The conditions for a rate cut are improving as inflation continues to fall. Growth meanwhile has bottomed out, it seems, and this reduces the pressure for an immediate move. Against this backdrop, the European Central Bank (ECB) is expected to keep rates on hold this week, but lay the groundwork for a cut in June.

With inflation coming down faster than initially expected, the doves at the European Central Bank (ECB) are getting more vocal in their demands for a rate cut. Executive Board member Cipollone recently suggested that rates can be cut “swiftly” and French central bank head Villeroy warned against the risk of cutting too late. However, that doesn’t mean that the European Central Bank (ECB) is ready to act, and even Villeroy suggested that “the exact date of the first cut — April or early June — has no existential importance”.

The doves seem happy to settle for June, and the rapid decline in goods inflation should mean that the hawks will be ready by then as well. HICP inflation fell to 2.4% y/y in the preliminary reading for March from 2.6% y/y in February. This was the lowest headline number since November of last year. Energy prices are still leading the way, but core HICP also declined and is now at the lowest level since February of 2022.

Services price inflation meanwhile remained at a high 4.0% y/y at the end of the first quarter, unchanged from the previous month and still twice the ECB’s inflation target. Services sector activity is expanding, especially in the southern European countries that are benefiting from the post-pandemic tourism boom. This helped the HCOB Eurozone Composite PMI to climb above the 50 point level.

This means the pressure on the European Central Bank (ECB) to ease monetary conditions in order to boost growth has eased, which should allow Lagarde and Co. to keep rates on hold this week. Indeed, HCOB reported that growth expectations are the most optimistic since the eve of Russia’s invasion of Ukraine in February of 2022. At the same time, the strengthening of services sector activity means that companies across the sector have more room to pass on higher wage costs, which could still undermine the downtrend in HICP. By June, the ECB will have a clearer idea of wage developments and also a new set of economic forecasts to justify a rate cut.

In theory, divergence with the Fed has the potential to trigger foreign exchange and bond market moves that could rekindle inflation pressures in the Eurozone. However, given developments in US data, markets are already pricing in swifter and more decisive cuts from the ECB. This should limit the impact of any delay in the Fed’s tightening cycle, as long as Powell doesn’t cancel cuts altogether for this year. If the Fed were to change its communication before the summer, it would indeed make it more difficult for the ECB to cut rates in June. This would be another argument for the hawks not to sign off on a move this week.

Another risk to the inflation outlook comes from oil prices, which have been on an uptrend in recent weeks. Demand has been stronger than anticipated, and under the assumption that OPEC+ is sticking with current output cut targets, the IEA sees a supply deficit for this year. This is coupled with geopolitical risks that could leave oil prices higher than the ECB assumed at the time of the last staff projections.

Risk of ECB rate cut this week

The conditions for a rate cut are improving as inflation continues to fall. Growth meanwhile has bottomed out, it seems, and this reduces the pressure for an immediate move. Against this backdrop, the ECB is expected to keep rates on hold this week, but lay the groundwork for a cut in June. The hawks will be eager to stress the data-dependency of a move.

Hence, even if the first cut comes in June, markets risk being too optimistic on the total number of rate cuts this year and indeed through the cycle. Unless the economic recovery is derailed, it seems unlikely that the ECB would move outside of meetings that come with a new set of forecasts. And we don’t expect moves greater than 25 basis points. This would mean a maximum of 3 cuts — or a total of 75 basis points — for this year.

EURUSD outlook

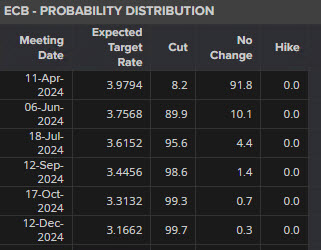

Data from Reuters shows markets are currently pricing in a 91% chance of no change at the ECB meeting on Thursday. But, unlike the Fed, in June 89% is clearly assigned to the possibility of a cut, of a 25bps. Last week the markets showed that they are pricing in the possibility that ECB will start easing earlier than Fed. That said, US Inflation (CPI) tomorrow could bring clarity on the FOMC’s path.

The fact is that Eurozone growth has bottomed out, while the US economy presents little to no slowdown – which has led markets to price in a higher chance that the ECB will be the first to cut rates.

