- The Eurozone is likely to have grown this past quarter according to the Bundesbank, but the DAX continues to decline.

- The chances of the European Central Bank cutting interest rates in June intensifies as Oil prices decline to a monthly low.

- Meta pays its shareholders dividends for the first time in its history. The stock continues to be one of the best performing NASDAQ components.

- The technology market gets ready for the start of earnings season for its sectors. Netflix will release its earnings for the first quarter with expectations more than double those seen in 2023.

EURUSD – The Eurozone is Not In A Recession!

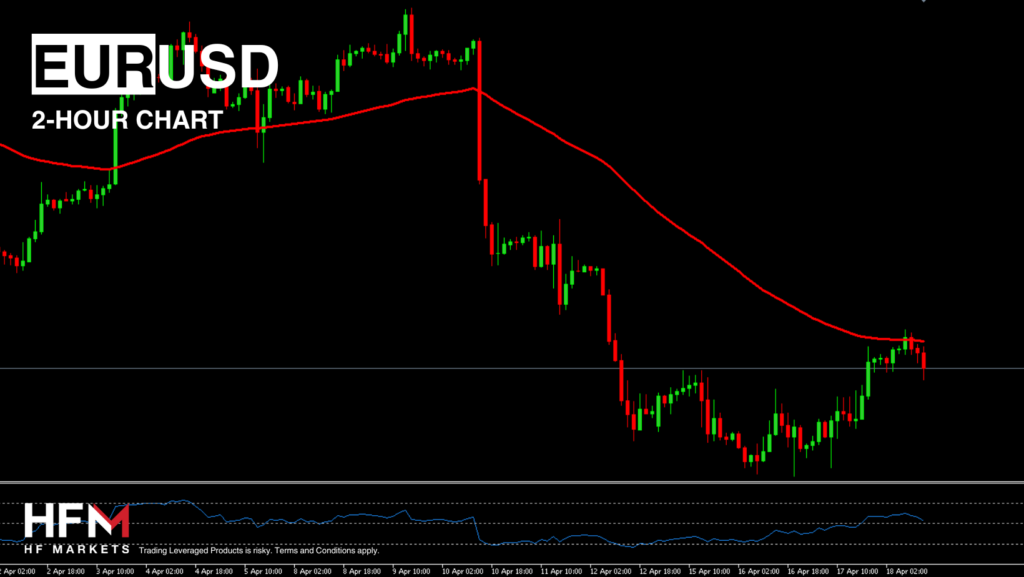

The price of the EURUSD is experiencing two currencies which are both declining against most currencies within the market. Therefore, investors need to be cautious of the current “tug-of-war” and how volatility might change after the opening of the US session.

Currently, the price is also receiving mixed signals from technical analysis. The price trades below the 75-Bar EMA but above the RSI and most oscillators. However, the bias based on technical analysis is likely to change if the price rises above 1.06810. Above this level, the price may gain bullish momentum and is likely to see fewer conflicting signals. If the US Dollar Index rises as the US session opens, a bearish bias will develop. For a bearish bias, the key breakout level can be seen at 1.06629, but traders will need to be cautious of a false or weak breakout.

The only concern for the Euro at the moment is the possible lower interest rates within the upcoming months. According to economists, comments from the representatives of the ECB point towards a rate cut in June 2023. However, the Bank of France Governor, Francois Villeroy de Galhau, said that regulator might reconsider if tensions in the Middle East intensify, causing rising energy prices and accelerating inflation. On this note, a positive factor for inflation is that the price of Oil has been declining for six consecutive days.

This is the primary concern for Euro holders. Should the Federal Reserve persist in postponing an adjustment while the Euro acts pre-emptively, there is potential for the exchange rate to experience a downturn. This is also something which was witnessed in 2023, but economists advise it is unlikely to be to that magnitude.

USA100 – Eyes on Earnings Data, But No Clear Direction Seen Yet!

The NASDAQ trades with no gains or losses and this can also be understood when monitoring the most influential components. From the top 15 most influential components (stocks) 6 are currently trading lower. Ideally investors looking to purchase wish to see 75% of components rising and “shorters” wish to see 75% in the decline. Currently, neither is being experienced, but investors will wait to see if such an opportunity to develop once the US session opens at 13:30 GMT.

Meta is one of the stocks which are currently within the spotlight. The company has decided to pay dividends to shareholders for the first time and continues to be one of the better performing stocks. In anticipation of the publication of the financial report, many institutions began to revise their estimates. Truist Securities experts adjusted the forecast from a target price of $525 to $550. Analysts believe that the company is actively introducing new advertising monetization opportunities based on a higher volume of impressions.

In the meantime, investors will continue focusing on upcoming earnings reports. These include Netflix, Alphabet, Tesla, Microsoft, Amazon as well as Meta. These quarterly earnings reports are also likely to increase volatility. If the USA100 crosses above $17,623.60, and earnings beat expectations, the USA100 could develop a bearish bias.

Michalis Efthymiou

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.