Apple (AAPL) is encountering a turbulent start to 2024, marked by downgrades and growing apprehensions about its growth trajectory. Today we will examine both the technical and fundamental aspects influencing Apple’s current market dynamics.

Apple (AAPL) is encountering a turbulent start to 2024, marked by downgrades and growing apprehensions about its growth trajectory. Today we will examine both the technical and fundamental aspects influencing Apple’s current market dynamics.

Analyst Downgrades and Concerns:

Apple recently faced its third downgrade in less than two weeks, with Redburn Atlantic, Barclays, and Piper Sandler expressing concerns about slowing iPhone sales and potential regulatory challenges. Fears of weakening iPhone sales and regulatory headwinds prompted these downgrades, particularly focusing on the deteriorating macro environment in China.

Mixed Performance and Valuation Challenges:

In the initial days of 2024, Apple’s stock dropped approximately 4%, in contrast to its Big Tech peers showing gains. Concerns about its high valuation are on the rise, especially amid worries about global economic downturns. Traders are apprehensive about Apple’s growth rate, particularly in the face of a potential global recession.

Positive Outlook and Catalysts:

Despite downgrades, some maintain a positive outlook. Evercore ISI’s Amit Daryanani sees an opportunity to buy the dip, emphasizing Apple’s strong fundamentals and potential positive news flow, especially related to Apple’s Vision Pro. Morgan Stanley’s Erik Woodring predicts a significant lift for Apple in 2024, citing the potential for Apple’s ‘Edge AI’ opportunity to materialize.

Challenges in the AI and Next-Gen Technology Sphere:

Apple’s emphasis on artificial intelligence (AI) and next-gen technology, including the high- priced Vision Pro headset, raises concerns. The success of the $3,499 Vision Pro spatial computing headset, set to launch in February, could significantly impact Apple’s stock price. Heavy investments in AI and next-gen headsets pose risks, particularly if Apple’s growth rate continues to decline.

priced Vision Pro headset, raises concerns. The success of the $3,499 Vision Pro spatial computing headset, set to launch in February, could significantly impact Apple’s stock price. Heavy investments in AI and next-gen headsets pose risks, particularly if Apple’s growth rate continues to decline.

Regulatory Risks and Competition:

Regulatory risks are surfacing, particularly concerning Apple’s services business, especially the app store, as antitrust investigations intensify. Apple’s lucrative agreement with Google as the default search engine in Safari faces uncertainty, adding another layer of complexity. Apple’s growth rate and competition in the AI and next-gen technology sectors remain pivotal factors influencing its stock performance.

Technical Analysis

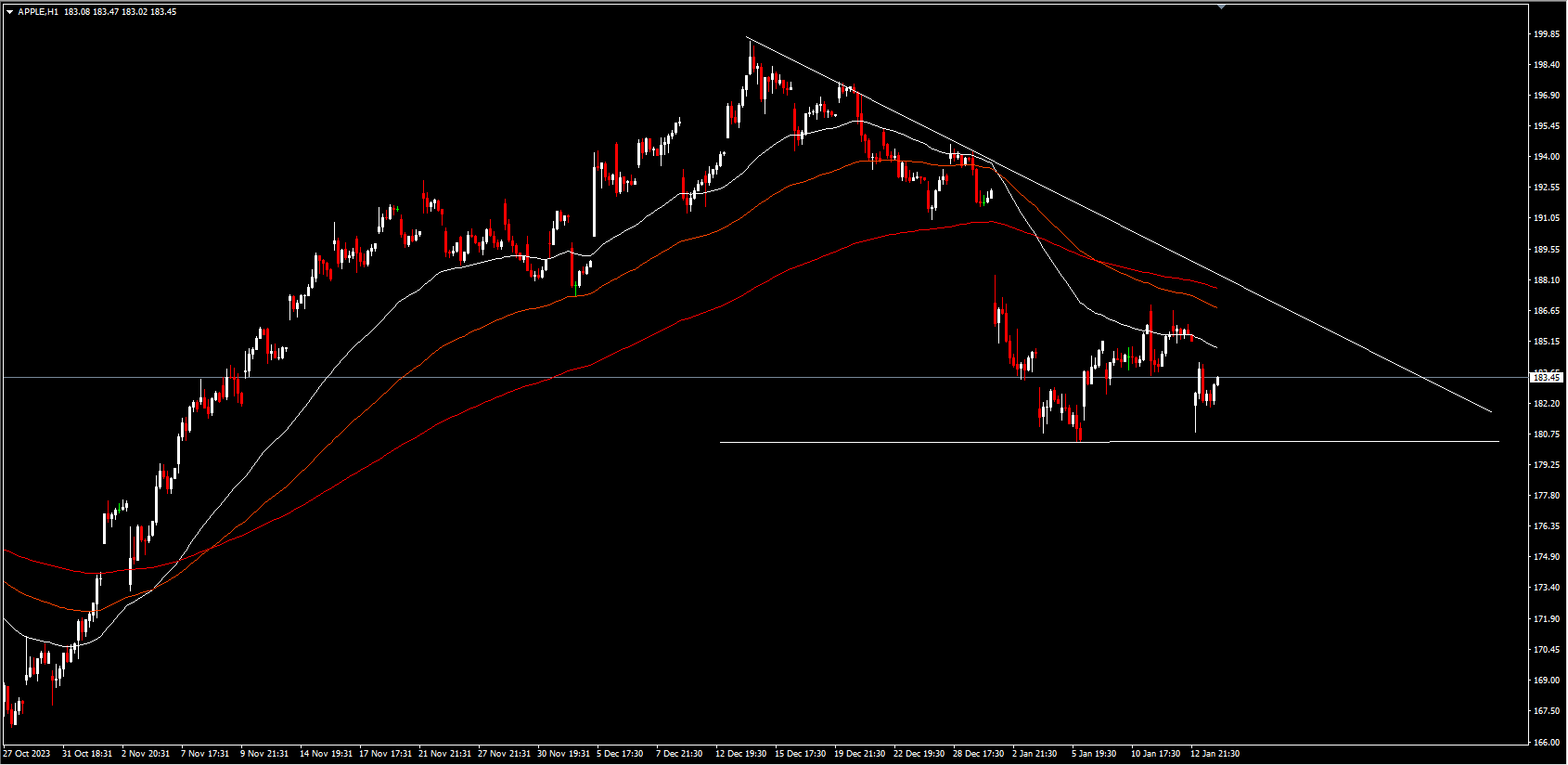

On the daily timeframe, Apple is positioned below the critical 100-day Exponential Moving Average (EMA), presently standing at $184.45. This placement suggests a potential bearish trend, as the EMA functions as a dynamic resistance level. Conversely, the stock maintains its position above the 200-day EMA, standing at $178.54, acting as a crucial dynamic support level.

Furthermore, a discernible descending triangle pattern is observable on the 1-hour timeframe, signalling a bearish continuation pattern that hints at a potential further downside breakout. The lower threshold of the triangle, situated at $180.30, serves as a pivotal support level. A breach below this point might pave the way for a substantial decline, targeting subsequent support levels at $174.00 and $167.

Conversely, if the stock rebounds from the $180.30 level, it could encounter resistance at the upper boundary of the triangle, marked at $184.45, aligning with the 100-day EMA. A breakthrough above this juncture could signify a reversal of the bearish trend, potentially triggering a rally towards subsequent resistance levels at $189 and $196.

Click here to access our Economic Calendar

Francois du Plessis

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.