South Africa is grappling with economic challenges, marked by persistent power outages, social unrest, and structural constraints hindering growth. The latest data from Statistics South Africa shows a 1.2% quarter-on-quarter GDP growth in Q2 2023, driven by mining, finance, and trade, while agriculture, manufacturing, and construction contracted. Year-on-year, GDP contracted by 17.2% in Q2.

Inflation, measured by the consumer price index (CPI), rose to 5.4% year-on-year in September, reaching a three-month high. Food, non-alcoholic beverages, housing, utilities, and transport costs were primary contributors. While still within the South African Reserve Bank’s (SARB) target range of 3% to 6%, it moved further from the 4.5% midpoint that the SARB aims to anchor.

Inflation, measured by the consumer price index (CPI), rose to 5.4% year-on-year in September, reaching a three-month high. Food, non-alcoholic beverages, housing, utilities, and transport costs were primary contributors. While still within the South African Reserve Bank’s (SARB) target range of 3% to 6%, it moved further from the 4.5% midpoint that the SARB aims to anchor.

The upcoming SARB interest rate decision on November 23 is crucial. Having maintained the repo rate at 8.25% in September, the SARB is employing a cautious, data-dependent approach, balancing economic support and inflation containment. The SARB’s Quarterly Projection Model suggests a probable 25 basis points rate hike in 2023, followed by two more hikes in 2024, contingent on inflation outlook and risk assessment.

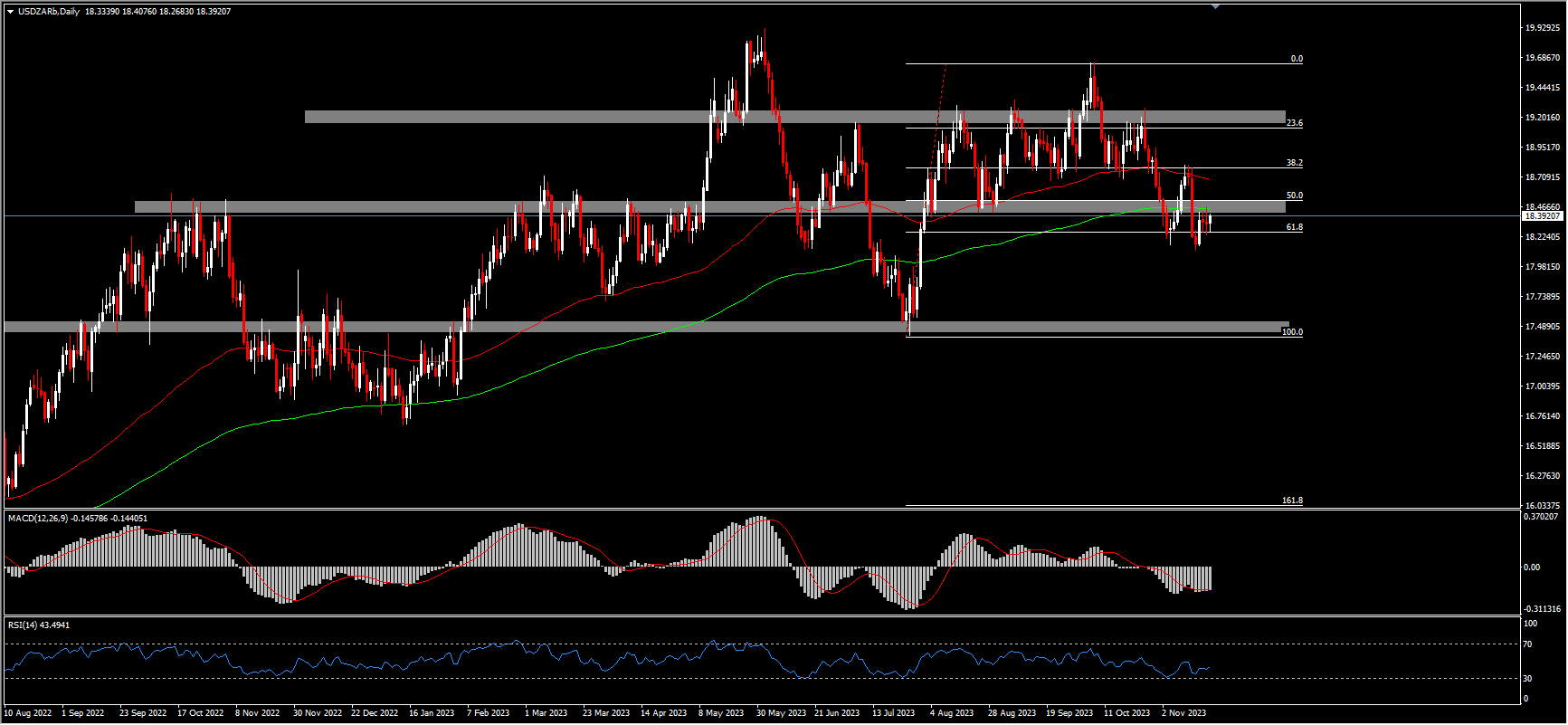

Examining the USDZAR technical analysis on the daily chart, the pair broke down the support at 18.40 and the 200-day moving average, trading just above the 61.8% Fibonacci level at 18.39. A break below 18.25 could lead to further declines towards 18.00 and potentially 17.50. Conversely, a bounce might encounter resistance at 18.52 and 18.78. The momentum indicators RSI and MACD are providing mixed signals, with RSI near the neutral 50 level, indicating a neutral bias, while MACD above the signal line suggests a bullish bias.

Click here to access our Economic Calendar

Francois du Plessis

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.