Apple, Inc., an American multinational technology company specializing in the design, manufacture, and sale of smartphones (iPhone), personal computers (Mac), tablets (iPad), wearables and accessories (Apple Watch, Airpods, Apple Beats), TVs (Apple TV) and other varieties of related services (iCloud, digital content stores, streaming, licensing services), shall release its Q1 2024 earnings result on 1st February (Thursday), after market close.

Apple has taken the reins in market capitalization, with the largest market capitalization at over $3 trillion, ahead of Microsoft which reached the milestone shortly after. What lies ahead for this conglomerate?

Apple – Revenue Change by Product Category. Source: MacroMicro

In the previous quarter, overall sales of Apple. Inc fell for the fourth quarter in a row, to $89.5B. The figure was down -1% from the same period last year. By product category, iPhone was the only hardware which reflected growth in the quarter, with sales improving more than 2% (y/y) to $43.8B (This was inclusive of a week of iPhone 15 sales). While the outlook for the sales of the iPhone 15 series seem brighter than its previous version, there were still obstacles faced by the tech conglomerate in its third largest market – China, following increased competition, geopolitical uncertainties, regulatory challenges and trade restrictions. It was reported that the Chinese iPhone sales dropped 30% in the first week of 2024, which led the company to slash its gadget price by 5% as an attempt to boost sales in the region.

On the other hand, Mac, iPad, wearables/accessories were down -33.8%, -10.2% and -3.4%, to $7.6B, $6.4B and $9.3B, respectively. Despite the disappointing sales slump, CEO Tim Cook expects ‘significant’ improvement in the Mac category, following the release of the latest version iPad Air equipped with speedier M3 processor. Sales of iPad may remain stagnant, as the revamped version is still in the process. Earlier, Apple had been banned from selling its Watch models Series 9 and Ultra 2 which include the blood oxygen feature following a patent infringement case. Nevertheless, the negative impact could be minimal, as the company is still allowed to sell those models with the feature removed. Last but not least, Apple’s first spatial computing device – the Vision Pro headset had pre-orders up to 180,000, but continuous demand for this “very niche product” is still questionable, as it “isn’t meant for the average consumer” in addition to the expensive price.

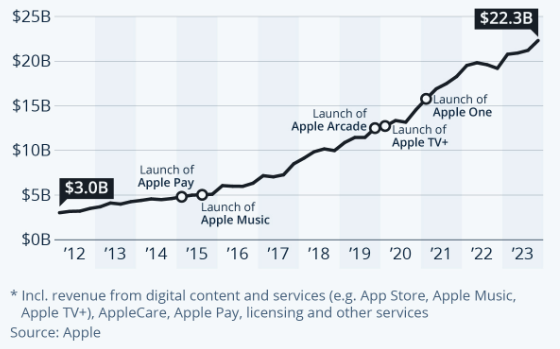

Apple Services: A Decade of Growth. Source: Statista

In addition, the services division (Apply Pay, Apple TV+, iCloud, Apple Music, App Store, advertisement, payments from Google for search) reached an all-time revenue high in the latest announcement, at $22.3B. This was driven by an installed base of over two billion active devices and constant investment in new service offerings. As of today, it was reported that Apple’s paid subscriptions hit more than one billion, nearly doubled from the figure reported three years ago. The management remains optimistic towards its services businesses, expecting to see average revenue per week grow at a similarly strong double-digit rate.

Apple.Inc: Reported Sales and EPS versus Analyst Forecast. Source: CNN Business

Consensus estimates for Apple’s sales revenue in the coming quarter stood at $126.1B, up over 40% from previous quarter, and up 7.6% from the same period last year. EPS is expected to hit $2.15, up over 47% from previous quarter, and up over 14% from the same period last year.

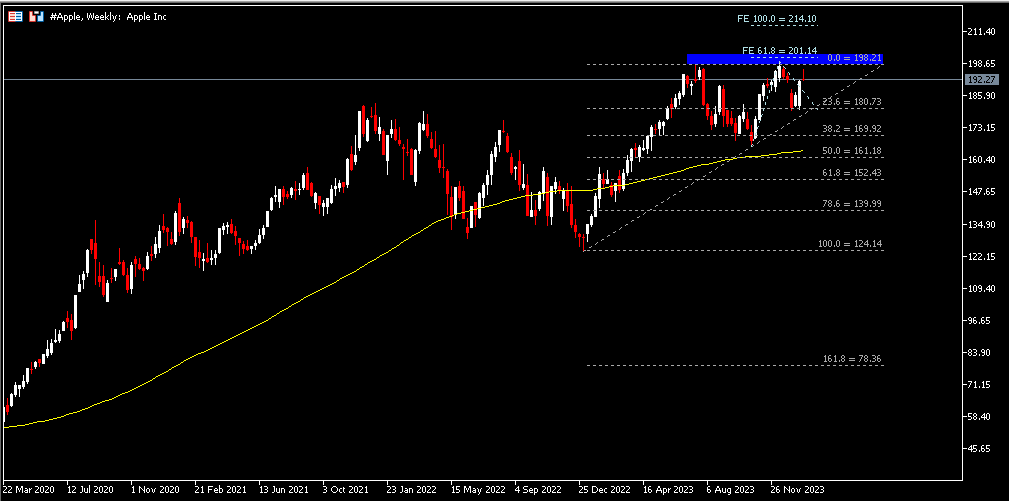

Technical Analysis:

#Apple, Weekly: The company share price last closed slightly above the high of the previous week. $198.21, the high of July 2023 and $201.15, a 61.8% FE level, both serve as the nearest resistance zone. Breaking above this level may lead the asset to test the next resistance level, at $214. On the other hand, $180.70 and the year low, $180.17 serve as the nearest support zone. Breaking below the latter may lead the correction towards the next support, at $170.

Click here to access our Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.