Sterling strengthened against most other currencies, after Bank of England Governor Andrew Bailey and two other policymakers told the Treasury Select Committee that there is a possibility that the bank rate will be paused at 5.25% for an extended period. Catherine Mann, a member of the Monetary Policy Committee, was also present and warned that the potential for more persistent inflation warrants tighter monetary policy. Dave Ramsden of the MPC said he did not rule out raising the Bank Rate further in the future.

The comments helped UK bond yields higher and triggered a widening of the gap between UK and German two-year bond yields by 2.0%. The yield differential remains the main driver of the exchange rate on EURGBP.

UK 10-year Gilt yields near the 4.1% mark remain near their lowest since 19 May, as investors await Finance Minister Jeremy Hunt’s budget update set for today. Meanwhile, recent UK data showing an unexpected drop in October retail sales and easing inflationary pressures, have reinforced expectations that the Bank of England might consider an interest rate cut in the coming year. Currently, the market projects a potential rate cut of 80 basis points throughout 2024, up from 60 basis points last week. Despite the change in market sentiment, Governor Andrew Bailey warned on Monday that talk of a rate cut was premature, suggesting that discussion on the matter may need to be postponed. The bank is clearly uncomfortable with this, as it runs counter to efforts to control inflation, and appears increasingly uncomfortable with rising rate cut bets.

Technical Review

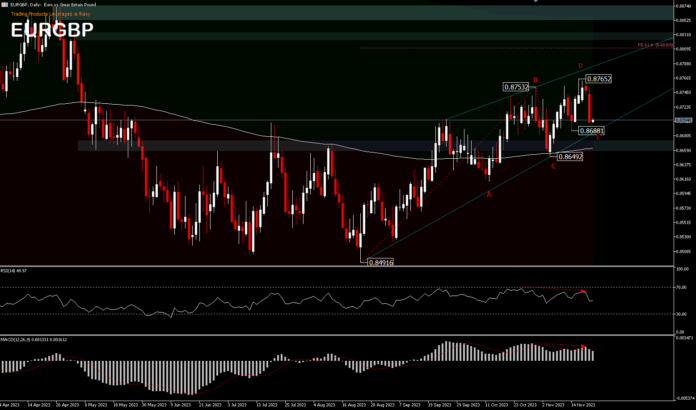

EURGBP is seen forming a rising wedge pattern. On Tuesday’s trading, the cross pair lost -0.5% and attempted to approach last week’s low of 0.8688. Overall the price is still moving above the 200-day EMA. EURGBP is expected to rally further as long as the 0.8649 support holds. The current upside from 0.8491 is projected for FE61.8% [from 0.8491-0.8753 and 0.8649 drawdown at 0.8810].

On the downside, a break of 0.8688 support would indicate a short-term topping and turn the bias back to the downside. RSI is neutral at 50 and MACD shows divergence.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.