Silver prices rose to $32.49 per ounce on Monday [20 May], the highest level since 2012, driven by a combination of demand-side impetus and positive futures market sentiment. Silver has rallied more than 28% since the start of the year, and has increased about 15% in the past three weeks.

The accumulation of profitable long bets in the futures market between February and April is recognised as the cause of the rally in the past 3 weeks. As a result, the demand for silver increased as many investors added to their holdings in silver. In addition, demand for the commodity has also increased due to the growth of electric vehicles (EVs) and this trend is expected to continue in the future, as more people switch to renewable energy sources.

Due to its outstanding electrical conductivity, silver is an important component in the production of superior electrical appliances and equipment.

According to some estimates, the electric vehicle sector may be responsible for the consumption of half of all silver purchased on the international market. This is because the commodity is essential for the production of critical electric vehicle components. The concept of renewable energy is one important driver of silver demand outside of the electric vehicle market.The metal is important for the production of solar panels, the demand for which is also expected to increase significantly. In terms of market fundamentals, China in particular is rapidly improving its capabilities in producing solar panels and electric vehicles, thus supporting the rise in silver prices.

XAGUSD closed down -3.8% on Wednesday’s trading [22 May].Wednesday’s USDIndex rally to a 1-week high and rising global bond yields pressured metal prices. Silver prices came under additional pressure after US home sales in April unexpectedly declined, which is a negative factor for industrial metal demand. Silver prices were also weighed down by the hawkish 30 April-1 May FOMC meeting minutes.

In today’s trading, silver prices stabilised above $30 per ounce, after hitting the highest level since December 2012 in the previous session, as investors reassessed the Federal Reserve’s monetary policy outlook following recent statements by Fed officials.

High interest rates are reducing the appeal of non-bearing assets, but the white metal remains supported by its industrial applications. Silver headed for a fourth consecutive year of deficit amid tightening supplies, with stocks tracked by the London Bullion Market Association falling to a second record low in April, and volumes on exchanges in New York and Shanghai near seasonal lows.

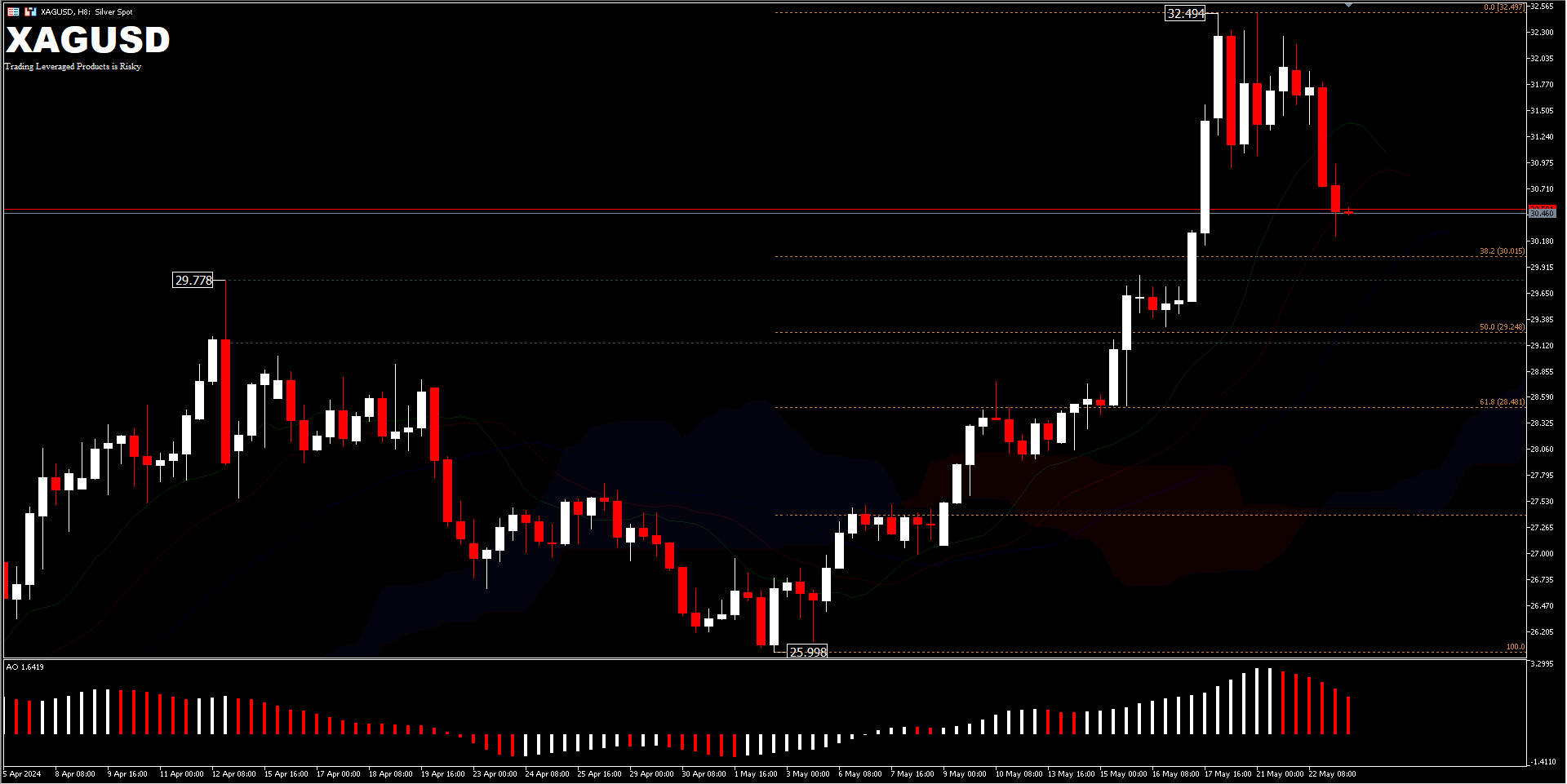

From a technical perspective, XAGUSD’s decline from the $32.49 peak is part of the correction of the 3rd wave bullish trend, established since September 2022. Further correction will be challenged at $29.77 resistance, which is now support. A move below this level, could test the 50% or 61.8% retracement levels, at $29.24 and $28.48 respectively. A change in trend will only occur, if there is a drop below the $25.99 support.

Despite the decrease in momentum, the silver price movement is still technically controlled by the bull herd. On the upside, the upward movement is likely to meet the recent peak of $32.49 first. A break above that mark is likely to reinforce another upside momentum.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.