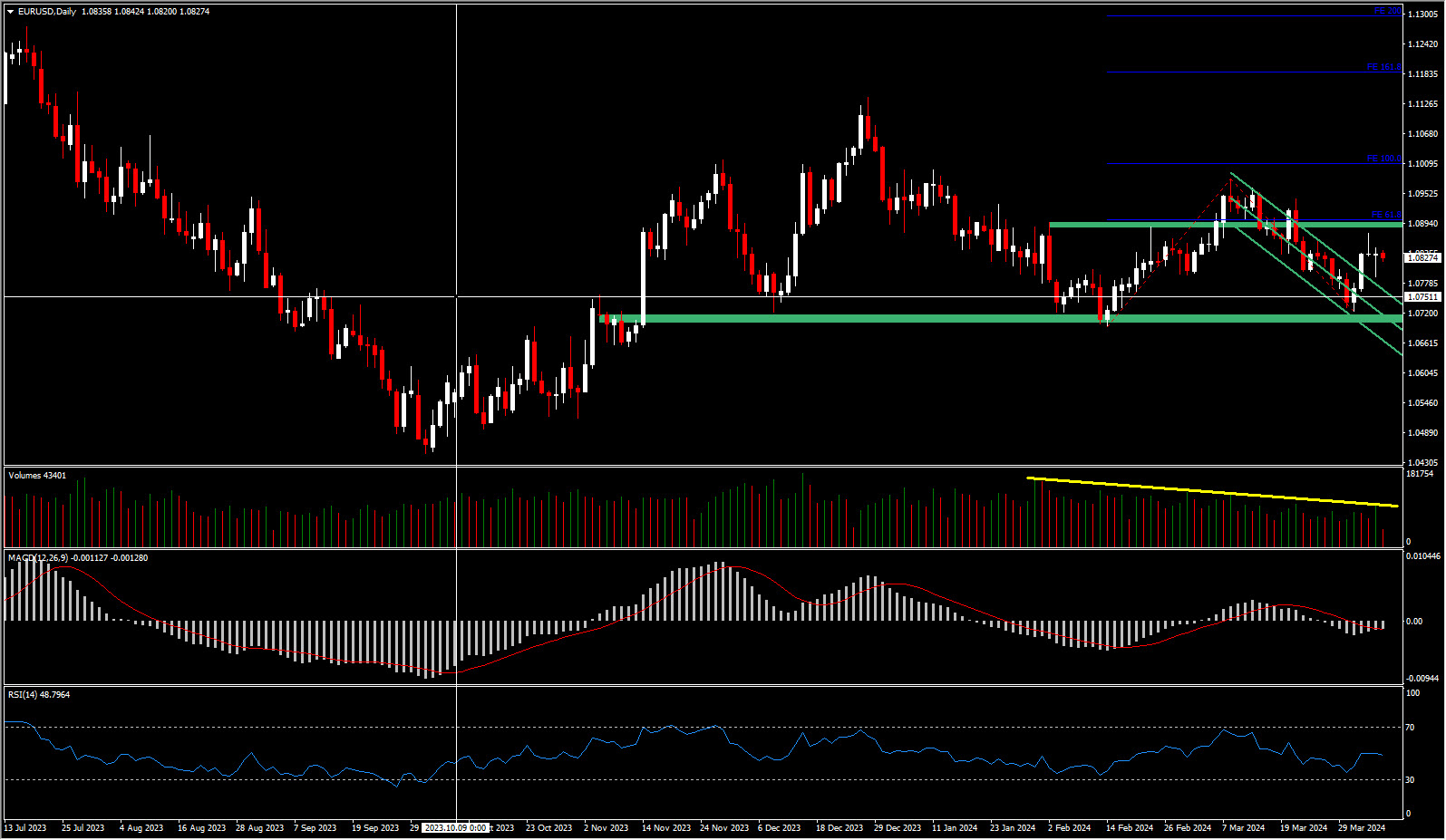

Whilst equities may receive a lift from a potentially more accommodative ECB stance, any talk of interest rate reductions from ECB President Largarde might push the EUR lower against the USD. Currently, EURUSD appears to have stabilized somewhat after recent buying pressure. However, the US/Germany yield spread widening as presented in the chart above, indicates that the US economy is posting stronger growth than the Eurozone, resulting in decreased demand for and potential weakness of the Euro.

That said, along with Volume in EURUSD deducting, and RSI failing to extend above 50, there’s a possibility of downward momentum, to 5-month lows at 1.07.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.