Following Fed Governor Christopher Waller’s comments, after the close of trading on Wednesday, Treasury yields rose across tenors in early Asian trading. Two-year Treasury bond rates, which are more vulnerable to policy changes, increased by three basis points as the USD appreciated against G10 currencies.

The USDIndex rallied around 104.4 on Thursday, near its highest level in six weeks as hawkish statements from Federal Reserve officials supported the currency. Waller said on Wednesday that the central bank could delay a rate cut amid strong inflation data. Waller said that a rate cut would not be rushed and he would like to see better inflation data for at least a few months, before rates are lowered.

After the SP500 ended at a record high, there was no movement in US equity contracts during Asian trading, suggesting that many institutional investors may have rebalanced their holdings. Meanwhile, Japanese stocks fell after trading ex-dividend. The action was taken after the Nikkei 225 index almost hit a new high on Wednesday. Meanwhile, Australian equities surged to a new high at the same time as Hong Kong benchmark futures showed gains.

Investors now look forward to Friday’s latest US PCE price index report, which is the Fed’s preferred inflation measure, for further guidance.

The USD strengthened across the board in the G10, but risks depreciating against the Yen as Japanese authorities signalled readiness to intervene again in the currency market. By October 2022, the Yen had fallen to 151.97 below policymakers’ intervention threshold. The Yen recovered from a 33-year low and moved higher amid speculation of intervention in the currency market to support the Yen, after Japan’s Ministry of Finance, the Bank of Japan and the Financial Services Agency held an unscheduled meeting.

The yen’s weakness came as investors speculated that the Bank of Japan’s monetary policy will remain accommodative for some time, despite recent changes towards negative interest rates.

Earlier, BoJ board member Naoki Tamura said that the risk of inflation overshooting and requiring the central bank to tighten monetary policy quickly is still small.

In the bank’s latest comments, Finance Minister Suzuki said that forex movements of 4% in 2 weeks are not moderate, and they will observe market movements with great urgency. Japan’s top currency official, Kanda, said that the recent weakening of the Yen cannot be said to be in line with fundamentals and it is clear that speculative movements are behind the Yen’s fall. He said that appropriate action will be taken against excessive movements, without ruling out any options.

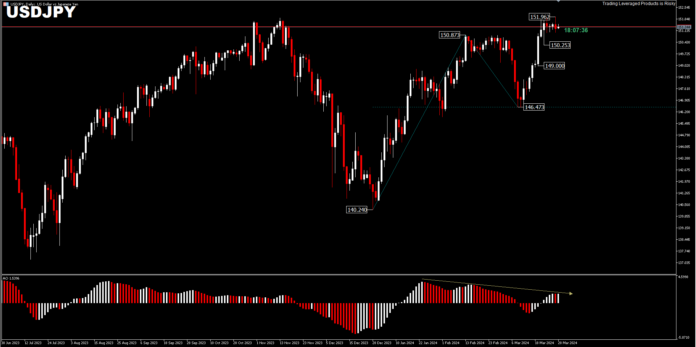

From a technical perspective, USDJPY’s intraday bias turned neutral, as it declined from a fresh high of 151.96. On the downside, a break of 150.25 support will confirm a short-term topping, and turn the bias back to the downside for the 149.00 balance zone and further to 146.47.

Nevertheless, a sustained break of 151.96 resistance will confirm the resumption of the long-term uptrend. The next short-term target is the FE61.8% projection in the 153.00 range.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.