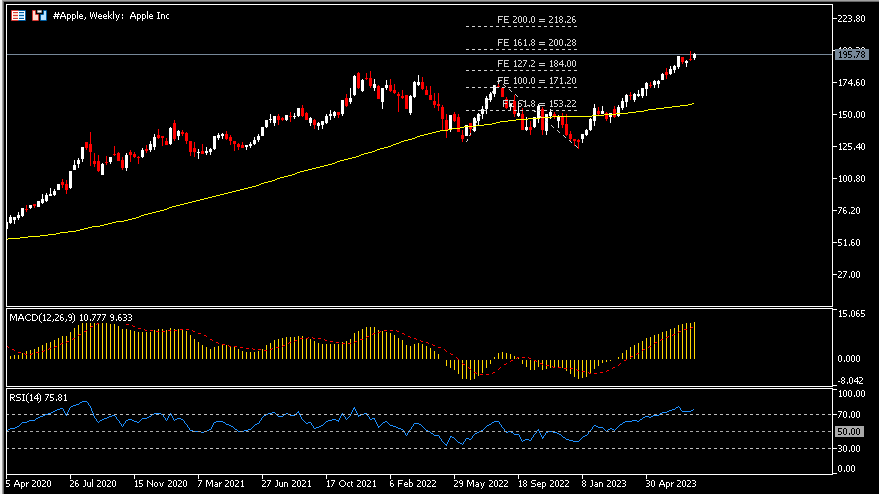

Technical Analysis:

The #Apple share price has closed bullish for seven consecutive months, leaving session lows at $124.14. The asset hit an ATH on 19th July, at $198.21. Together with $200 (FE 161.8%), these two points form the nearest resistance zone. A strong bullish breakout is required for the bulls to continue testing the next resistance at $218. The high estimate of analysts stood at $240. On the contrary, a price retrace may keep $184 at test, followed by $171. MACD indicator remains in positive configuration, while RSI is hovering at the overbought zone.

Click here to access our Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.