The ongoing developments in the Middle East fueled supply concerns and sparked a wave of risk aversion as investors headed for safety. Hopes for imminent rate cuts from the Federal Reserve diminish while attention is now turning towards the demand outlook.

The Gold price hit a high of $2417.89 per ounce overnight. Sentiment has already calmed down again and bullion is trading at $2376.50 per ounce as haven flows ease. Oil prices initially moved higher amid concern over escalating tensions, with the WTI contract hitting a session high of $85.508 per barrel overnight, before correcting to currently $81.45 per barrel.

Oil Prices Under Pressure Amid Middle East Tensions

Last week, commodity indexes showed little movement, with Oil prices undergoing a slight correction. Meanwhile, Gold reached yet another record high, mirroring the upward trend in cocoa prices.

Once again today, USOil prices experienced a correction and have remained under pressure, retesting the 50-day EMA at $81.00 as we move into the weekend. Hence, despite Israel’s retaliatory strike on Iran, sentiments stabilized following reports suggesting a measured response aimed at avoiding further escalation. Brent crude futures witnessed a more than 4% leap, driven by concerns over potential disruptions to oil supplies in the Middle East, only to subsequently erase all gains. Similarly to USOIL, UKOIL hovers just below $87 per barrel, marginally below Thursday’s closing figures.

Nevertheless, volatility is expected to continue in the market as several potential risks loom:

-

Disruption to the Strait of Hormuz: The possibility of Iran disrupting navigation through the vital shipping lane is still in play. The Strait of Hormuz serves as the Persian Gulf’s primary route to international waters, with approximately 21 million barrels of oil passing through daily. Recent events, including Iran’s seizure of an Israel-linked container ship, underscore the geopolitical sensitivity of the region.

-

Tougher Sanctions on Iran: Analysts speculate that the US may impose stricter sanctions on Iranian oil exports or intensify enforcement of existing restrictions. With global oil consumption reaching 102 million barrels per day, Iran’s production of 3.3 million barrels remains significant. Recent actions targeting Venezuelan oil highlight the potential for increased pressure on Iranian exports.

-

OPEC Output Increases: Despite the desire for higher prices, OPEC members such as Saudi Arabia and Russia have constrained output in recent years. However, sustained crude prices above $100 per barrel could prompt concerns about demand and incentivize increased production. The OPEC may opt to boost oil output should tensions escalate further and prices surge.

-

Ukraine Conflict: Amidst the focus on the Middle East, markets are overlooking Russia’s actions in Ukraine. Potential retaliatory strikes by Kyiv on Russian oil infrastructure could impact exports, adding further complexity to global oil markets.

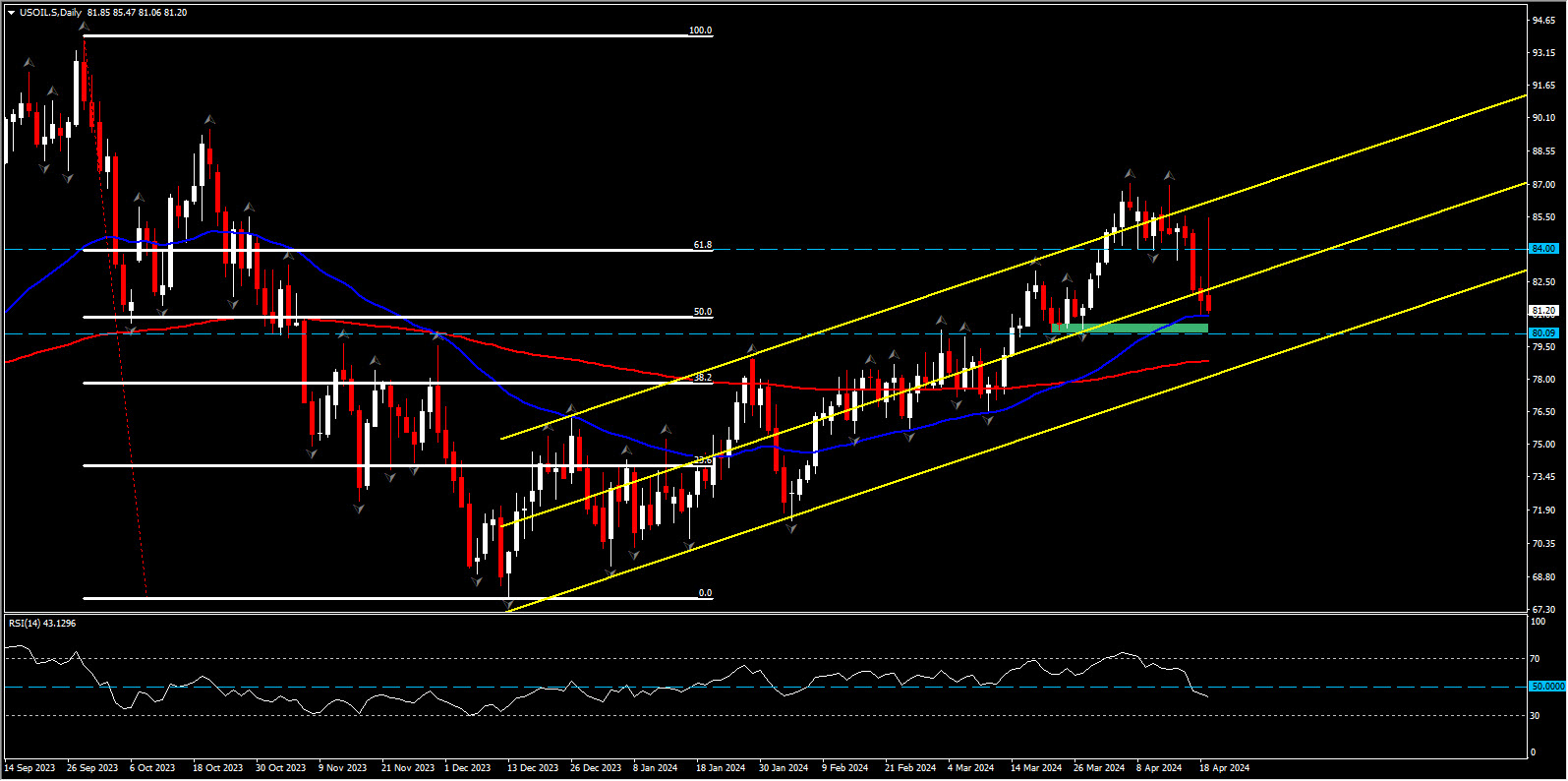

Technical Analysis

USOIL is marking one of the steepest weekly declines witnessed this year after a brief period of consolidation. The breach below the pivotal support level of 84.00, coupled with the descent below the mid of the 4-month upchannel, signals a possible shift in market sentiment towards a bearish trend reversal.

Adding to the bearish outlook are indications such as the downward slope in the RSI. However, the asset still holds above the 50-day EMA which coincides also with the mid of last year’s downleg, with key support zone at $80.00-$81.00. If it breaks this support zone, the focus may shift towards the 200-day EMA and 38.2% Fib. level at $77.60-$79.00.

Conversely, a rejection of the $81 level and an upside potential could see the price returning back to $84.00. A break of the latter could trigger the attention back to the December’s resistance, situated around $86.60. A breakthrough above this level could ignite a stronger rally towards the $89.20-$90.00 zone.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.